Bitcoin enters a high-risk window as credit stress builds beneath a record 206% stock bubble

Bitcoin is entering a period where macro sequencing matters more than narrative. Equity markets are trading near record valuations, real yields remain elevated, and credit markets are expanding into increasingly opaque corners of the financial system. None of these conditions guarantees

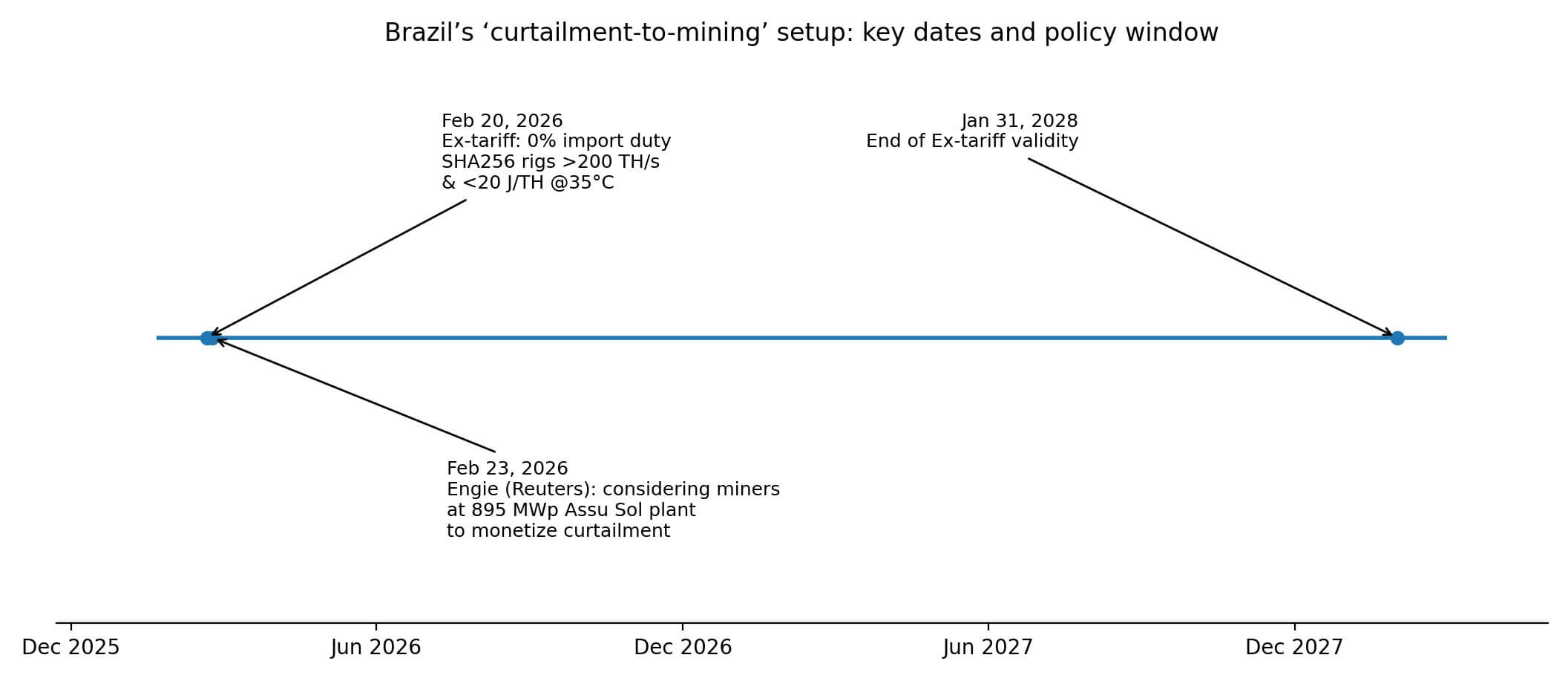

Brazil cuts Bitcoin miner import duty to zero and companies may plug them into stranded solar next

On Feb. 20, Brazil's foreign trade council published a technical resolution reducing import duties to zero for a narrow class of hardware: SHA256 Bitcoin miners exceeding 200 terahashes per second with energy efficiency below 20 joules per terahash. Three days later,

Bitcoin faces a liquidity trap as spot ETF flows go flat

Spot Bitcoin ETFs gave the market a clean, daily scoreboard: a green print meant fresh cash crossing the boundary from traditional brokerage accounts into Bitcoin exposure, and a red print meant the opposite. For much of the first year of spot

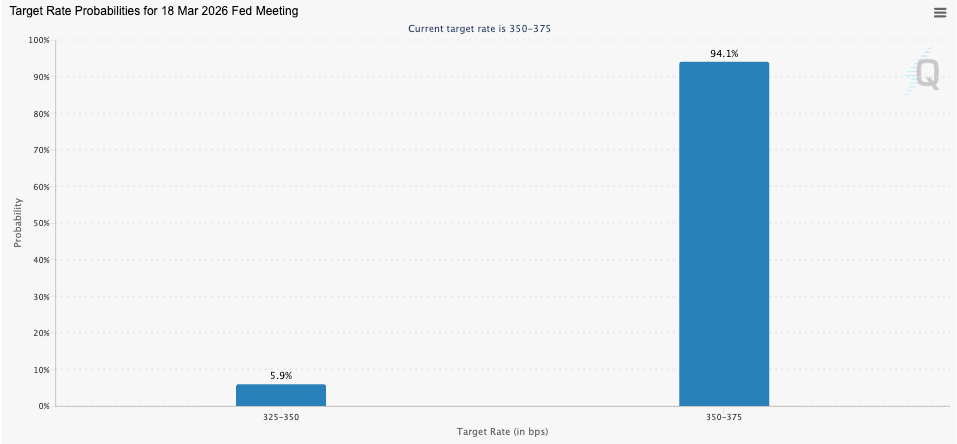

862k jobs vanished, CPI cooled, and Bitcoin now trades like a bond – What Would Satoshi Say?

Bitcoin is trading like a rates product now because real yields are the new “gravity” Earlier this month, we saw the macro picture shift in a very real and tangible way. The record of last year's job level changed significantly, and

Crypto has a native version of the M2 money supply that’s falling and killing Bitcoin liquidity

Stablecoin supply is crypto’s deployable cash. With a total stablecoin market cap of around $307.92 billion and down -1.13% in the past 30 days, the pool has stopped growing month over month. When supply stalls, price moves get sharper, and Bitcoin

The Bitcoin CME gap is dead – and past gaps could close forever in May this year

CME Group has spent most of its life as the financial plumbing moving the gears behind wheat hedges, rate bets, equity futures, the quiet machinery that keeps risk moving. Now it is taking a very public step into crypto’s always-on

A $1.2T shift toward Bitcoin may be starting — and one grim index says altcoins may never rally

Bitcoin’s grip on the crypto market is tightening again, and the numbers behind that shift help explain why a broad basket of altcoins is unlikely to beat the top crypto. Data from CoinMarketCap indicate that Bitcoin's dominance is edging upwards towards

BlackRock to skim 18% of staked Ethereum ETF rewards from investors — and ETHB exits could take weeks

BlackRock has sharpened the staking posture for its iShares Staked Ethereum Trust ETF (ETHB), outlining a plan to keep most of the fund’s ETH staked and earning rewards rather than held in custody. In its latest amended filing, the sponsor said

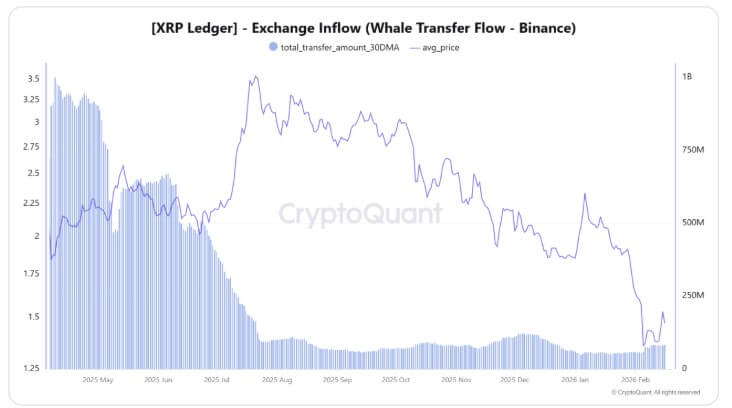

Standard Chartered slashes XRP price target by 65% as whales send millions of tokens to Binance

XRP is sliding even as the XRP Ledger (XRPL) rolls out features that supporters have long framed as a bridge to institutional adoption. According to CryptoSlate's data, the token has been trading around $1.47, while a mix of fresh supply signals,

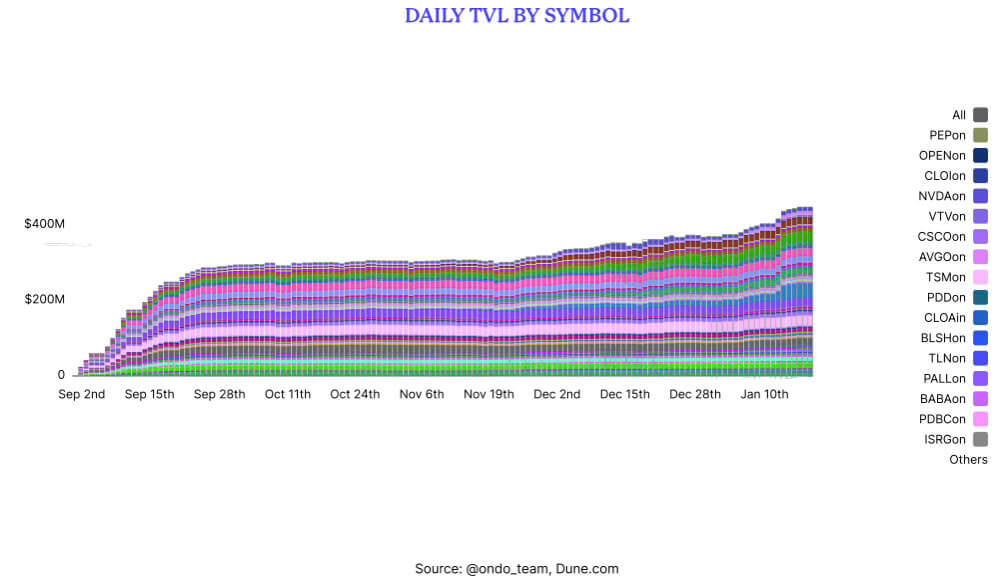

XRPL holds 63% of this T-bill token supply but barely any of the trading, and that’s a problem

Tokenized US Treasuries are close to $11 billion, but the chain war is shifting from issuance to distribution and utility. Where yield tokens actually sit, how often they move, and whether they plug into stablecoin settlement and collateral workflows are

Bitcoin down $20k, recession odds fade, stocks rip higher — but bottom signals are flashing early this year

Bitcoin bottom signals: ETF outflows, miner stress, and why a 2026 recession looks like the outlier Bitcoin could be approaching a cycle low as spot Bitcoin ETF flows keep leaking and miner economics stay tight, even while recession talk dominates the

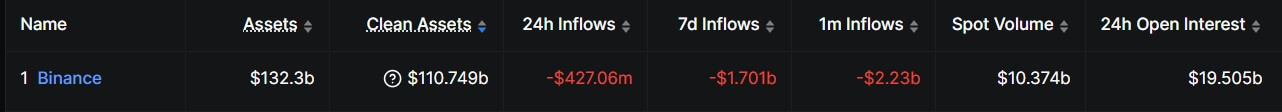

Binance bank run? Reserves show a $40B drop yet Bitcoin holdings rose to 655k BTC, so what changed?

Binance is at the center of renewed speculation as the specter of insolvency has once again cast a long shadow over the crypto sector. Over the past weeks, rumors have emerged that the world’s largest cryptocurrency exchange is facing a liquidity

Uniswap is bringing BlackRock’s $2.2 billion BUIDL to DeFi, but the trade access comes with a catch

On Feb. 11, Uniswap announced that BlackRock's $2.2 billion USD Institutional Digital Liquidity Fund (BUIDL) would trade on UniswapX via a partnership with Securitize. The integration enables BUIDL holders to swap into USDC via an on-chain request-for-quote system that settles atomically

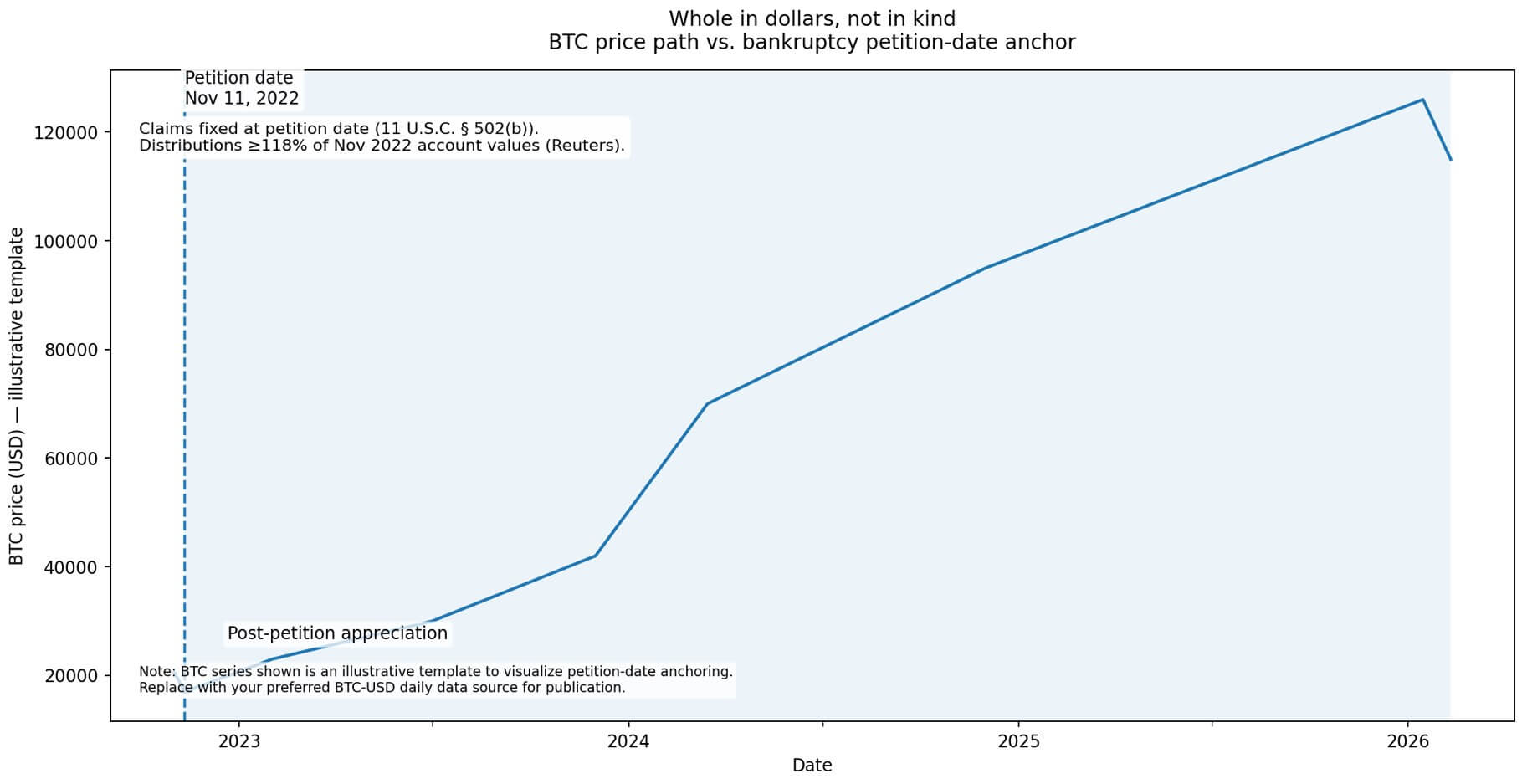

Sam Bankman-Fried requests new trial claiming FTX had $16.5 billion surplus in 2022, but does it matter?

Sam Bankman-Fried filed a motion for a new trial on Feb. 10, advancing a claim that reframes FTX's collapse not as fraud-driven insolvency but as a recoverable liquidity crisis. The motion invokes Rule 33 of the Federal Rules of Criminal Procedure,

The real drivers of XRP supply: A guide to understand Ripple’s monthly releases and what matters

XRP supply and escrow unlocks: a guide to modeling 2026 net flows XRP supply in 2026 hinges on how much escrowed XRP Ripple chooses to distribute after monthly unlocks. The process is capped by the ledger, while market impact still depends on

White House meeting could unfreeze the crypto CLARITY Act this week, but crypto rewards likely to be the price

White House stablecoin meeting could unfreeze the CLARITY Act, but your USDC rewards may be the price The newly confirmed Feb. 10 White House meeting on stablecoin policy is being framed by some market observers as a step toward breaking the

Tokenized equities approach $1B as institutional rails emerge

The following is a guest post and analysis from Vincent Maliepaard, Marketing Director at Sentora. A year ago, tokenized equities barely registered as an asset class. Today, the market is approaching $1 billion—a nearly 30x increase—and December 2025 may have delivered

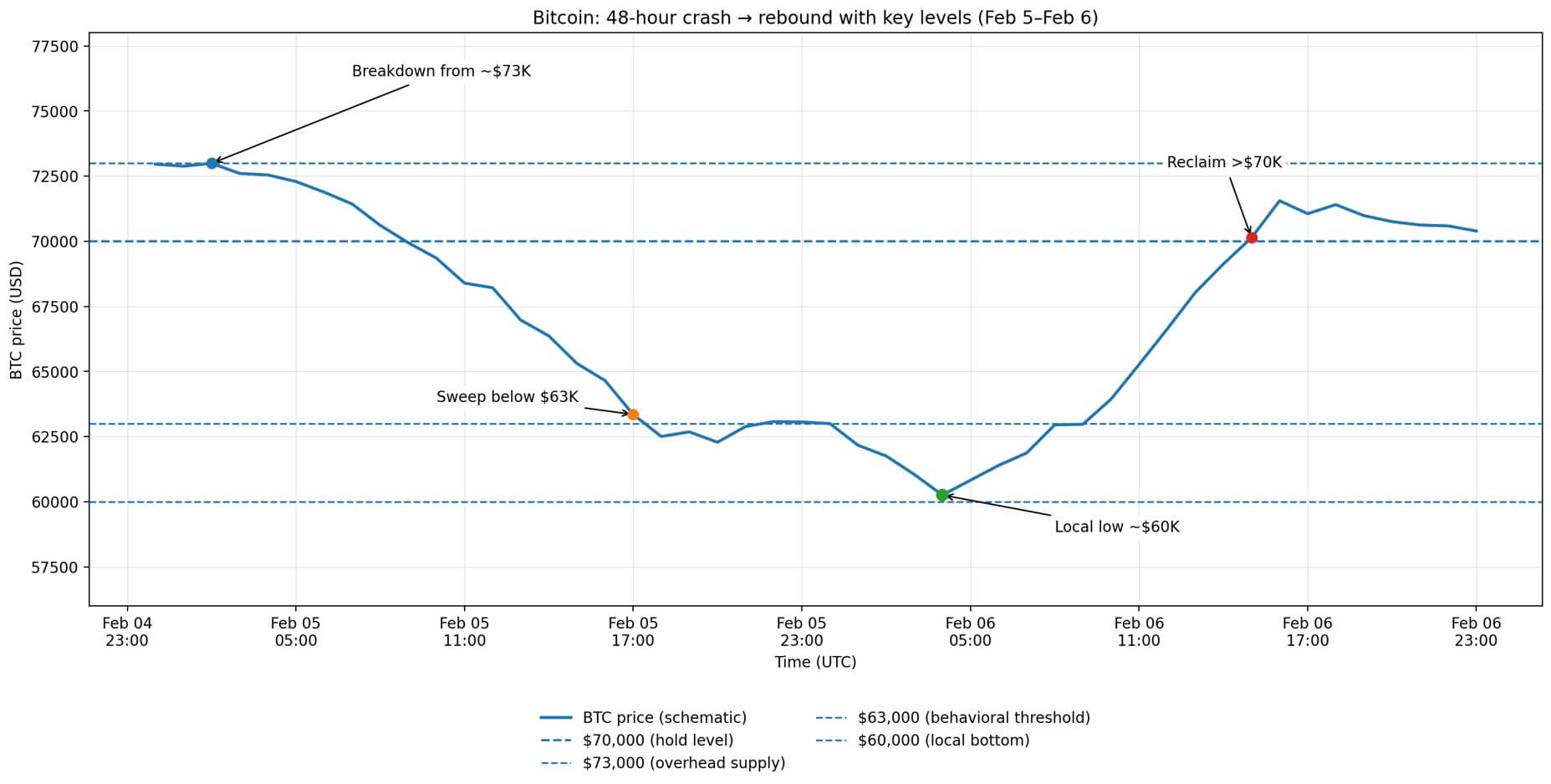

Bitcoin rocketed 15% to get back above $70,000 but the options market is currently pricing in a terrifying new floor

Bitcoin ripped from $60,000 to above $70,000 in less than 24 hours, erasing most of a brutal 14% drawdown that had tested every bottom-calling thesis in the market. The speed of the reversal, 12% in a single session and 17% off