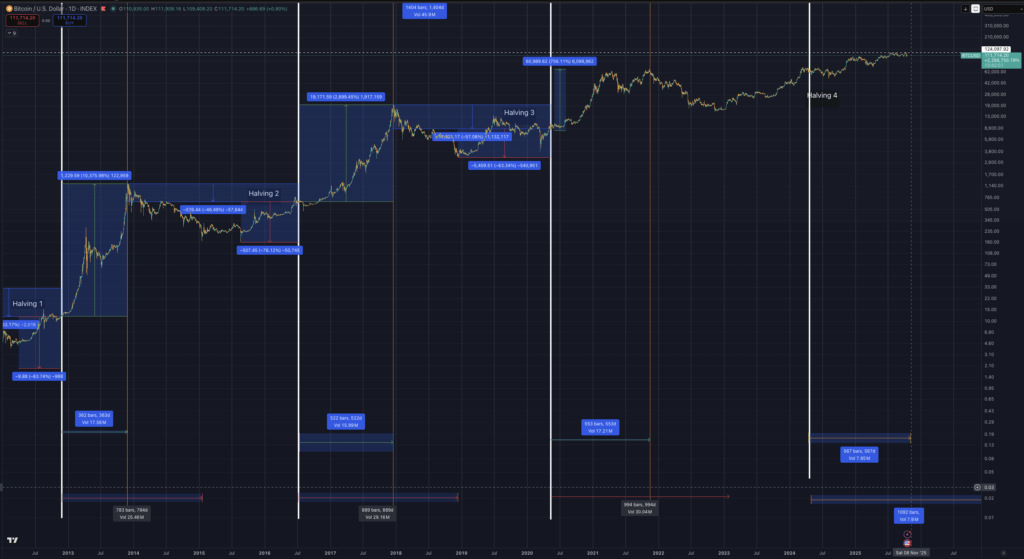

Time is up: The case for why Bitcoin bear market cycle started at $126k

No one has a crystal ball, but if Bitcoin continues to behave according to its past cycles, then we’ve most likely already reached the peak. Bitcoin printed an all-time high on Oct. 6, but it failed to extend the move as

The Big Bitcoin Short (Part 2): Rumor mill suspects link to US government insiders

Previously on The Big Bitcoin Short: a trader shorted Bitcoin minutes before President Trump’s tariff post and booked about $160 – $200 million. Eye, a crypto investigator who helped frame the story by tracing wallets and proposing that Garrett Jin could

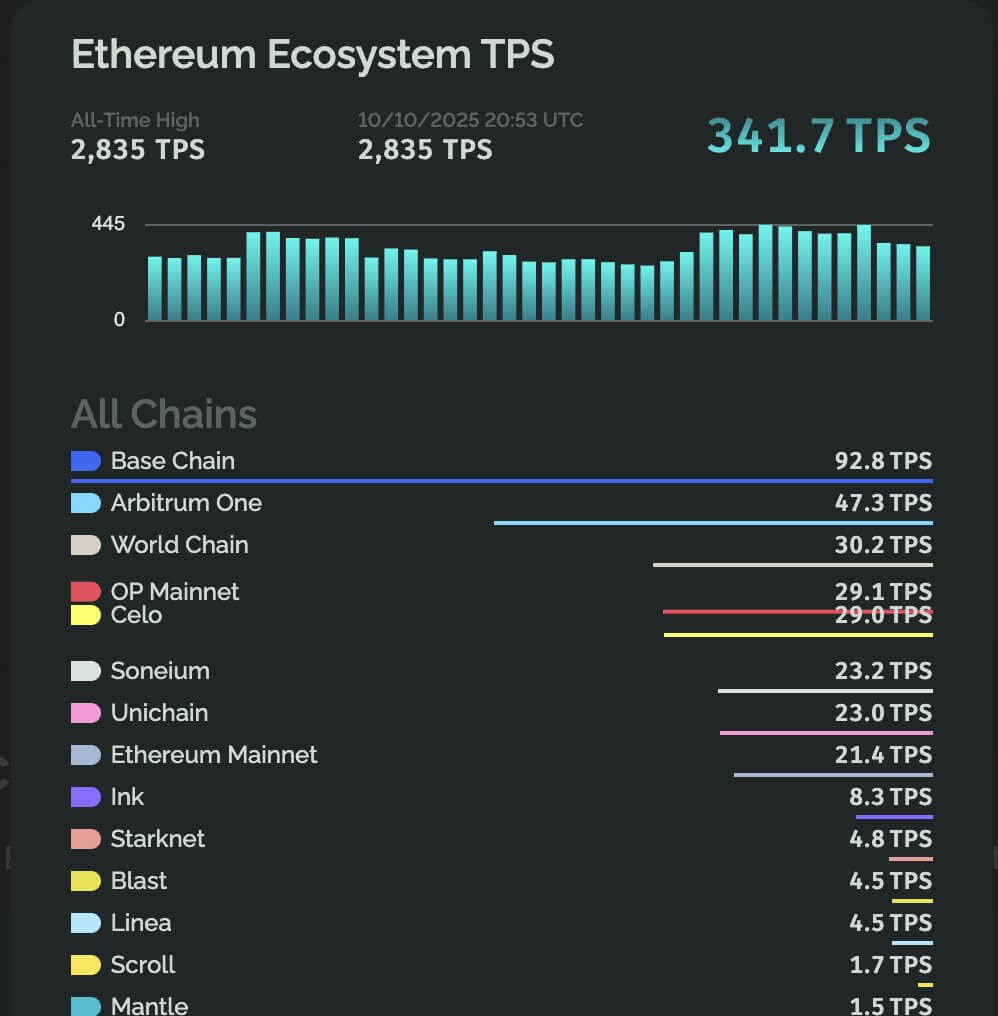

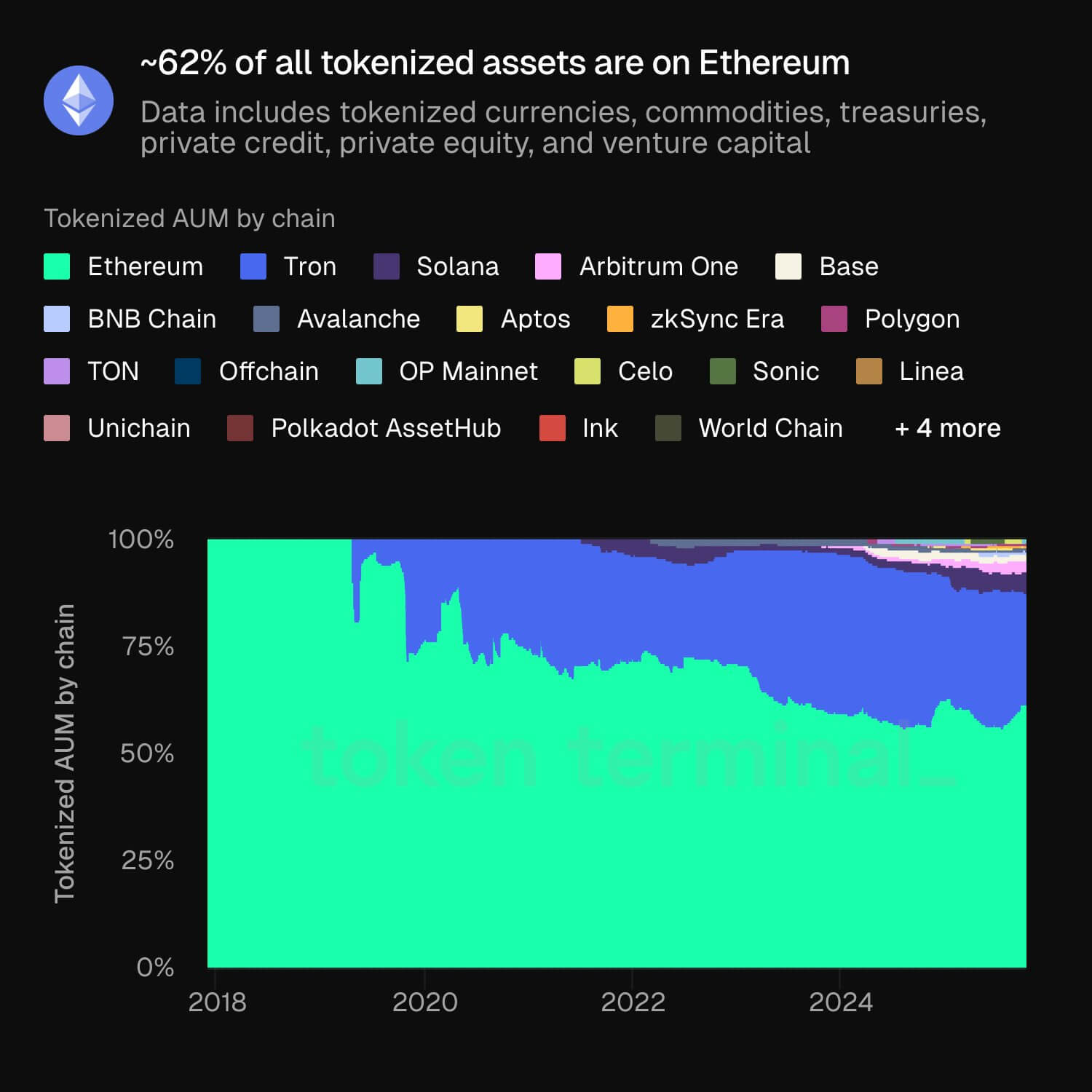

Ethereum to onboard 1.4B new users as Chinese AliPay megacorp launches own L2

Ant Group is betting that the next leap in digital finance will not happen in a bank but on Ethereum. On Oct. 14, the Chinese fintech giant behind Alipay’s 1.4 billion-user payment network launched Jovay, a new Layer-2 (L2) blockchain built

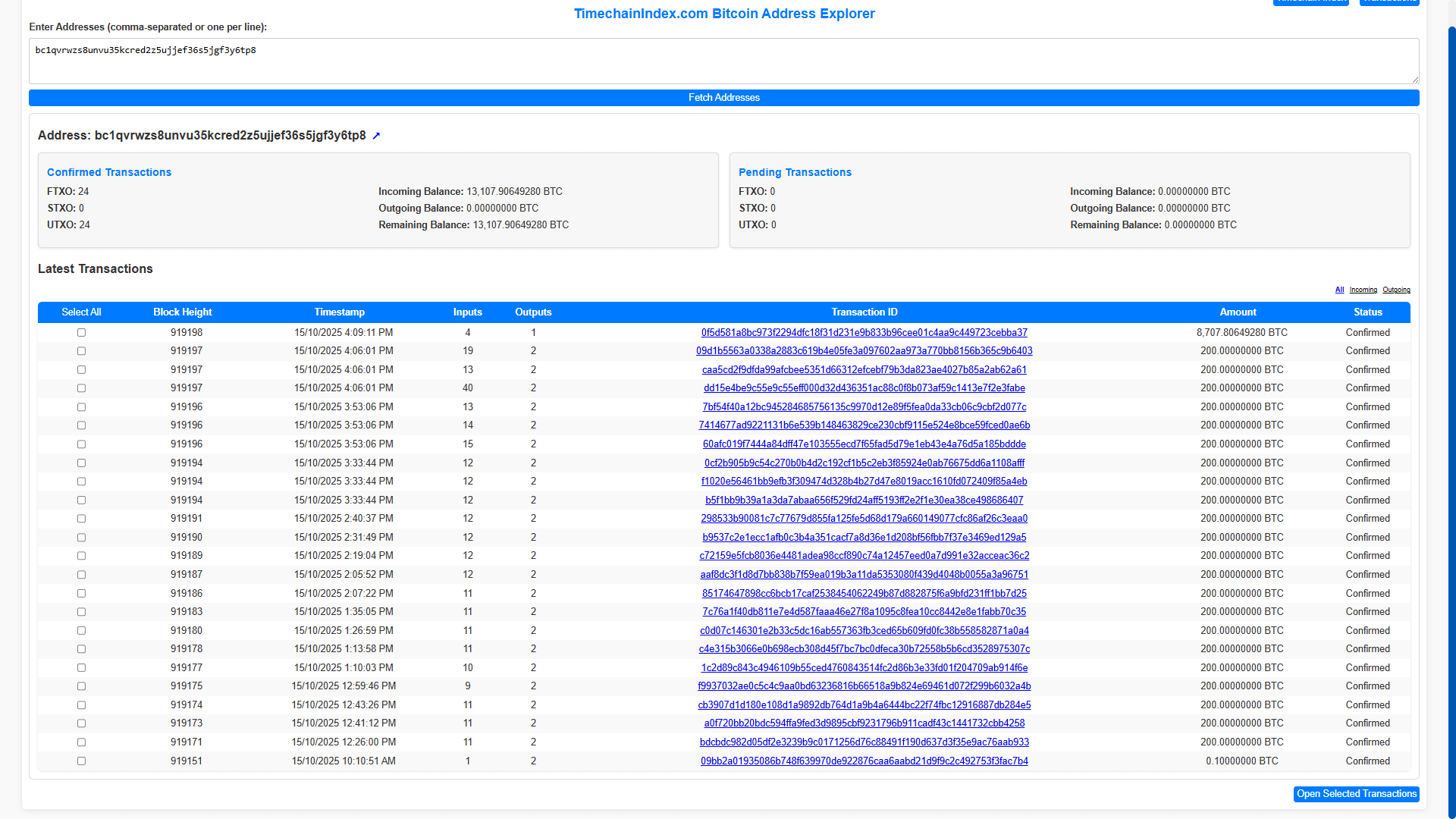

Bitcoin mining pool’s ‘missing’ $2B BTC may soon form American 340k BTC reserve

The United States could still claim another $2 billion worth of Bitcoin linked to the defunct LuBian mining pool, despite already announcing the largest crypto seizure in its history. On October 15, blockchain investigator Sani reported that nearly 16,237 BTC, worth

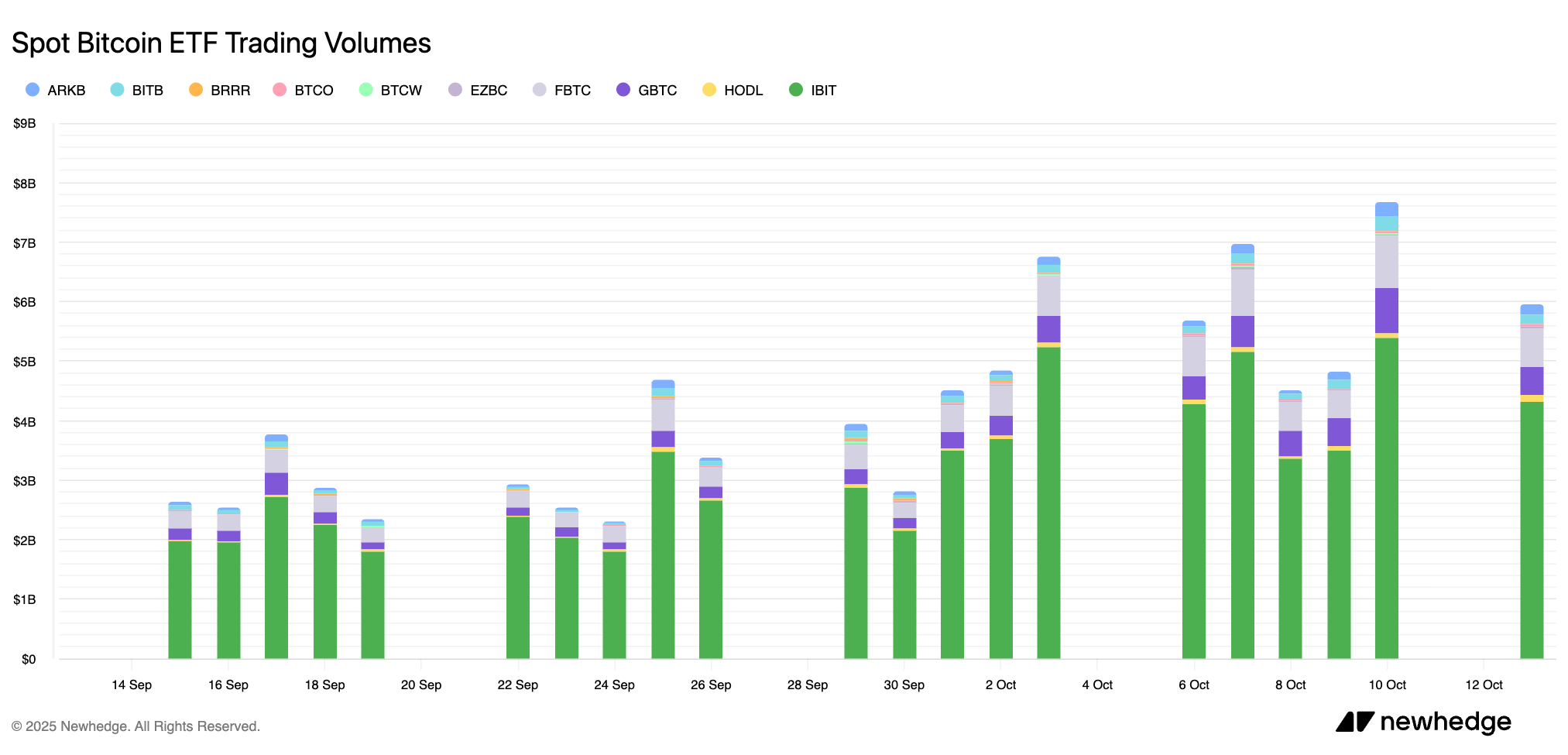

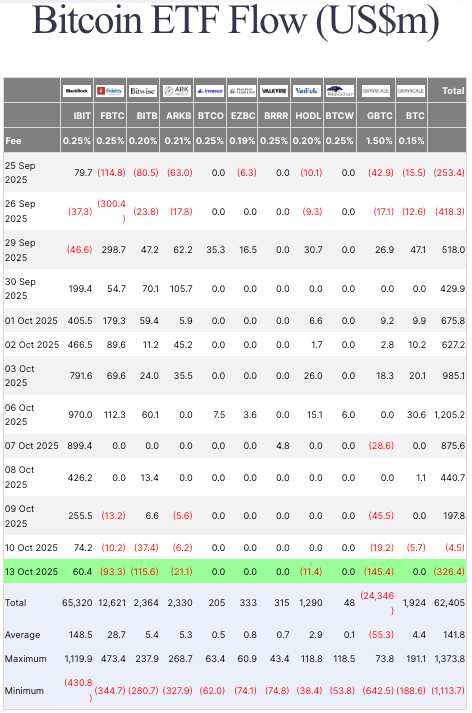

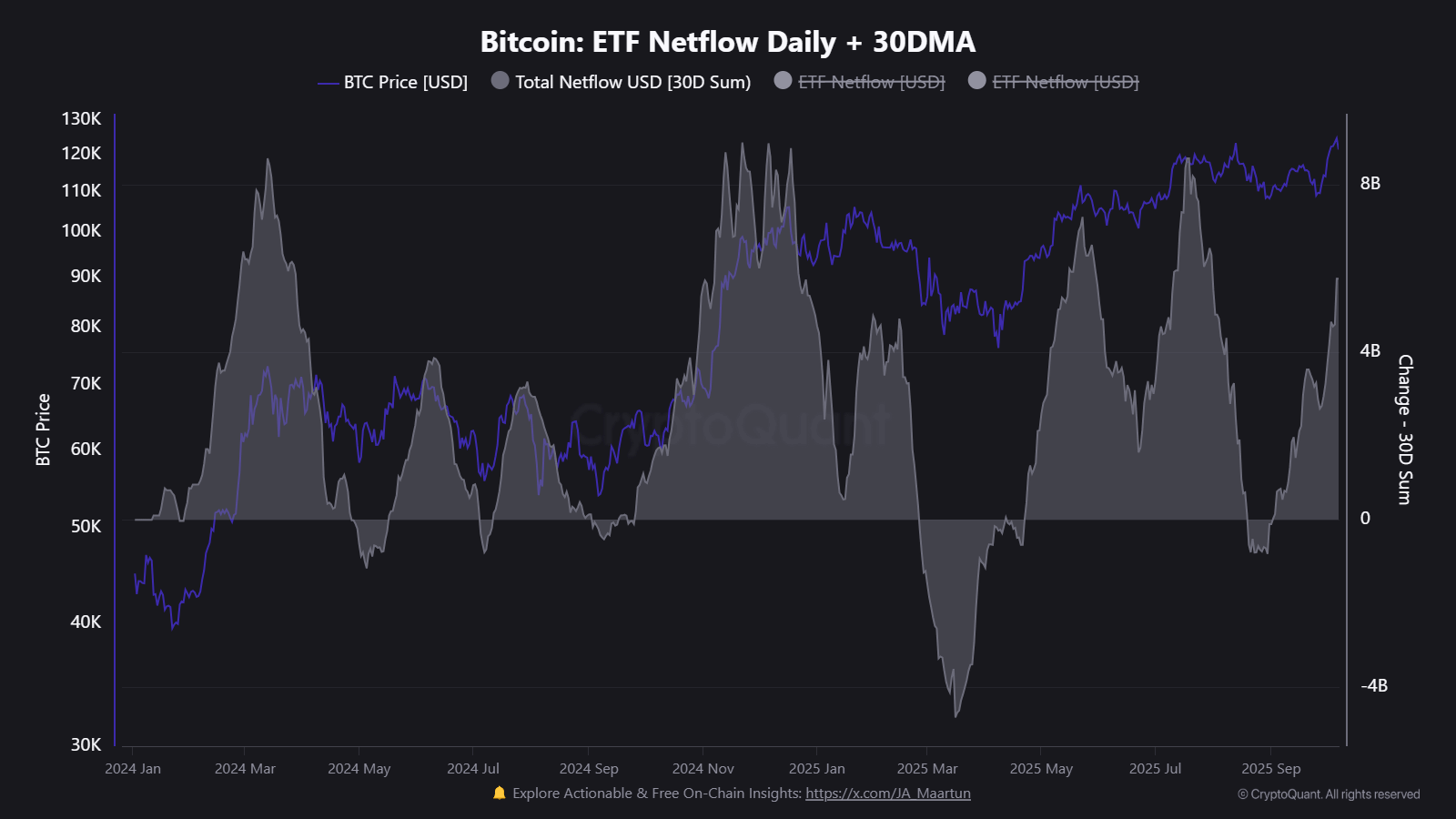

Why Bitcoin ETF trading volume exploded to $9.7B as trade war fears hit

Bitcoin ETFs saw a surge in trading activity on Friday and Monday, with combined volumes reaching $9.7 billion and $6.7 billion as tariff headlines rattled risk markets. BlackRock’s IBIT alone handled over $6.9 billion on Oct. 10 (its second-highest day ever),

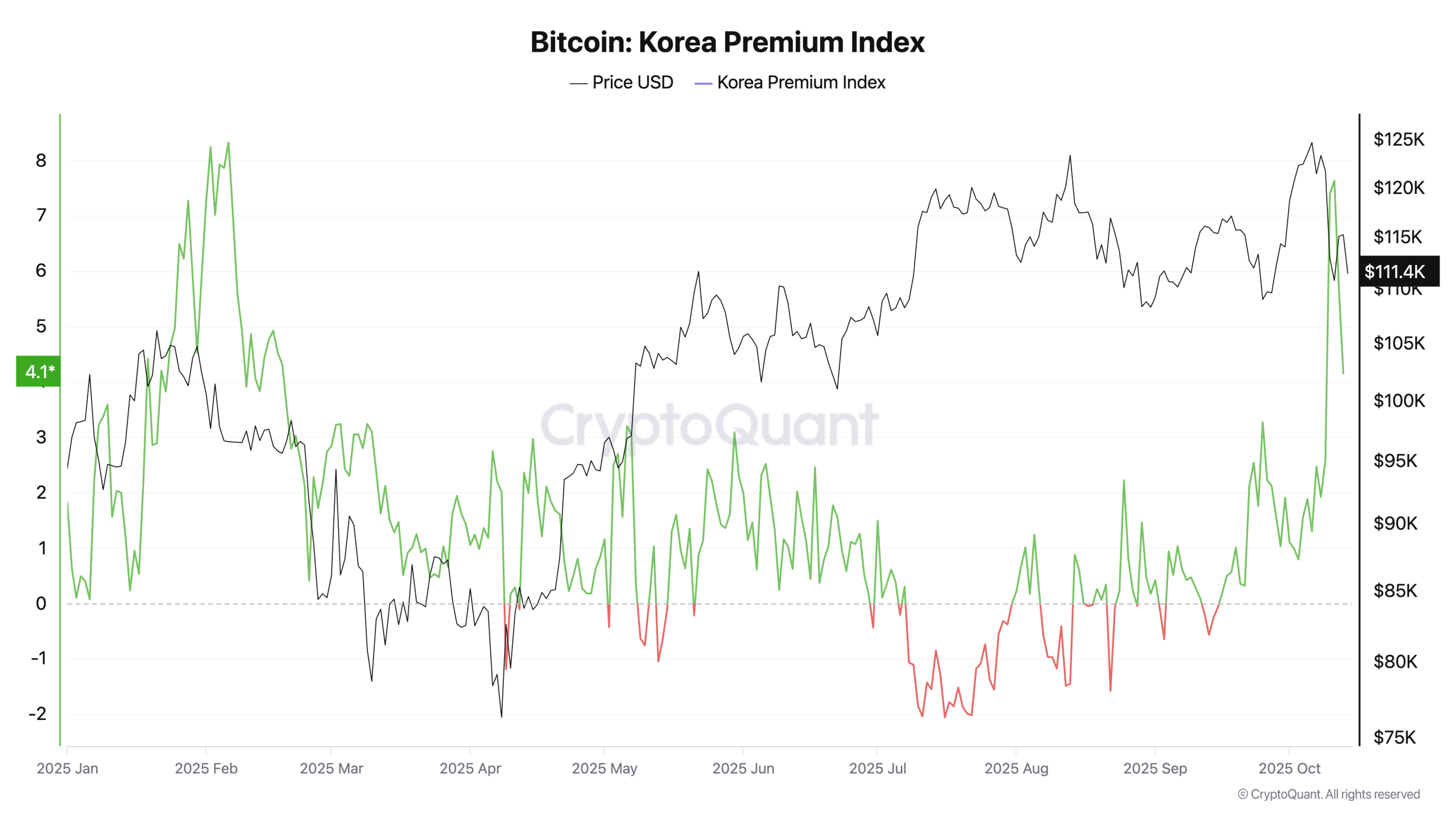

Is the Korean Kimchi Premium still front-running Bitcoin price?

For almost as long as Bitcoin has been trading, Korea’s “kimchi premium” has been one of the market’s favorite ghost signals. When spot prices in South Korea climb faster than those in the US, traders interpret this as a sign of

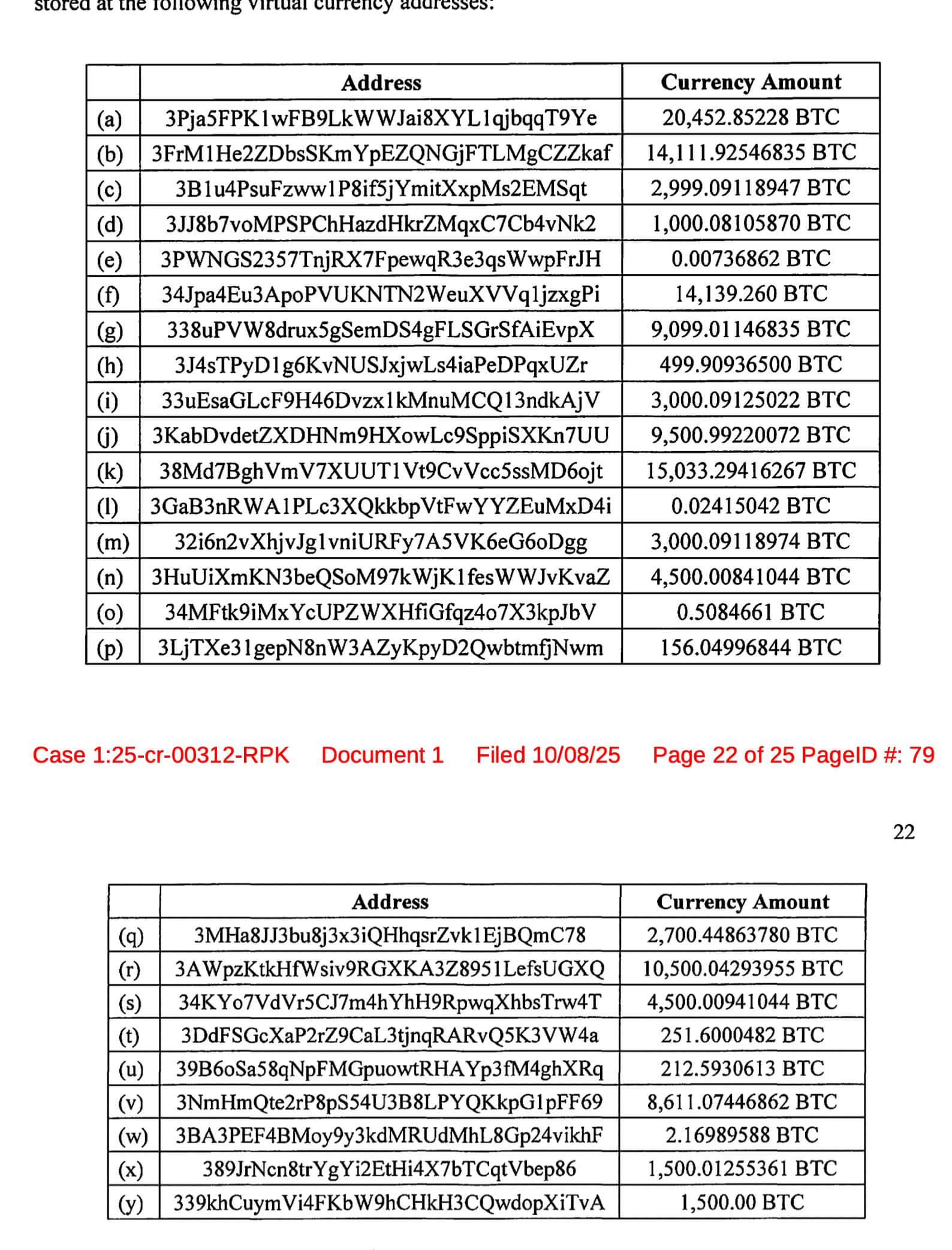

US to add $14 billion BTC to Strategic Bitcoin Reserve seized from Chinese scammer

The US government is moving to seize 127,271 Bitcoin worth about $14.2 billion, which investigators say was generated through a cross-border “pig butchering” scam operated by Chinese national Chen Zhi. If completed, the Bitcoin should be added to the U.S.’s Strategic

Is BlackRock’s IBIT flows keeping Bitcoin above $100k?

Bitcoin’s weekend was a classic macro hit-and-run. On Friday, tariff threats toward China knifed through risk assets and shoved BTC through $110,000, with roughly $7 billion in crypto positions liquidated as leverage unwound into a thin tape. By Sunday night and

Can Ethereum secure a nation’s identity? Bhutan is betting on it

Bhutan is rebuilding the core of its digital identity framework on Ethereum. The initiative, confirmed by Ethereum Foundation’s Aya Miyaguchi, is part of the Himalayan kingdom’s wider experiment with emerging technologies. It signals that blockchain, once confined to trading and tokens,

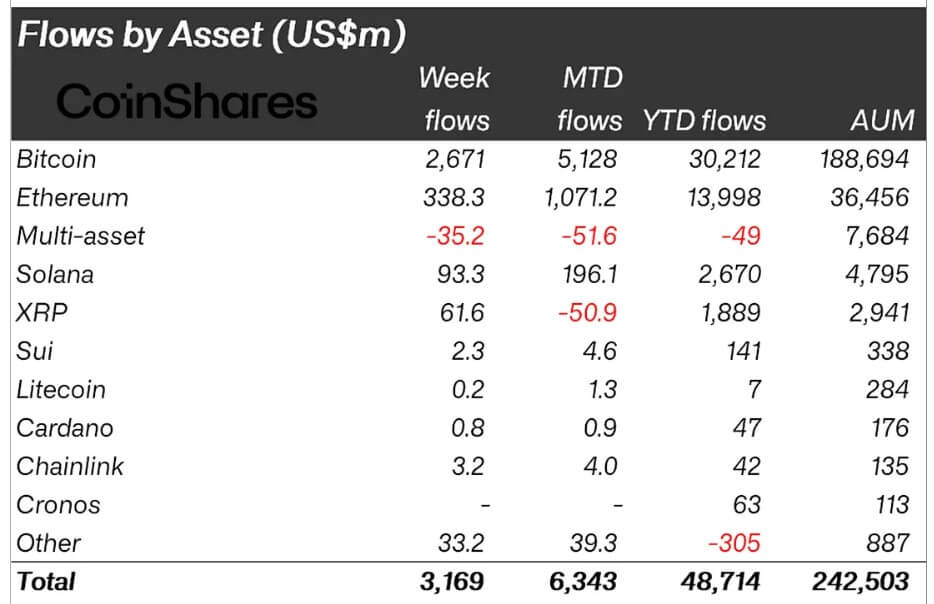

Trump’s tariff on China spurs record $10 billion volume for Bitcoin funds

Crypto-based funds attracted $3.17 billion in new capital, even as markets reeled from tariff-related tensions between the United States and China, according to CoinShares weekly report. On Oct. 10, President Donald Trump announced that the US could raise tariffs in response

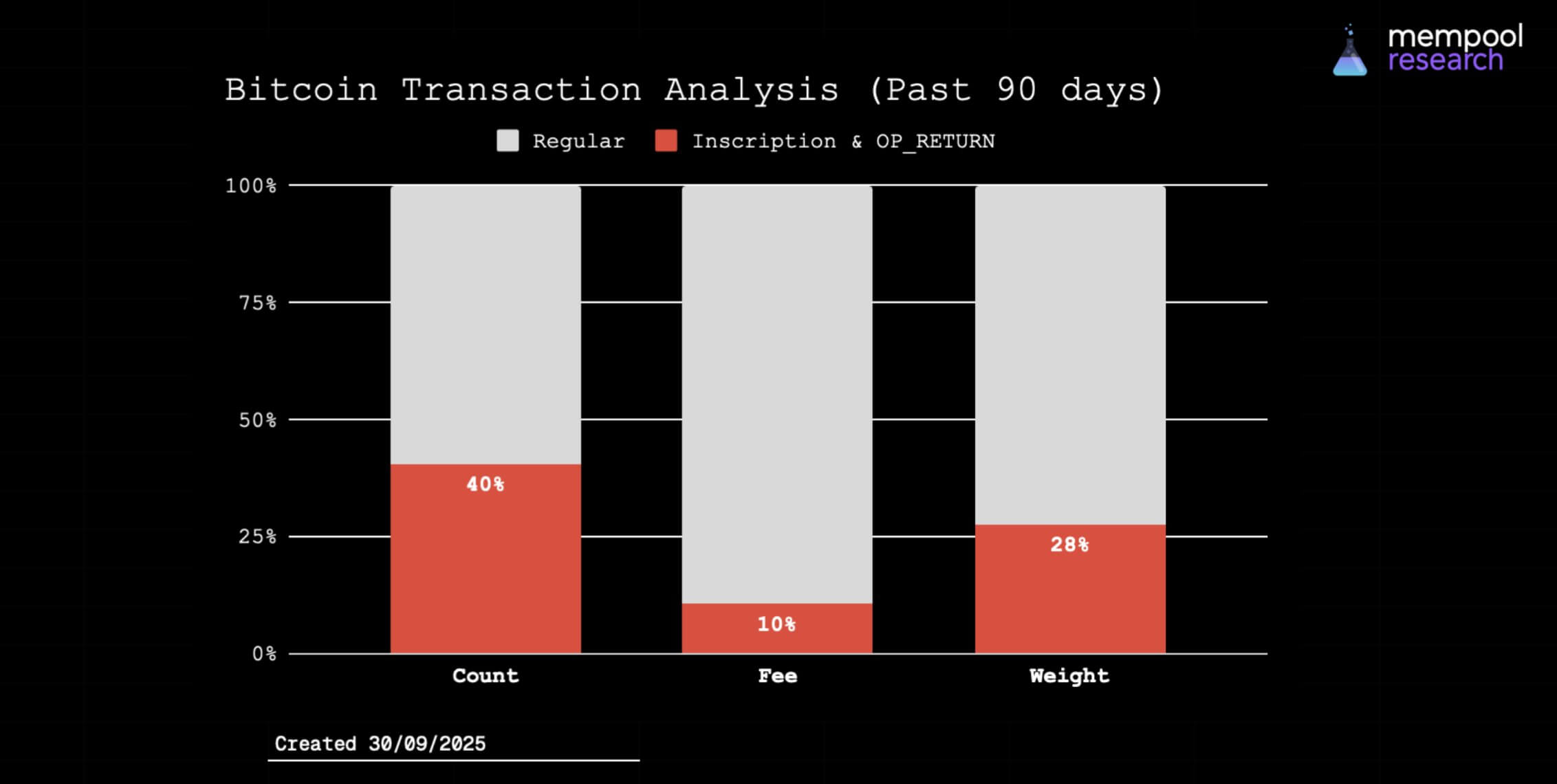

Latest Bitcoin software called “malware” as developers split by code change

Bitcoin Core, the dominant software powering roughly 80% of all BTC nodes, has rolled out its long-awaited v30.0 update. The update, published on Oct. 11, brings optional encrypted node connections, performance and fee optimizations, and several bug fixes. Yet the change to

$2B Ethena USDe depeg exposes cracks in crypto’s ‘synthetic dollar’ system

Ethena’s synthetic dollar, USDe, shed over $2 billion in market capitalization after briefly losing its dollar peg on Binance. The flash event exposed structural risks in crypto’s stablecoin plumbing. According to CryptoSlate data, USDe’s market value dropped from $14.8 billion on

Bitcoin falters again causing $200B wipeout: Will BTC hold $110k or break to $104k?

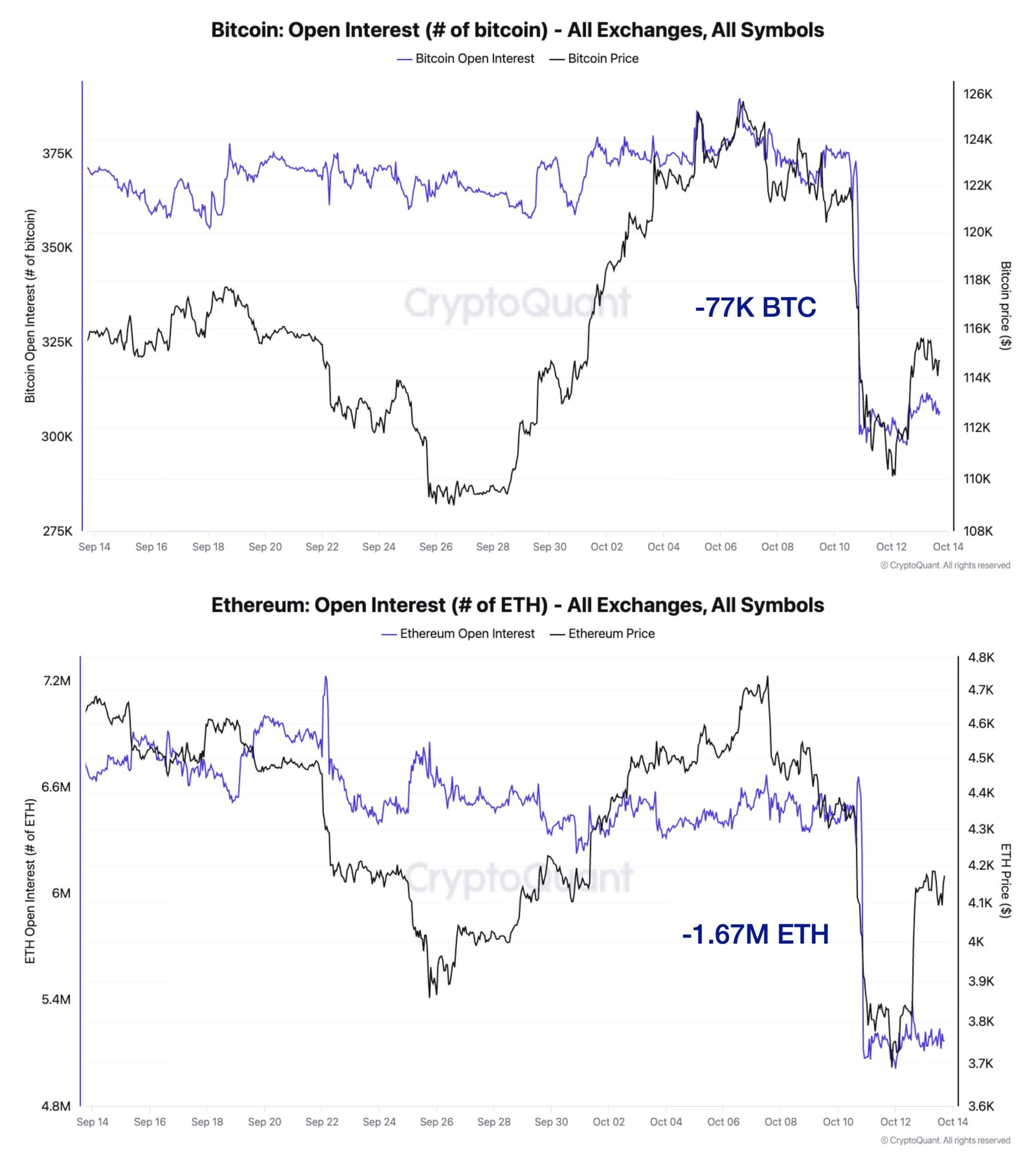

The crypto market lost nearly $200 billion in value as escalating trade tensions between China and the United States reignited global risk aversion. This halted Bitcoin’s fragile recovery after last weekend’s record $19 billion liquidation. Bitcoin price struggles Data from CryptoSlate shows the

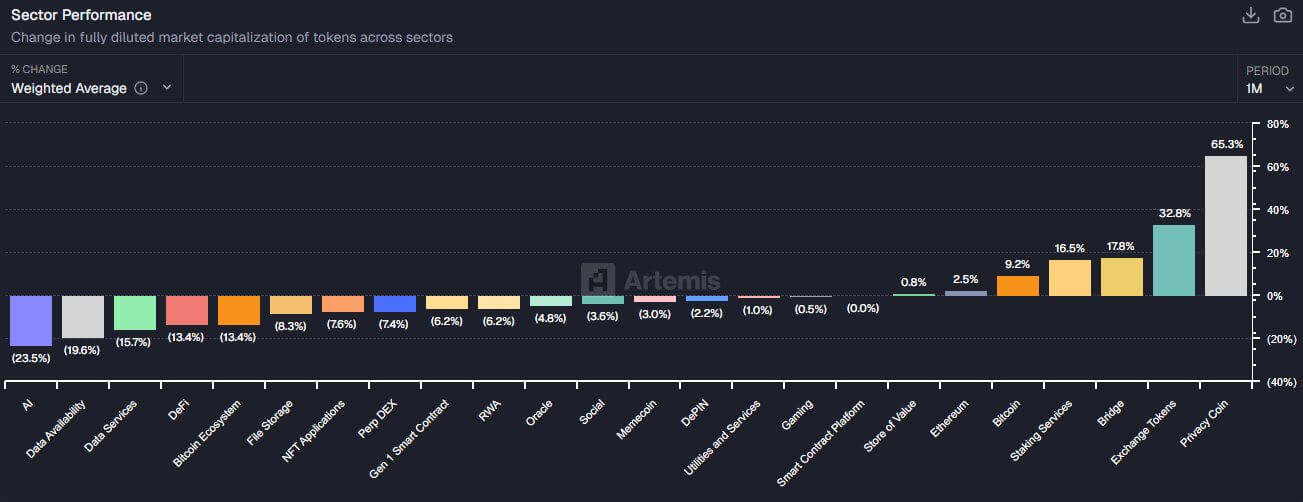

$9.4B in liquidations over 24 Hours triggers ‘2021 type situation for altcoins’

There may be no crying in the casino. But on days like these, you’d be forgiven for shedding a tear. With $9.4 billion liquidated in a single day in the crypto market, the flash crash comes just in time to

Can Bitcoin really reach $150K, what would it take?

Bitcoin’s steady climb to a new all-time high this October has revived the familiar question of whether the next breakout could mark the first sustained run to $150,000. The optimism follows a surge in derivatives positioning and ETF inflows, suggesting that

Ethereum doubles down on privacy with new ‘Kohaku’ wallet ahead of Devcon

Ethereum is putting privacy back at the center of its roadmap. This November, during the Devcon conference in Argentina, the Ethereum Foundation will unveil Kohaku, a new wallet framework designed to let users transact without exposing unnecessary personal or transactional details. The

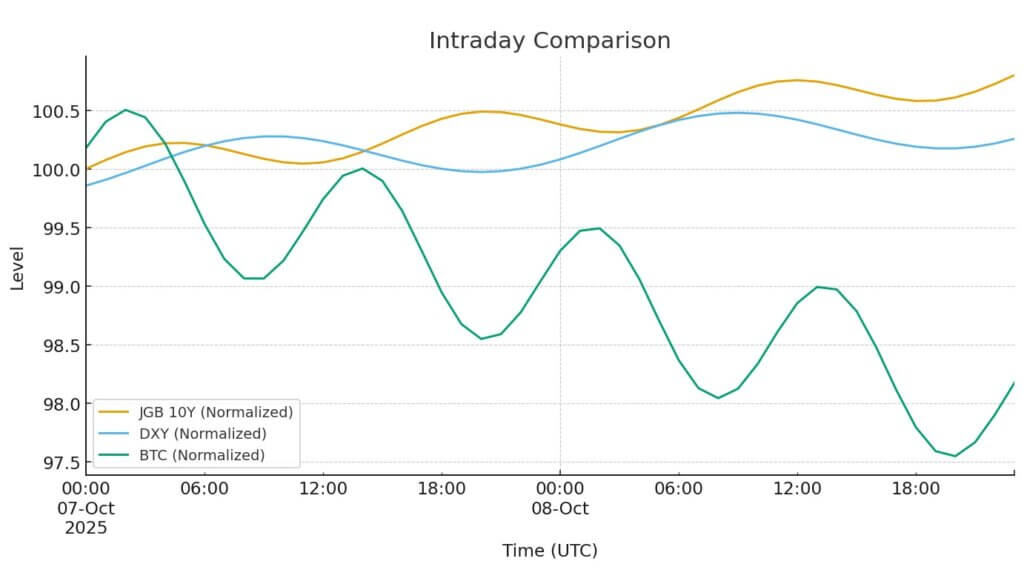

JGB 17-year yield spike tests Bitcoin at $123k; is risk off back?

Japan’s 10-year government bond (JGB) yields reached levels not seen since 2008, triggering a scenario that pressures Bitcoin through spot depth and order-book mechanics rather than direct correlation. The long-end selloff in Japanese government bonds pushes domestic yields higher, reducing the

Eight years of CryptoSlate: What we have learned, what we are building next

CryptoSlate turns eight today, and as Editor-in-Chief, I could not be prouder of what we have achieved and where we’re going next. Our first story in 2017 asked which countries were most open to crypto, and since then, millions of readers