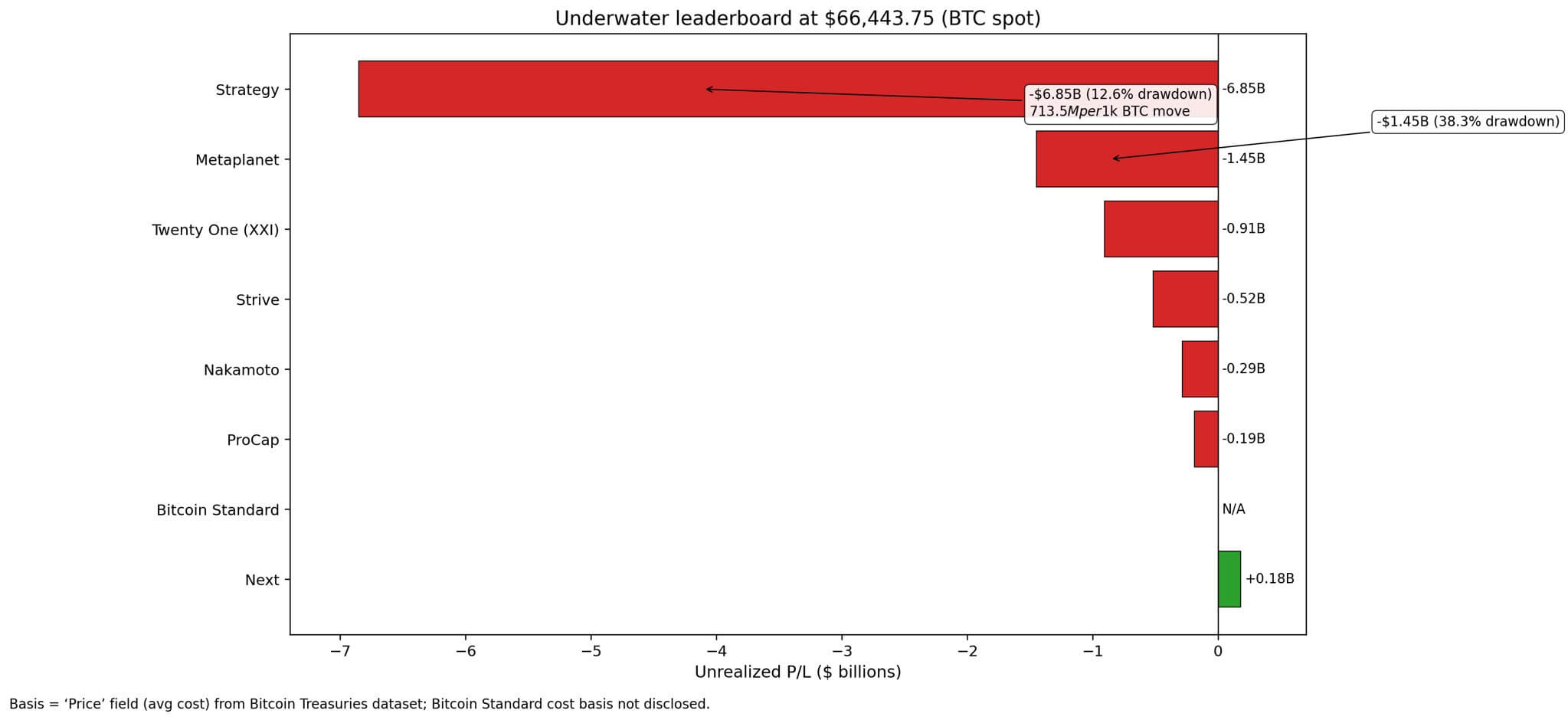

Bitcoin’s slide to $60k puts BTC treasury companies $10B underwater as one major firm is braces for a $27B disaster

Bitcoin's (BTC) slide to as low as $60,233 overnight, before recovering somewhat to $65,443, has left most of the largest pure-play Bitcoin treasury companies deeply underwater on their holdings, with combined unrealized losses approaching $10 billion across eight entities that

Bitcoin’s slides to $70,000 triggering structural crisis that could make FTX collapse look like child’s play

Bitcoin’s latest drawdown is forcing a critical stress test on the “treasury company” trade. Over the past months, the model appeared simple, requiring companies to sell stock or low-cost convertible notes, buy Bitcoin, and rely on rising prices and a persistent

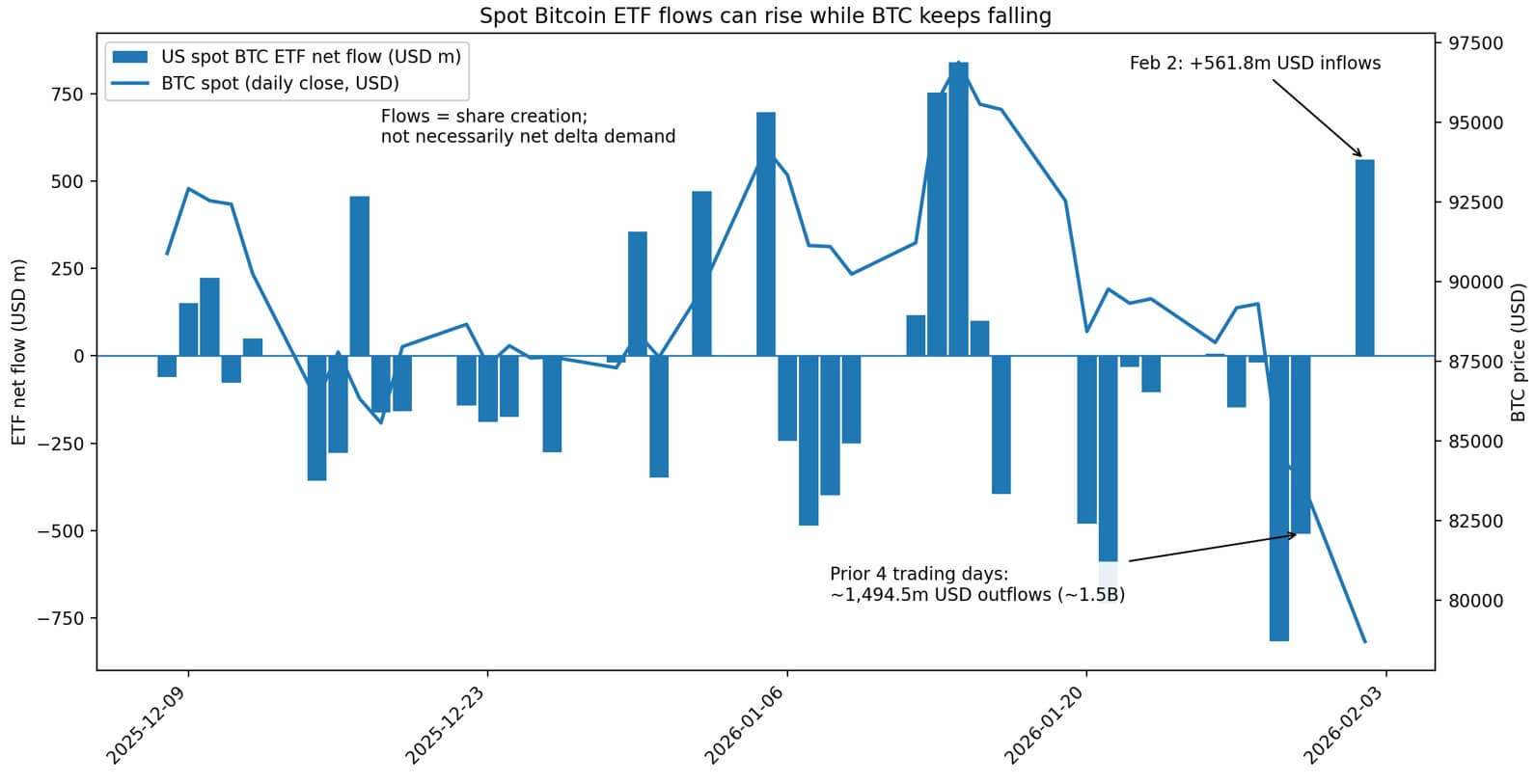

Bitcoin has ended its $1.5B outflow streak, yet the trade driving inflows could vanish under pressure

US spot Bitcoin exchange-traded funds recorded $561.8 million in net inflows on Feb. 2, ending a four-day streak of nearly $1.5 billion in outflows. Investors could interpret the number as a return of conviction after punishing outflows, but Jamie Coutts, chief

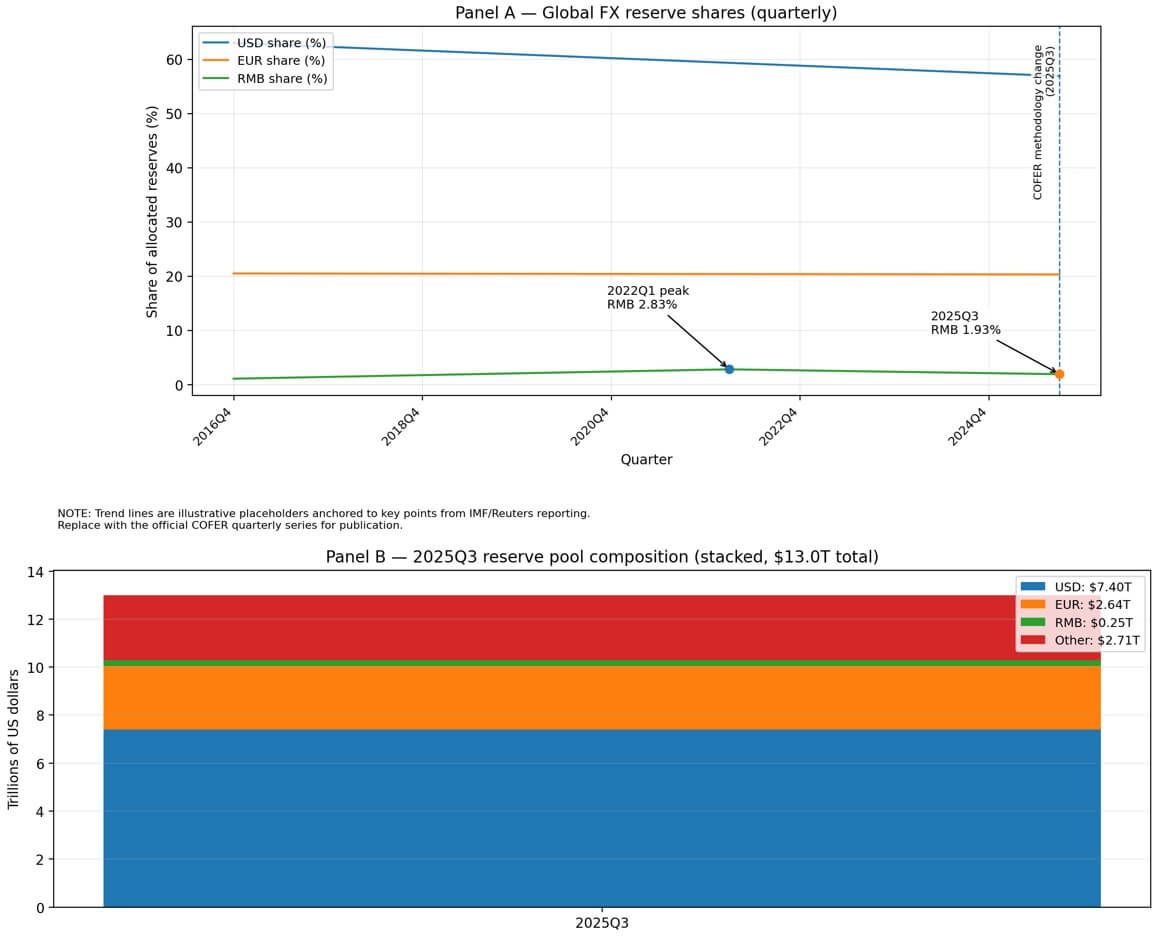

China targets global reserve currency status but capital controls push traders toward USDT and Bitcoin

China seeks to make the renminbi a true reserve currency, but the numbers reveal a story in which Beijing's capital controls create conditions for Bitcoin and dollar stablecoins to thrive as workarounds rather than competitors. The International Monetary Fund's latest reserve

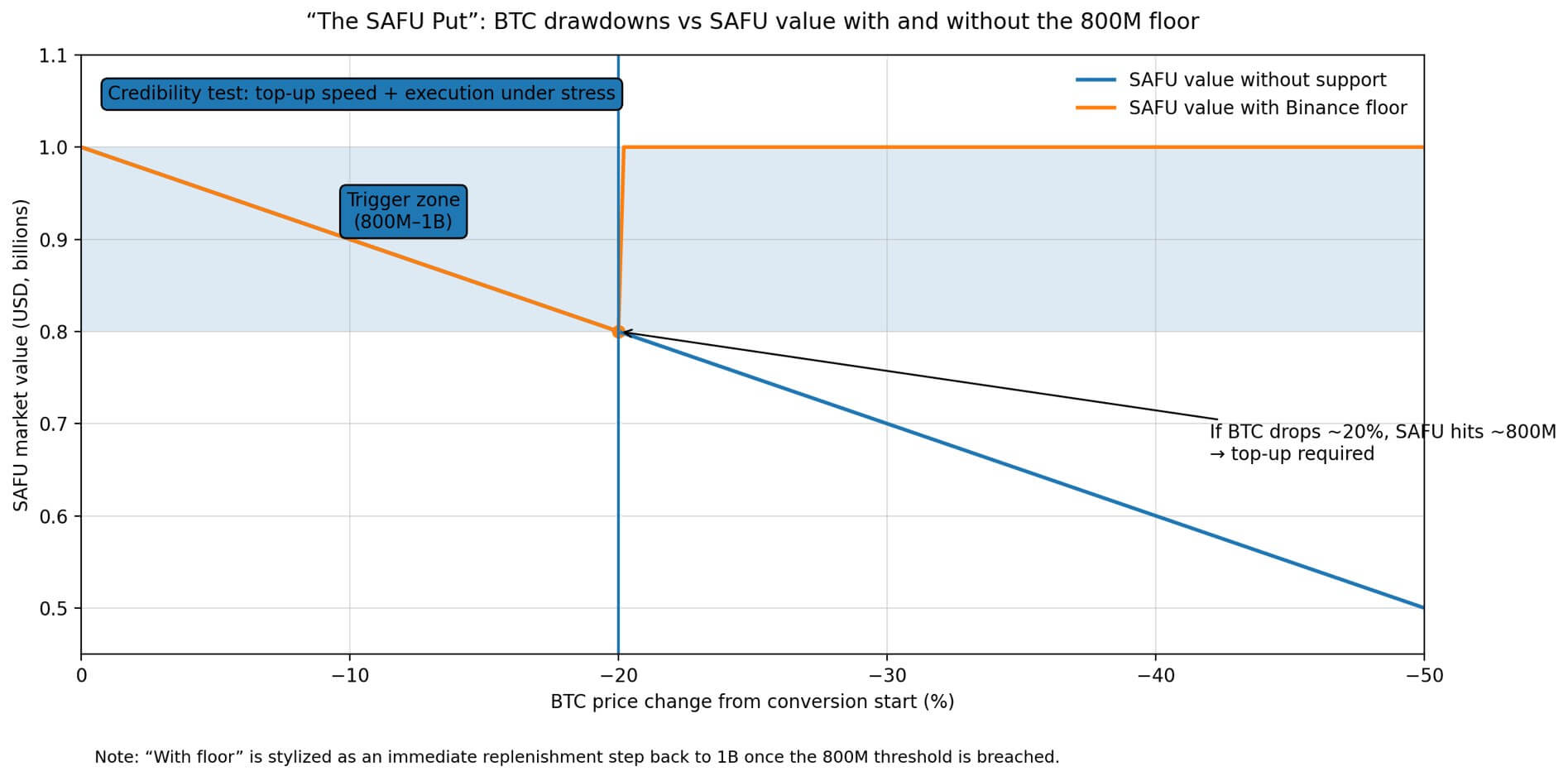

Binance commits to gigantic Bitcoin purchase as an implicit apology for October liquidation meltdown

Binance just turned its emergency insurance fund into a public, auditable pledge. And it reads like a crisis-repair letter in balance sheet form. The exchange announced Jan. 30 that it will convert SAFU's roughly $1 billion stablecoin reserves into Bitcoin within

Will MAGA style Fed rhetoric under Warsh break the market, redefining dovish vs hawkish trades?

Trump picked Kevin Warsh for Fed chair, the first big market change may be the way the Fed talks When Donald Trump says Jerome Powell “got it wrong,” he usually means one thing: rates should have come down faster. Powell, for all

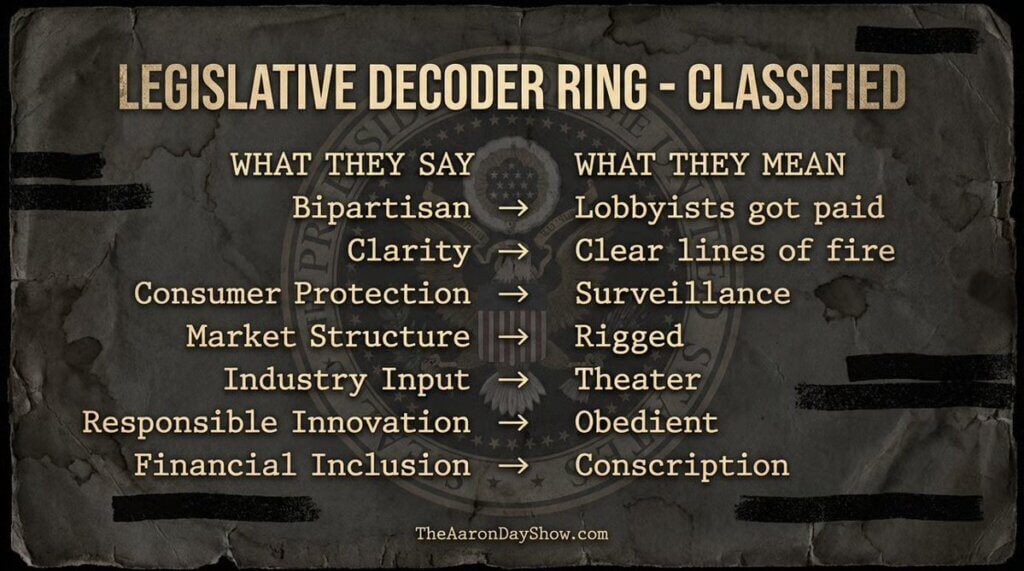

The CLARITY Act uses Bank Secrecy laws to quietly kill decentralized access without ever banning code

DeFi exclusions sound protective, yet the CLARITY Act’s Bank Secrecy expansion may target your access points While supporters say the CLARITY Act could bring long-awaited regulatory certainty to crypto markets, not everyone is on board. Critics argue the bill doesn’t need to

Bitcoin ready to record fourth straight red month and the $81,000 floor is suddenly everything

Bitcoin is struggling to avoid a fourth consecutive monthly decline as the cryptocurrency market grapples with a fundamental shift in momentum that has left most investors underwater. Data from CryptoSlate indicate that the largest digital asset declined by nearly 7% over

Ripple’s billion dollar masterstroke forces 13,000 banks to rethink corporate cash while raising tough questions for XRP

Ripple has pushed deeper into corporate finance with a new treasury platform that aims to let finance teams manage cash and digital assets in one system. The product, called Ripple Treasury, is built on treasury management software Ripple acquired in October

Aave has created a systemic DeFi feedback loop with only a $460M backstop as its lending monopoly reaches 51%,

Aave now controls 51.5% of the DeFi lending market share, the first time any protocol has crossed the 50% threshold since 2020. The milestone arrives not through competitor collapse but through steady accumulation: Aave's $33.37 billion in total value locked sits

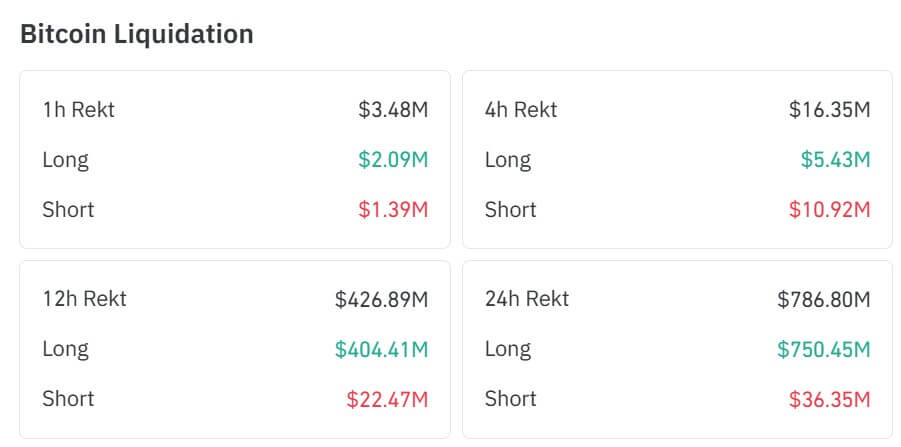

Panic selling Bitcoin on Coinbase triggers a Binance price gap that reveals a “messy” institutional market failure

Coinbase's Bitcoin (BTC) price dropped below competing exchanges this week, and the gap continues to widen. CoinGlass reported on Jan. 26 that its Coinbase Bitcoin Premium Index, which tracks the price difference between Coinbase's BTC/USD and Binance's BTC/USDT, turned sharply negative,

Deloitte warns of dangerous “blind spot” in tokenized settlement that will make market manipulation nearly impossible to stop

Wall Street’s next leap may look boring from the outside, but it's a huge development that's shrouded in corporate speak: T+0 settlement, shorthand for settling a trade the same day it happens. Deloitte’s 2026 outlook flags it as one of the

Explosive truth behind crypto bots that front-run thieves to “save” funds — but they decide who gets paid back

Makina Finance lost 1,299 ETH, roughly $4.13 million, in a flash-loan and oracle manipulation exploit. The attacker drained the protocol's funds and broadcast the transaction to Ethereum's public mempool, where it should have been picked up by validators and included in

From prison to Davos, pardoned Binance founder CZ exposes a $33 trillion secret the global elite can’t hide anymore

Changpeng Zhao spoke at the World Economic Forum's 2026 Annual Meeting in Davos this week, his first appearance on the official programme since Binance's 2023 US settlement and his subsequent guilty plea, prison sentence, and presidential pardon. The listing placed him

Ethereum is facing a brutal institutional “midlife crisis,” and the Foundation’s 35-point response reveals a shocking new reality

When the Ethereum Foundation dropped a thread on Jan. 19 claiming “Ethereum is the #1 choice for global financial institutions” and backing it with 35 cited examples, it moved past the standard protocol update or developer announcement. It read like institutional

Natural gas surged 17% yesterday and it’s triggering a macro trap that could suddenly tank Bitcoin prices

Natural gas prices surged 17.76% on Jan. 19, driven by cold forecasts across Northeast Asia and Europe, tightening liquidity in global LNG markets, and short-covering in European storage inventories sitting 15% points below the five-year average. For most crypto traders, a

Bitcoin options just overtook futures for the first time, and the new way institutions hedge is trapping retail leverage

By mid-January, open interest in Bitcoin options rose to about $74.1 billion, edging past Bitcoin futures open interest of roughly $65.22 billion. Open interest is the stock of outstanding contracts that have not been closed or expired, so it measures position

Discord is suddenly locking down servers for the same alarming reason X just purged these crypto developers

X revised its developer API policies to ban applications that financially reward users for posting, and enforcement has already begun. Nikita Bier, who joined X's product team after selling his social app tbh to Meta, framed the move as part of