Bitcoin price is exploding, and a rare “gamma squeeze” suggests the price action is about to get violent

Bitcoin's brief climb above $97,000 over the past day extended a run that suggests the underlying mechanics signal a structural shift in how capital is interacting with the asset class. According to CryptoSlate data, BTC reached a peak of $97,860, its highest

How solo Bitcoin miners hit 22 blocks hit in 12 months as another hit the jackpot this week

A single Bitcoin (BTC) miner collected a full block reward on Jan. 13, claiming 3.125 BTC plus fees worth close to $300,000 at current prices. The win wasn't split among thousands of pool participants. One address received the entire payout in

Can Bitcoin help amid internet blackouts after Iran’s currency collapsed 95% overnight?

Iran's currency, the rial, has collapsed to around 1 million per US dollar, a record that spotlights how quickly savings can be wiped out when trust in money breaks. The currency lost nearly half its value across 2025, with official inflation

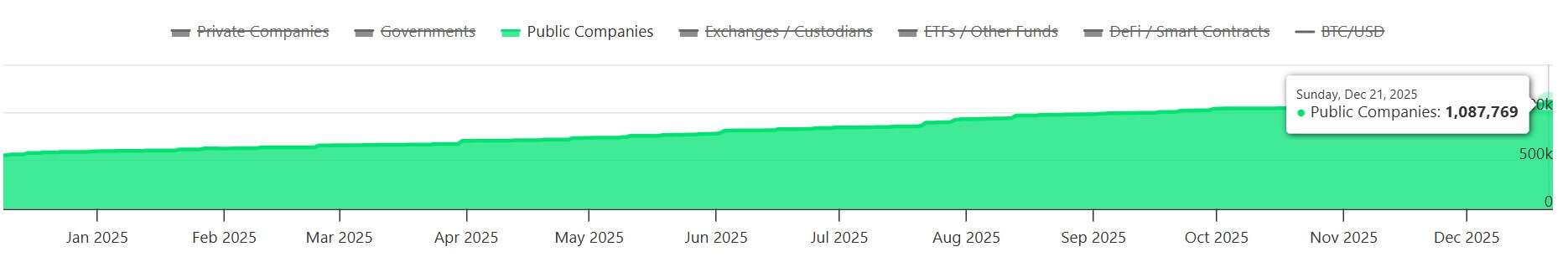

Bitcoin is being hijacked by three “boring” institutional dials that are overpowering the halving’s supply shock

Bitcoin’s four-year cycle used to be a comfort blanket. Even people who claimed they didn’t believe in it still traded as they did. The halving would cut new supply, the market would spend months pretending nothing happened, then liquidity would show

Ethereum just solved a critical problem Bitcoin doesn’t want to fix on its own network – but why?

A few years ago, the easiest way to explain Bitcoin to a newcomer was to keep it simple, slow, and sturdy. Ten-minute blocks. Limited space. Everyone checks everything. Nobody gets special treatment. That design is a feature. It is what makes Bitcoin

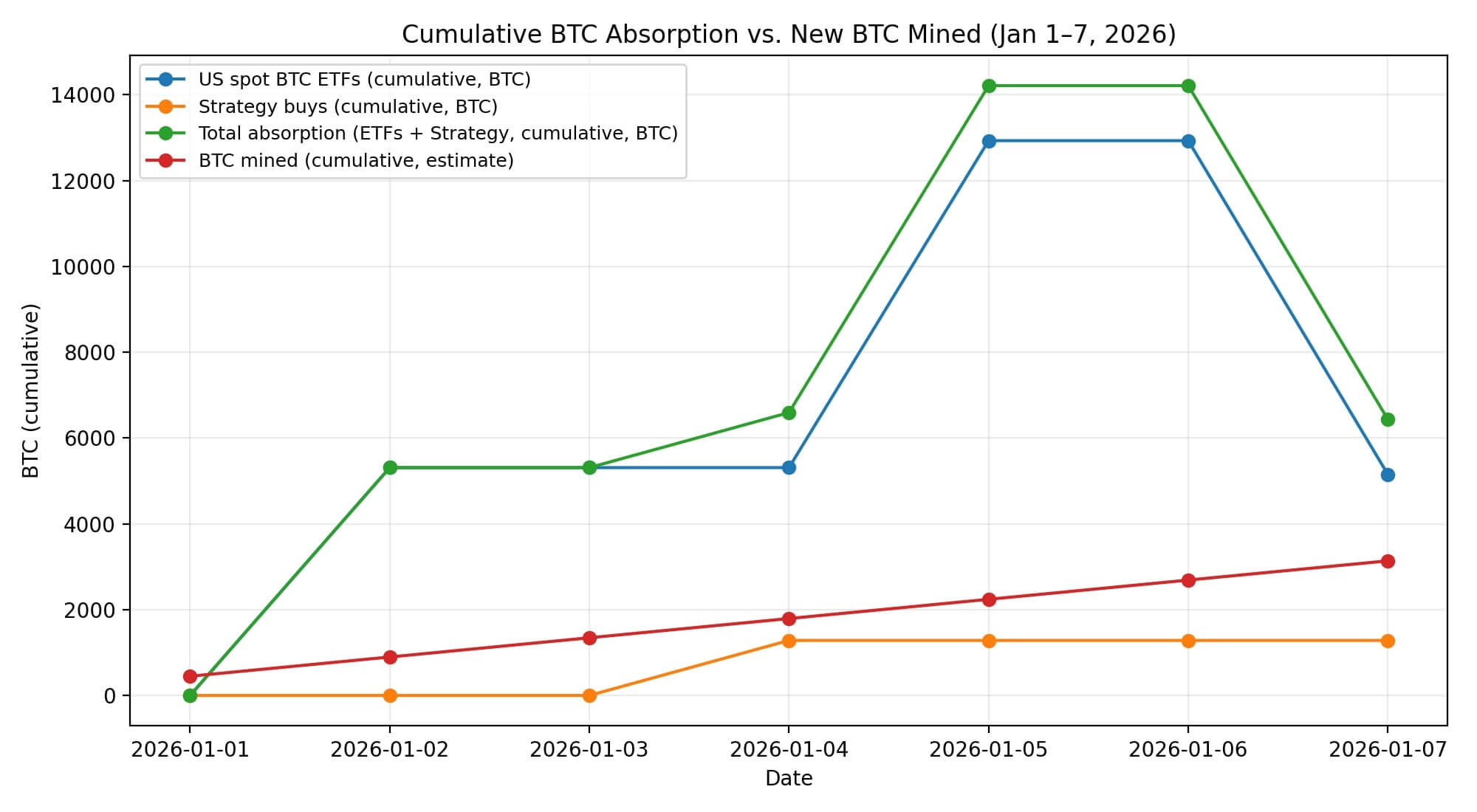

Bitcoin is stalling, but this low-key “absorption signal” shows a violent supply shock could be inevitable

Bitcoin (BTC) opened 2026 with the kind of price action that tests conviction, with the first five days taking BTC close to $95,000, only for it to test the $90,000 footing again. The movement follows weeks of choppy trading, failed breakout

Bitcoin is trapped in a $54 billion Nvidia gamble that could trigger a sudden institutional sell-off

Beijing's reported request for Chinese tech firms to halt orders of Nvidia's H200 chips arrives at a moment when Bitcoin has become uncomfortably tethered to AI equity sentiment. As The Information and Reuters reported on Jan. 7, the move affects “some”

XRP ETFs are devouring supply at a rate that exposes a glaring $1 billion institutional secret

XRP has emerged as the best-performing asset among the top 10 cryptocurrencies by market capitalization to start 2026, outpacing market leaders Bitcoin and Ethereum. According to data from CryptoSlate, XRP has jumped by 28% since the start of the year to

Bitcoin breaks $94,000 for the first time in a month: Why is crypto up today?

Bitcoin (BTC) pierced $94,000 on Jan. 5, reaching its highest level since Dec. 10 and capping a rally that added nearly $100 billion to the total crypto market capitalization in 24 hours. The move came as spot Bitcoin ETFs recorded their

Oil prices just did the unthinkable after the Venezuela raid, and it hands Bitcoin a rare advantage

When the futures market opened Monday, the screens told a story that felt backward. The U.S. had just captured Venezuela’s president, Nicolás Maduro, in a weekend operation that jolted geopolitics and dominated headlines. And yet oil did not spike. It slipped. At the

XRP’s $1 billion ETF record is misleading, and one hidden flow metric explains why price remains stagnant

XRP spot ETFs have crossed $1 billion in assets under management, with about $1.14 billion spread across five issuers. Net inflows since Nov. 14 sit near $423.27 million. On the same CoinGlass dashboard, XRP itself sits around $1.88, with a market

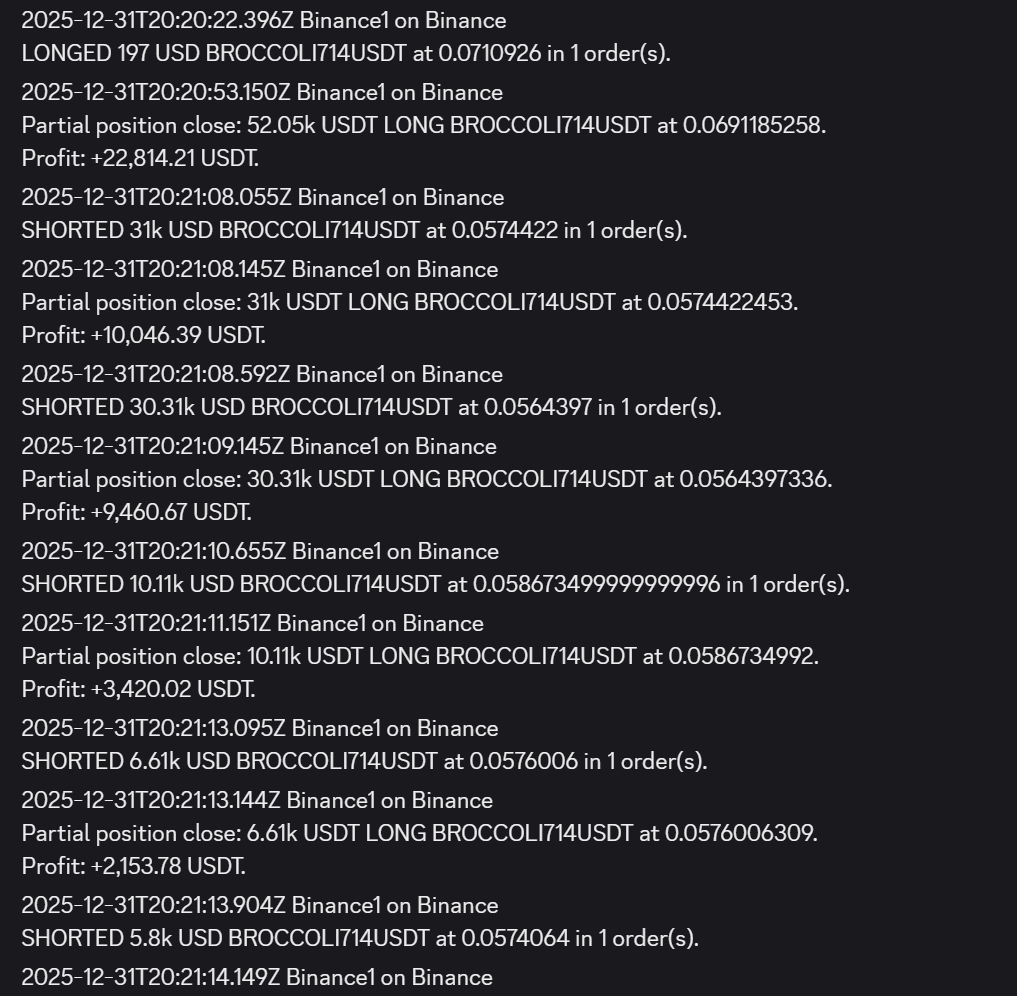

How this trader exploited a New Year glitch on Binance to make $1.5 million in a day

A crypto trader, Vida, realized more than $1.5 million in gains after spotting an anomalous wall of buy orders on Binance for the little-known token BROCCOLI714 on New Year's Day. Vida, who shared detailed logs of the trade on social media platform

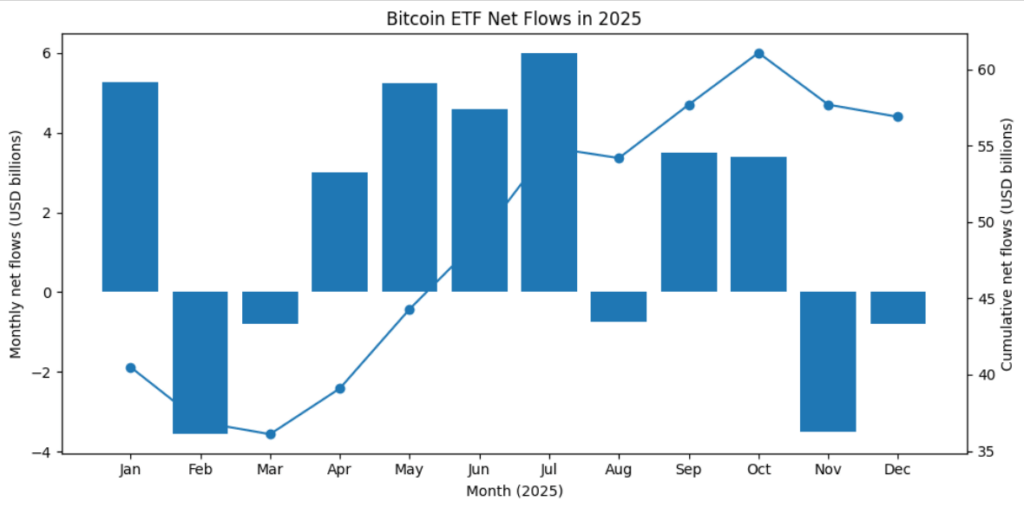

Bitcoin ETF “record outflows” are deceptive as crypto products absorbed $46.7 billion in 2025

Bitcoin ETF headlines have turned into a scoreboard with “record inflows,” “largest outflows ever,” and “institutions dumping.” The problem is that most stories isolate a single day or a single fund. Without context on cumulative flows, fund cohorts, and custody plumbing,

Bitcoin’s 2025 review: The “violent transformation” hidden behind the year’s deceptively flat price chart

2025 delivered a brutal lesson in market structure for Bitcoin. The year began with political momentum and drifted into a summer of aggressive policy signals. Yet, it snapped into one of the sharpest boom-to-bust sequences in the asset’s history. By December, the

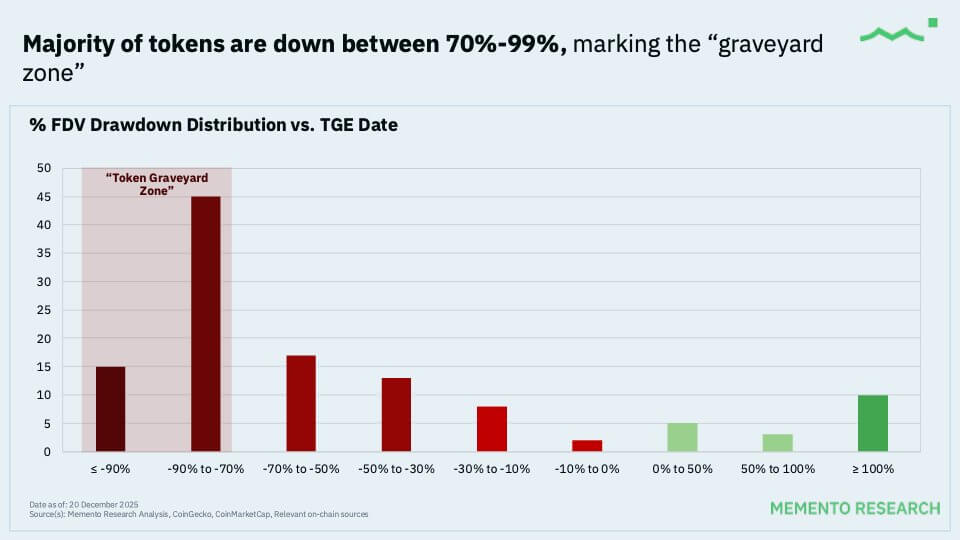

Crypto insiders stopped buying new tokens 2 years ago, creating a liquidity trap that’s crushing retail buyers

More than 80% of the tokens launched this year are trading underwater, marking a definitive shift in the market's appetite for venture-backed cryptocurrency projects. Data from Memento Research showed that it tracked 118 major token generation events in 2025 and found

Bitcoin stalled at $90,000 because that “perfect” inflation report hides a massive data error

US inflation came in softer than expected, and the Fed delivered its third consecutive rate cut. The Bank of Japan raised rates for the first time in three decades without triggering a meltdown. On paper, the macro tape into year-end looks

Bitcoin’s inability to reclaim $90,000 exposes a deep structural fracture that could trap investors during the next unwind

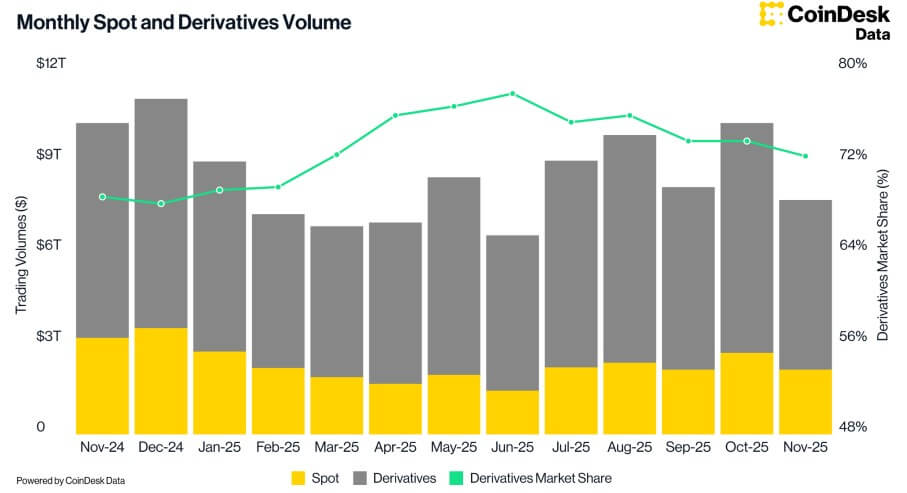

Bitcoin’s inability to reclaim $90,000 is looking less like a debate about narratives and more like a test of market plumbing. For the better part of 2025, the surface story was institutional momentum. The US moved toward a workable regulatory perimeter,

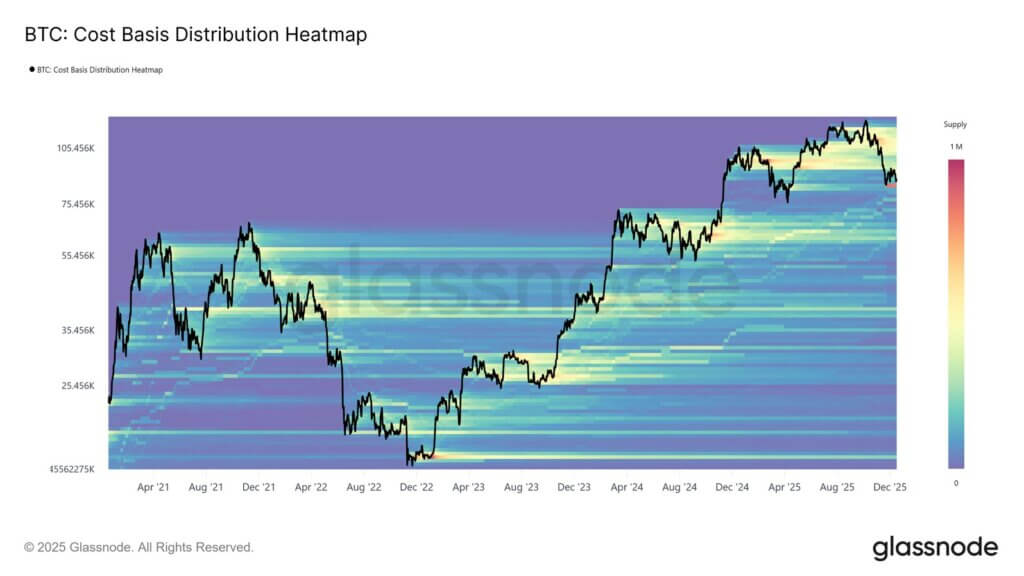

Bitcoin is facing a hidden “supply wall” at $93,000 that creates a ceiling no rally can break right now

Bitcoin surged $3,000 in an hour on Dec. 17, reclaiming $90,000 as $120 million in short positions vaporized, then collapsed to $86,000 as $200 million in longs liquidated, completing a $140 billion market-cap swing in two hours. The movement was driven