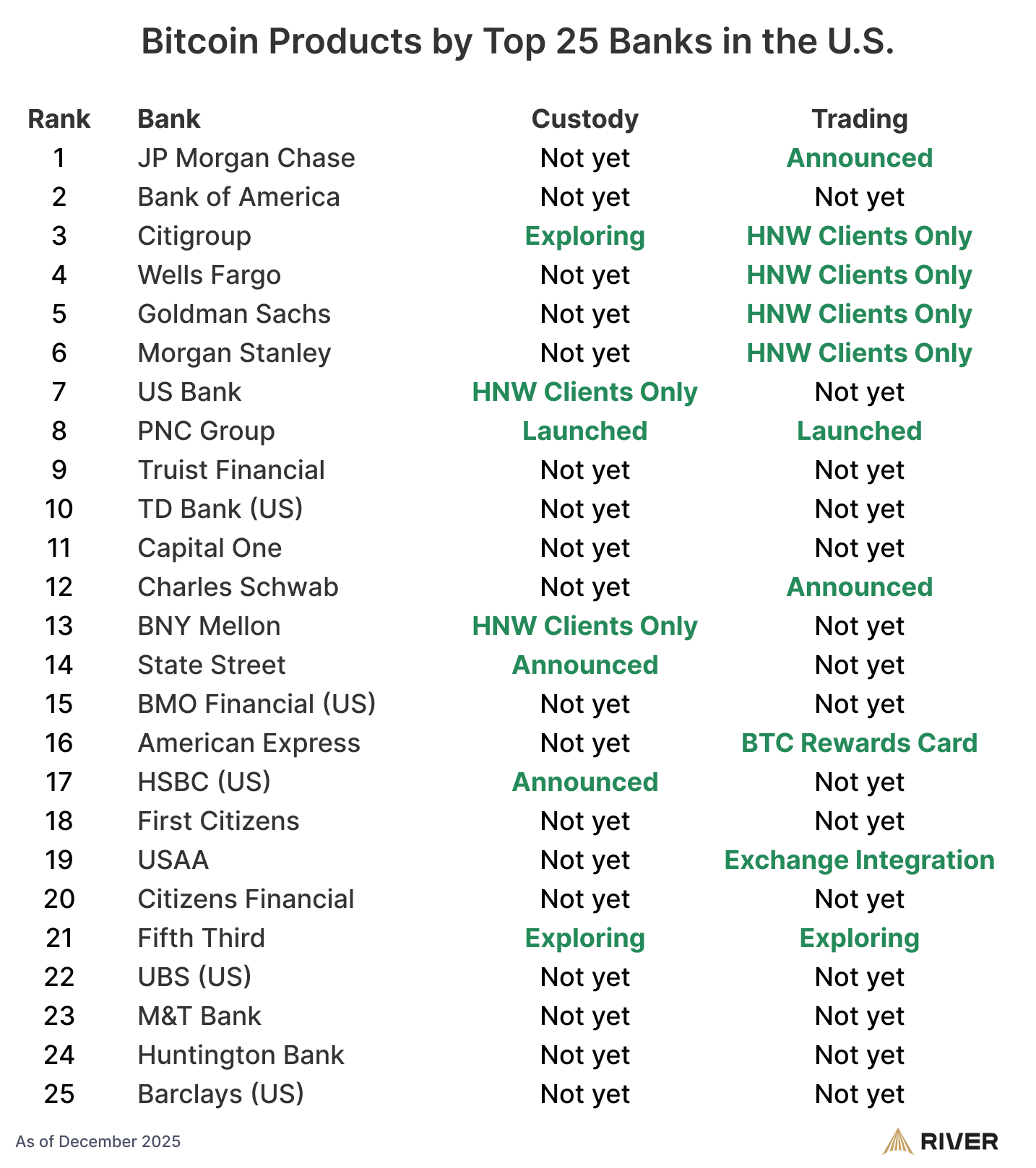

Bitcoin data proves 60% of top US banks are quietly activating a strategy they publicly denied for years

For years, US banks treated Bitcoin as something best observed from a distance. The asset lived on specialist exchanges and trading apps, walled off from core banking systems by capital rules, custody worries, and reputational risk. However, that posture is finally giving

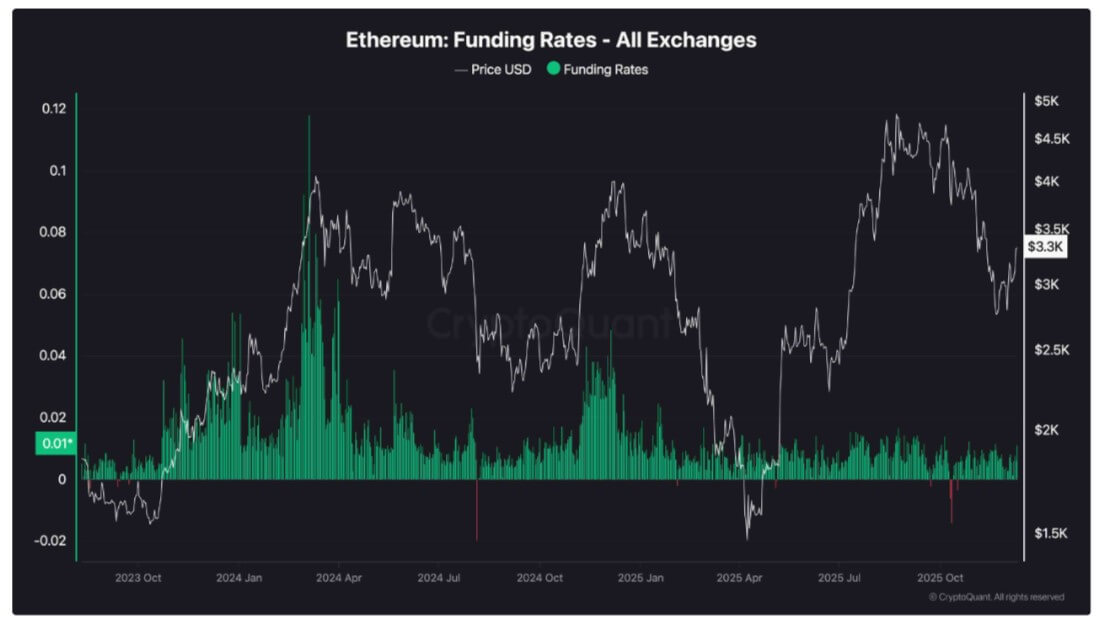

Ethereum fees just hit 7-year low as it finally outperforms Bitcoin – one hidden data point proves rally is sustainable

The Federal Reserve has delivered the quarter-point rate cut markets demanded, and Ethereum is responding exactly as the “smart money” anticipated. While Bitcoin effectively shrugs off the news near $92,000, Ethereum is holding its pre-meeting gains above $3,300, validating the sharp

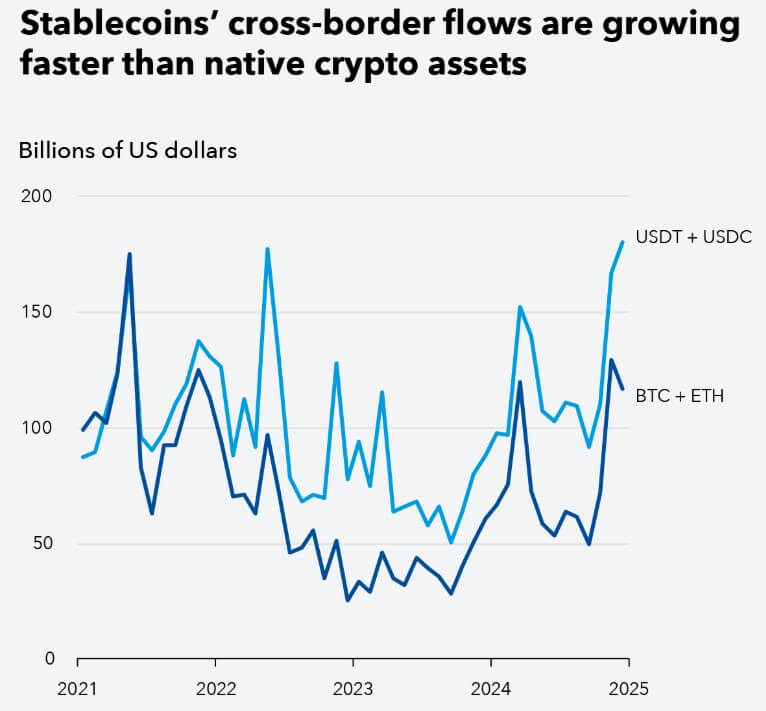

Stablecoins just eclipsed Bitcoin in the one metric that matters, exposing a $23 trillion global fault line

Stablecoins were once a minor appendage of crypto markets, a functional parking spot for traders cycling between Bitcoin and Ethereum. However, framing no longer fits. With a circulating supply above $300 billion and annual trading volumes exceeding $23 trillion in 2024,

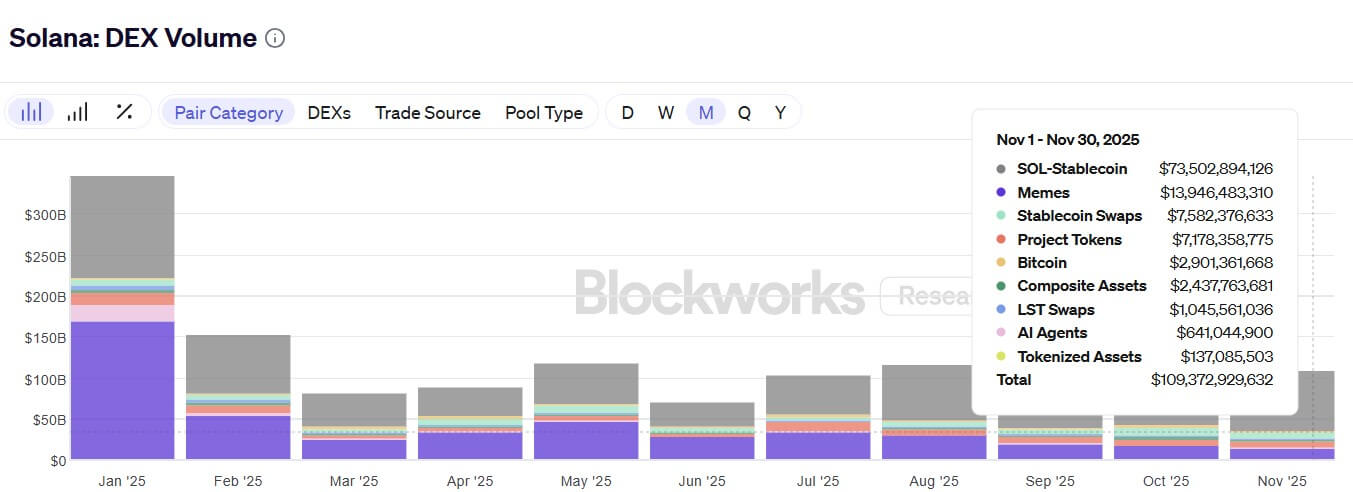

50 secret wallets fueled PIPPIN’s 556% rally — and $3B in derivatives volume may explain why

The broader Solana memecoin economy is currently facing a liquidity crisis and collapsing volumes, but one asset has successfully decoupled from the sector-wide decline. According to CryptoSlate data, PIPPIN, a token born from an AI experiment in early 2024, has emerged

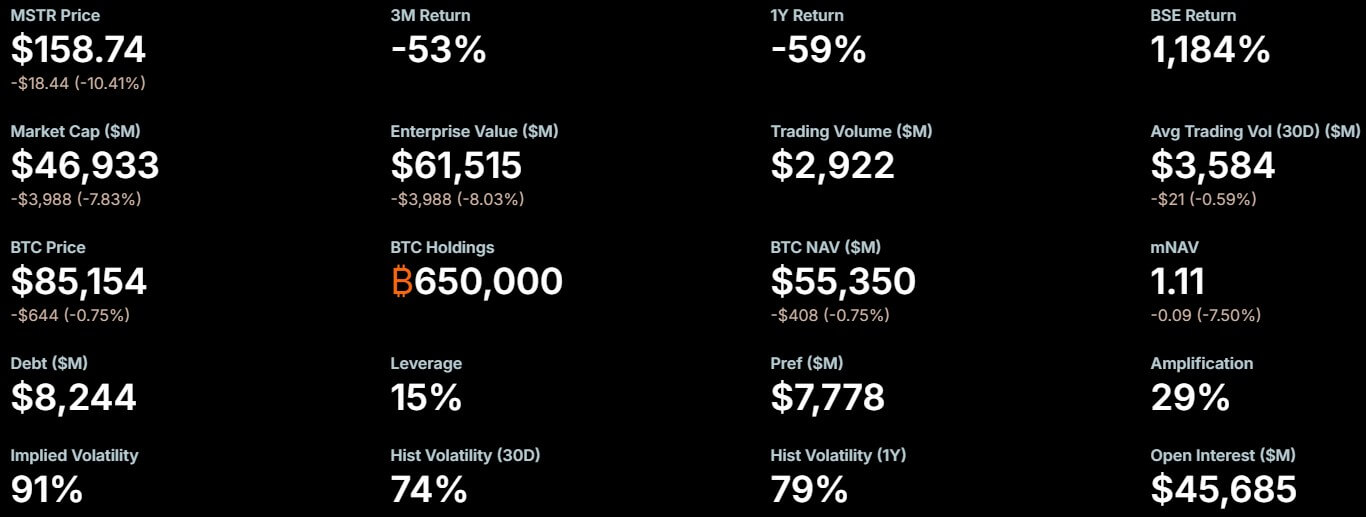

Strategy new ‘last resort’ to sell Bitcoin could trigger on 15% dip – sets $1.4B cash reserve contingency

Strategy Inc., the corporate Bitcoin vault formerly known as MicroStrategy, has signaled that the mechanics driving its rapid growth have hit a cyclical wall. On Dec. 1, the Tysons Corner-based firm revealed that it was prioritizing a $1.44 billion cash reserve

$150B wiped: Bitcoin drops below $87k on Japan yield shock

Bitcoin price erased recent gains, shedding nearly 5% to below $87,000 in early Asian trading hours on Dec. 1. This came as a surge in Japanese government bond yields triggered a broad risk-off sentiment, shattering a fragile, low-volume market structure. According to

Bitcoin on Wall Street will never be the same after a quiet Nasdaq move

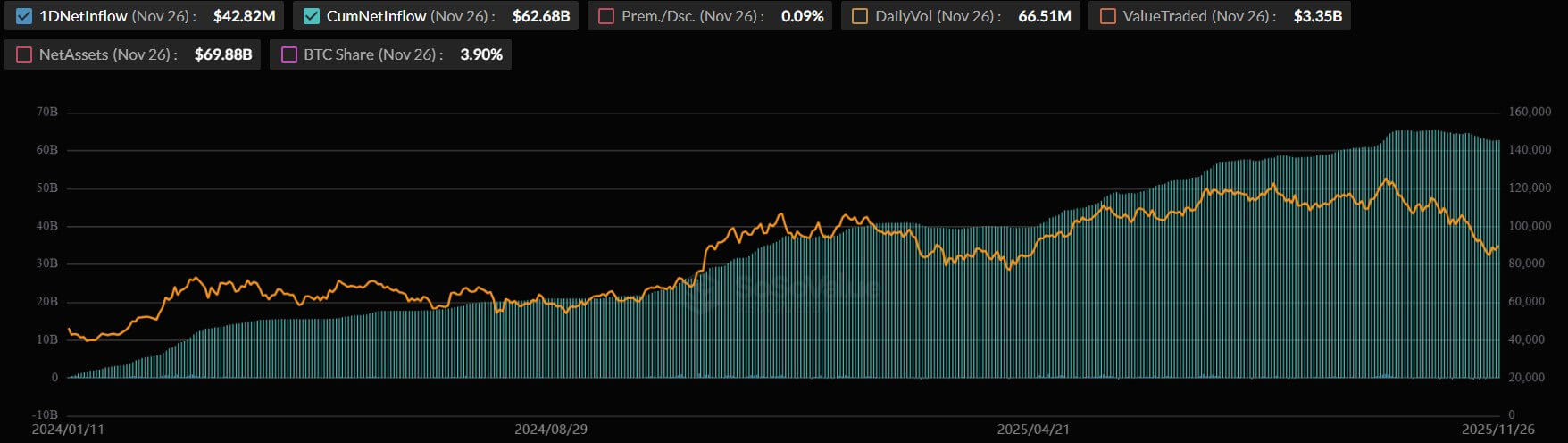

On Nov. 26, Nasdaq’s International Securities Exchange quietly triggered one of the most important developments in Bitcoin’s financial integration. The trading platform asked the US Securities and Exchange Commission (SEC) to raise the position limit on BlackRock’s iShares Bitcoin Trust (IBIT)

Why Wall Street is blocking Strategy’s S&P 500 entry — even with its $56B Bitcoin empire

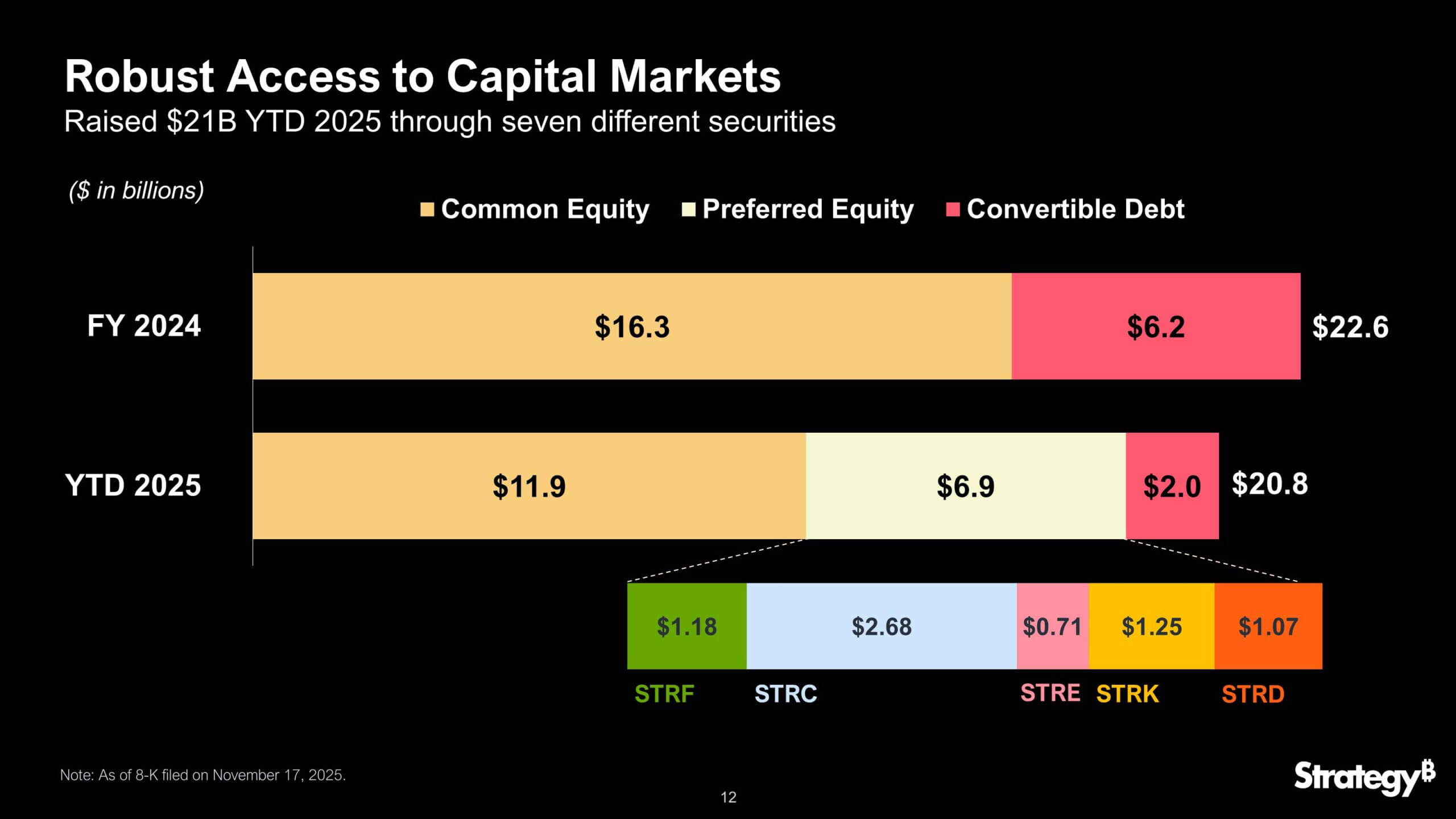

Strategy Inc. (formerly MicroStrategy) spent 2025 building the largest corporate Bitcoin reserve the public markets have ever financed, but the scale of that ambition ended up colliding with the logic of its own stock. What began as an aggressive accumulation strategy,

Dogecoin ETF debut flops with no inflow revealing concerning market reality

Wall Street has finally built a bridge to the internet’s most famous meme coin, but on day one, no one crossed it. On Nov. 24, Grayscale’s Dogecoin ETF (GDOG) began trading on the NYSE Arca without logging a single unit of

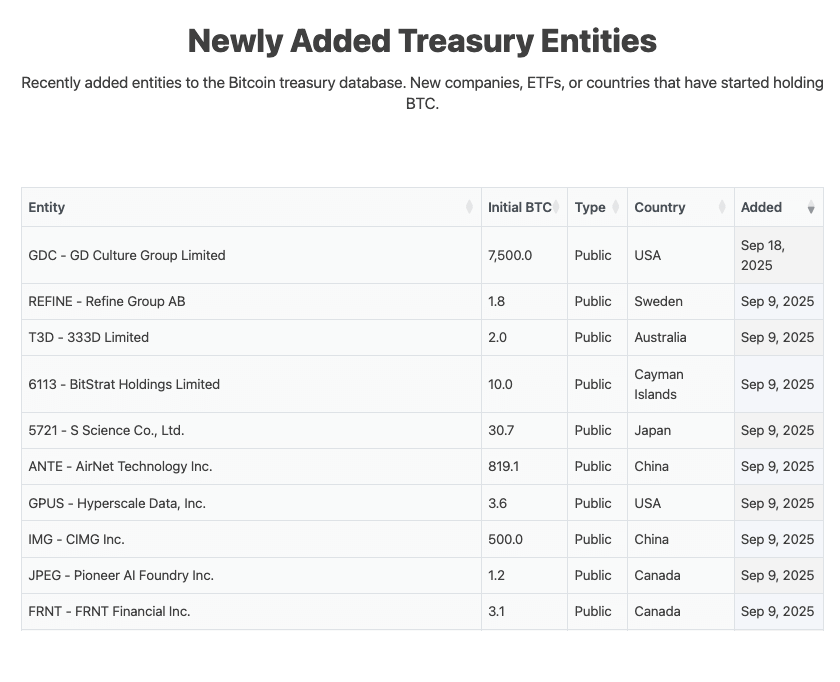

We’ve had 2 months without a single new company buying Bitcoin – Why is it so quiet?

The story of corporate Bitcoin adoption is often told as a parade of logos. New CFO decides to be bold. Board nods. Treasury buys coin. Number go up. That parade has not shown up for two months. According to BitBo’s treasuries

Ethereum’s crash just exposed a $4B time bomb — why regular investors should pay attention

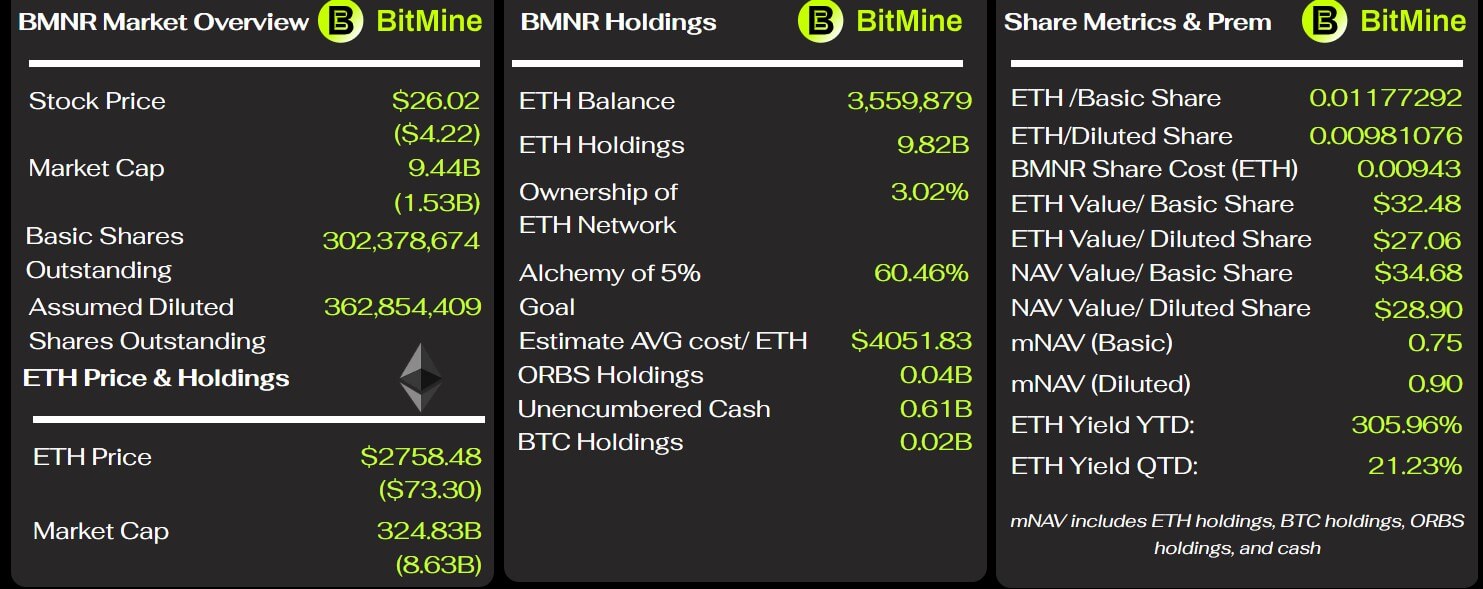

BitMine, once hailed as a potential digital-asset equivalent of Berkshire Hathaway, envisioned itself locking down 5% of all Ethereum’s circulating supply. Its core strategy was to turn its corporate balance sheet into a long-term, high-conviction bet on the blockchain network’s infrastructure. Today,

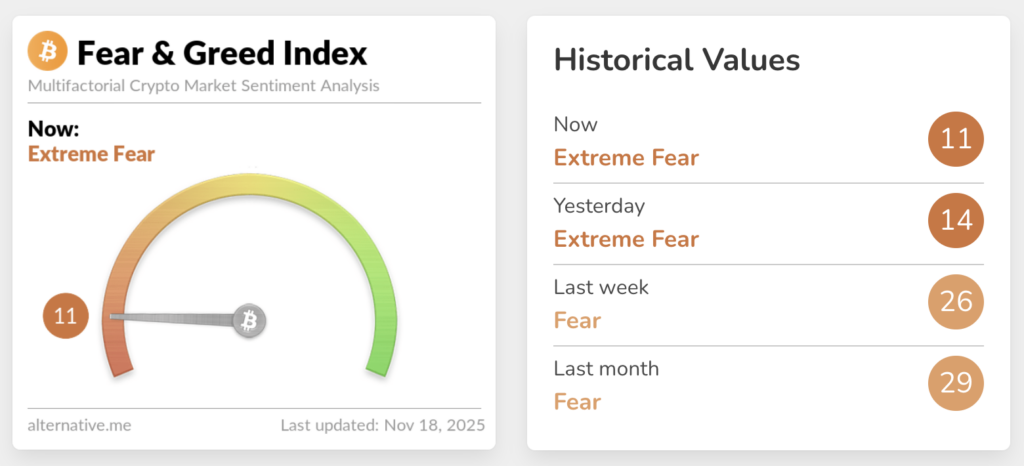

Bitcoin sentiment has hit rock bottom – as bad as COVID and FTX crashes

The Crypto Fear & Greed Index has just printed 10 out of 100, which is not typically seen during a bad week or a rough month, but only at huge stress moments, such as the March 2020 COVID crash, the

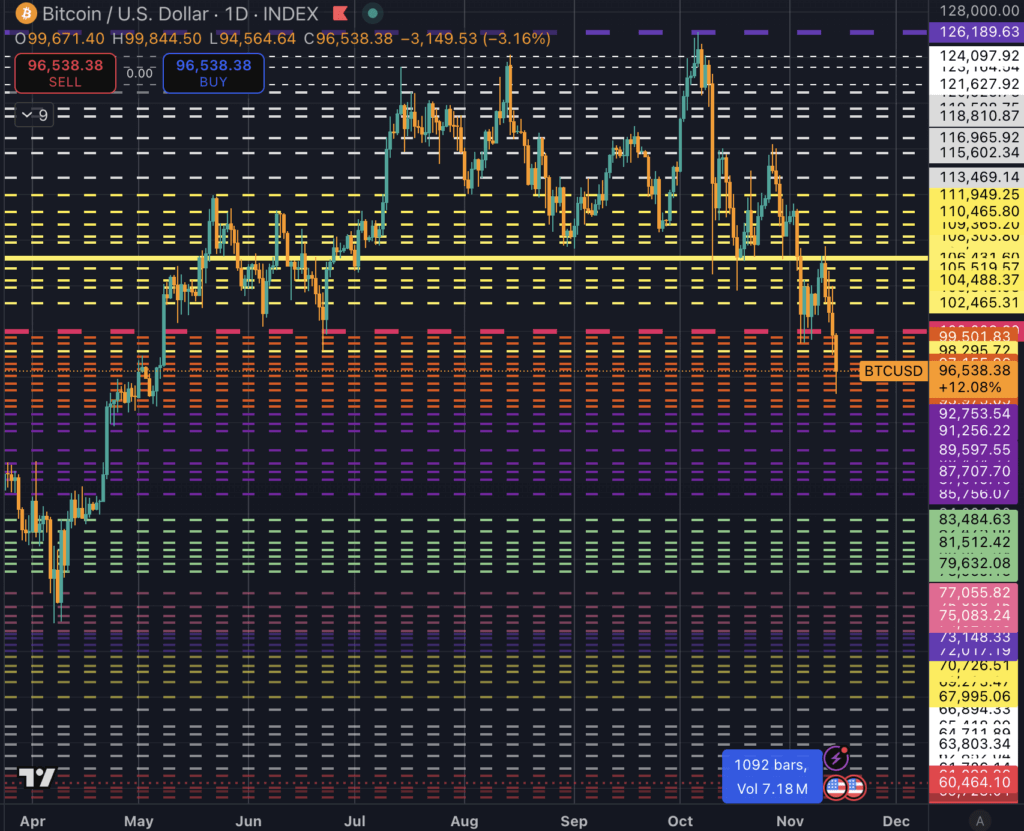

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

Bitcoin is slipping again, and the mood across the market is shifting. Traders who were celebrating six-figure prices only weeks ago are suddenly watching key levels evaporate. The move below $106,400 was the first real warning sign, the collapse through $99,000

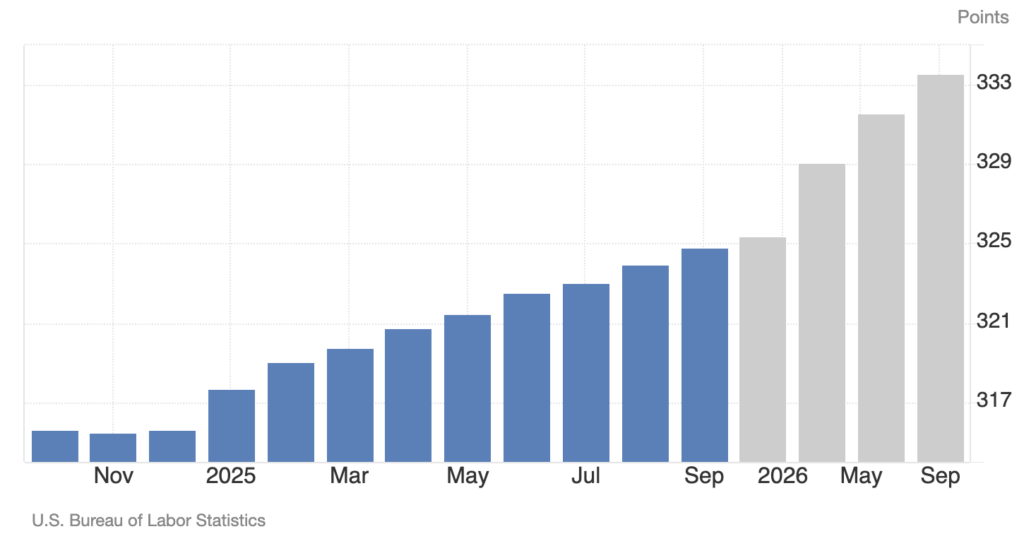

US inflation data goes dark: Shutdown wipes out October CPI, leaving Bitcoin hanging

For months, crypto traders have timed leverage, funding, and liquidity around the monthly U.S. inflation print. This week, those who had hoped the recent vote to reopen the government would bring new macro data were disappointed to find nothing on the

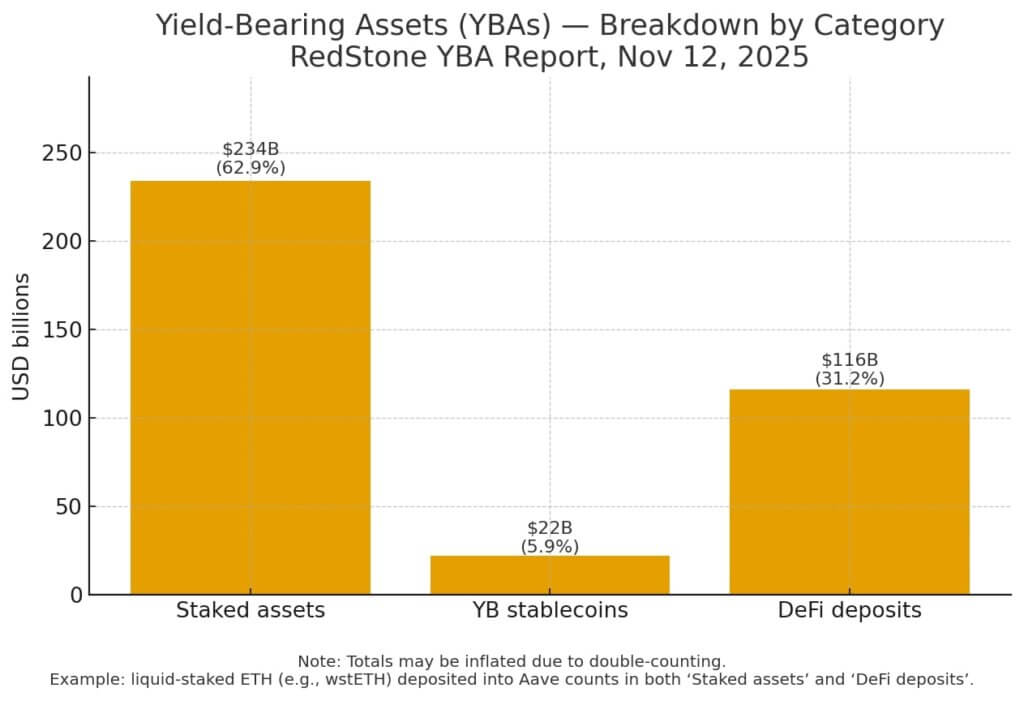

Only 10% of crypto earns yield now — why most investors are sitting on dead money

Crypto has spent years building yield infrastructure, such as staking on Ethereum and Solana, yield-bearing stablecoins, DeFi lending protocols, and tokenized Treasuries. The pipes already exist, the APYs are live, yet only 8% to 11% of the total crypto market generates

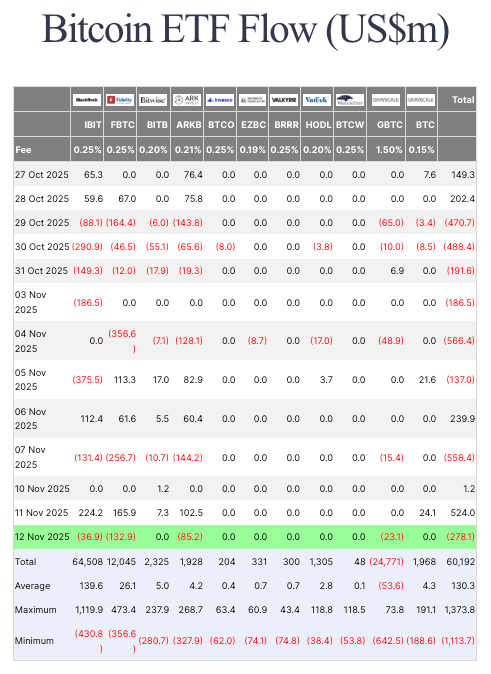

Bitcoin ETF flows reveal the market’s biggest fear heading into key inflation data

The Bitcoin market spent the week caught between confidence and caution, and ETF flows captured that tension. On Tuesday, Nov. 11, spot Bitcoin ETFs saw $524 million in inflows, their strongest single-day intake in over two weeks. However, on Nov. 12, they

Bitcoin loses its last line of defense: $98k breakdown sparks cascade not seen since May

Bitcoin (BTC) dropped 3% to $98,550.33 as of press time, falling below the psychological $100,000 threshold for the third time this month amid cascading leverage liquidations, persistent ETF outflows, and a broader risk-off posture across digital assets. The slide accelerated after

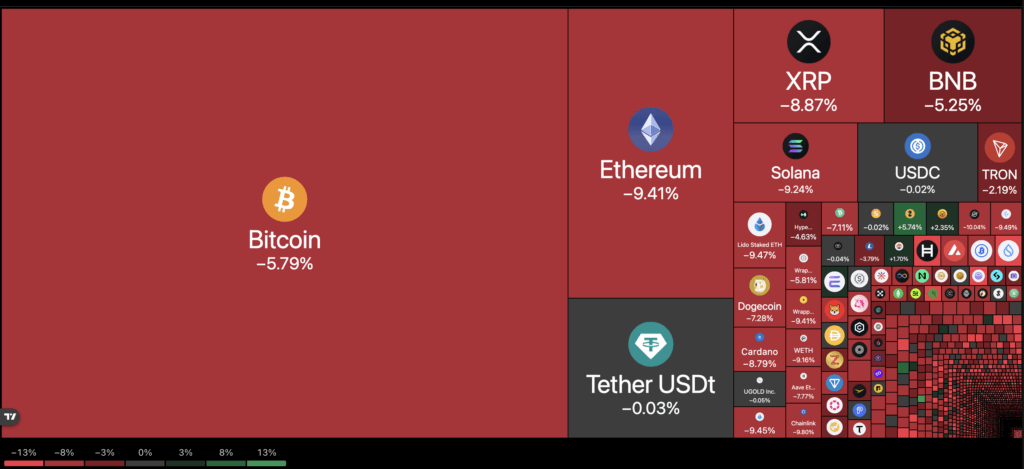

Why is everything down? Macro shock turns Bitcoin and other risk assets red across the board

Equity screens show a broad red, with the S&P 500 down around 1.8% and the entire crypto market under pressure simultaneously. What appears to be an unexplained wipeout is, in fact, a layered move driven by interest rate expectations, crowded positioning