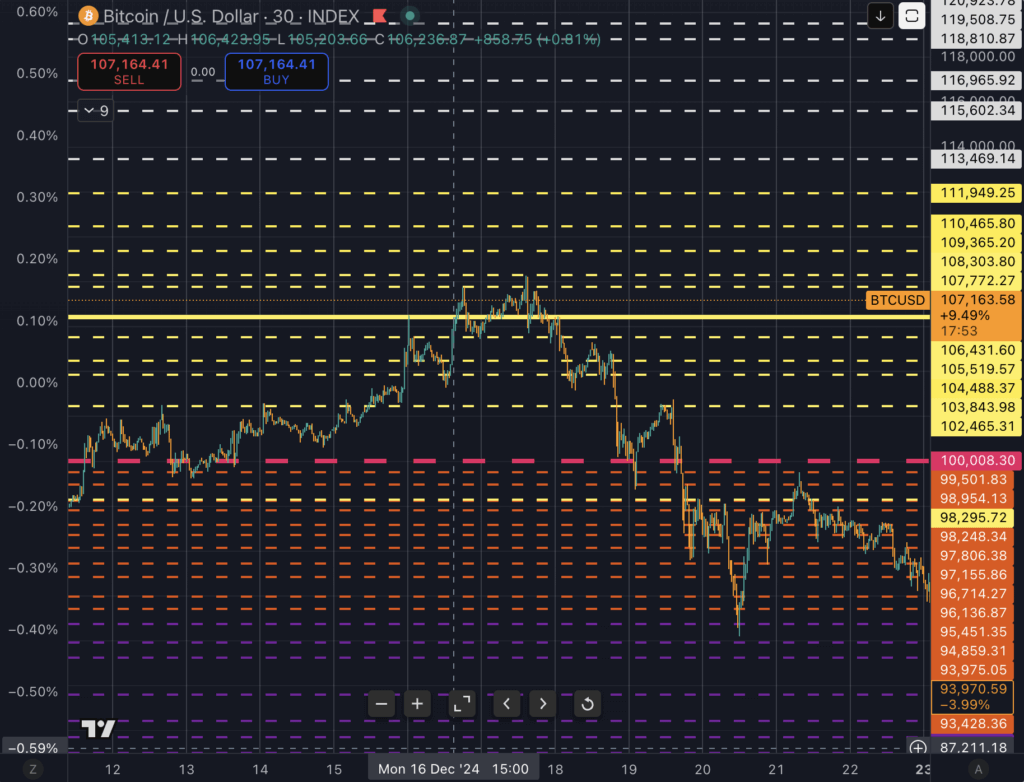

Bull or bear? Next $106k retest could decide Bitcoin’s fate

Bitcoin has treated $106,400 as a pivot across the current cycle, acting as both resistance and support. Price has repeatedly clustered near the level, cleared it on retests, and expanded toward the next channel bands, while breaks below the level often

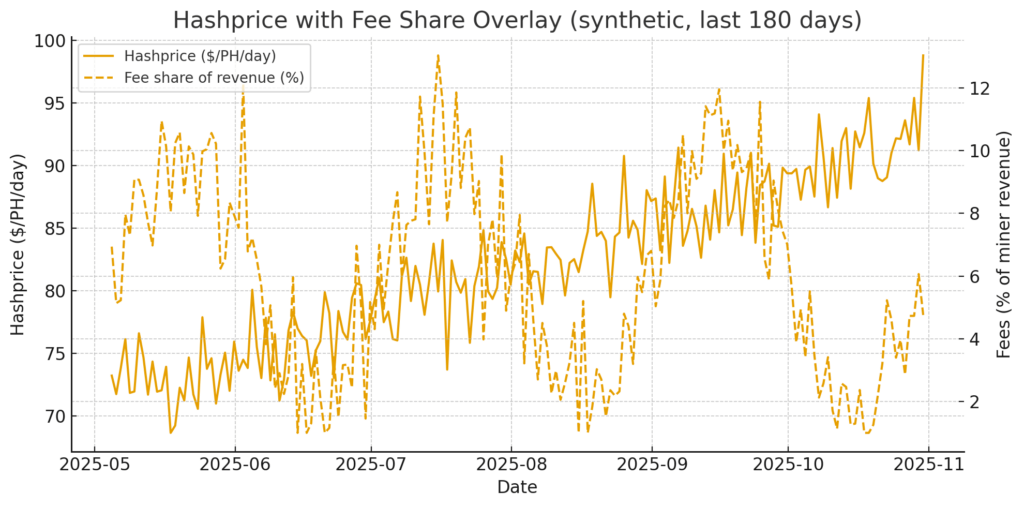

Are Bitcoin miners becoming AI utilities? The math says yes

Bitcoin’s (BTC) April 2024 halving cut block rewards from 6.25 to 3.125 BTC, compressing the hash price and forcing Bitcoin miners to reconsider their business model. Instead of waiting for fee markets to rescue margins, the largest operators started signing contracts

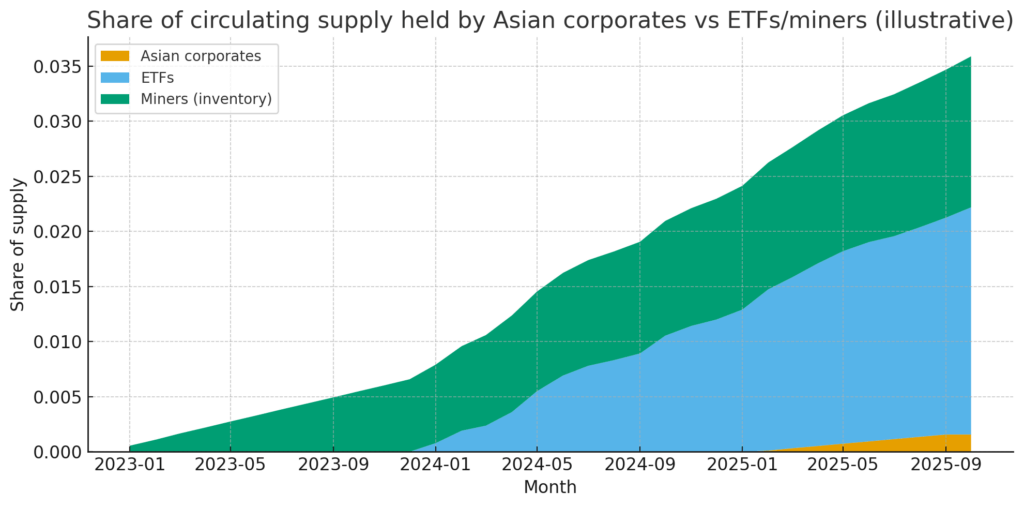

Can Asia’s mid-caps absorb 30% of new BTC supply?

Set against recurring billion-dollar ETF inflows, Asia’s mid-caps are starting to look like the next structural bid for bitcoin’s free float. Japan’s Metaplanet has surpassed 30,00 BTC on its balance sheet, and Korea’s Bitplanet initiated a supervised, rules-based accumulation program. What began

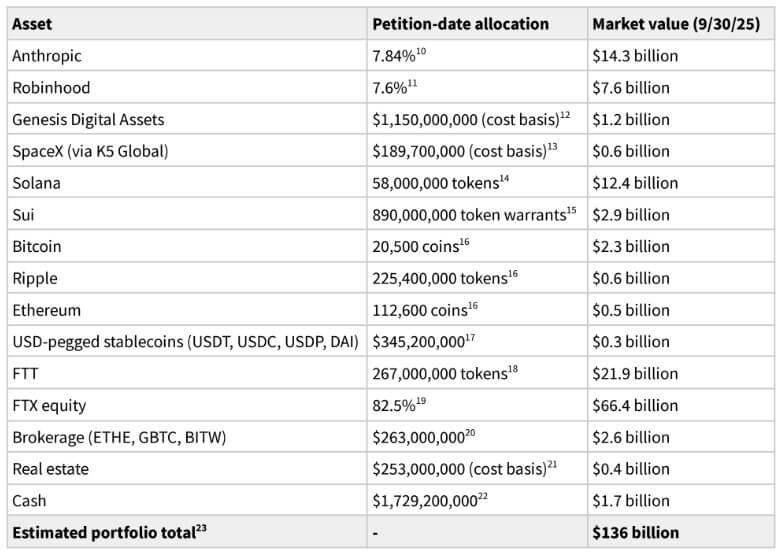

New prison report flouts claim FTX could have repaid customers from $25B in assets

Sam Bankman-Fried is again challenging the core narrative of his downfall: that FTX was insolvent when it collapsed in November 2022. In a 15-page report written from prison and dated Sept. 30, the convicted founder claimed the exchange “was never insolvent”

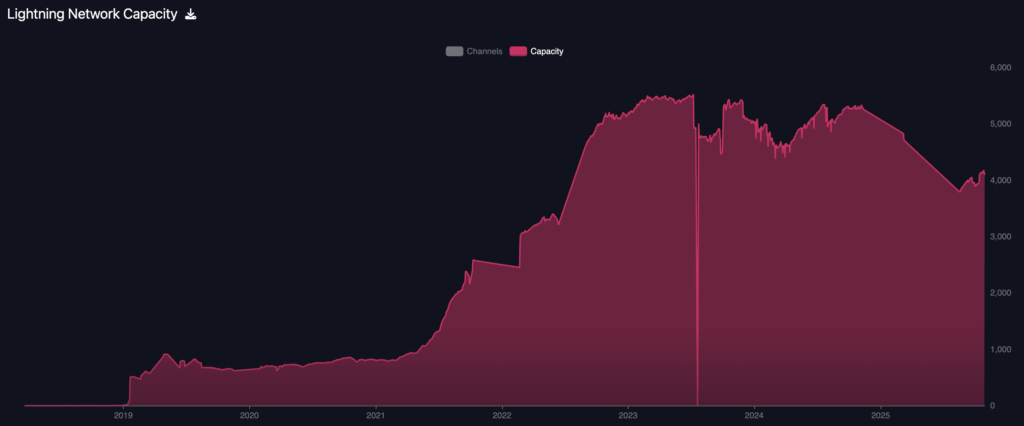

Invisible Lightning: Why exchange channels break a favorite Bitcoin metric

The Bitcoin Lightning Network was once the crown jewel of Bitcoin’s scaling story, a living map of open channels and growing liquidity that reflected adoption in real-time. However, as the network matures, the picture has blurred. Behind the steady decline in

The first AI launchpad on Sui: Empowering retail investors to invest like VCs

I. The Consensus Has Arrived: Crypto Belongs to AI Agents Google recently launched the Agent Payments Protocol (AP2), bringing together crypto heavyweights including Ethereum Foundation, Mysten Labs, and MetaMask. A clear consensus is crystallizing: cryptocurrency will become the native economic language of

Does Bitcoin Power Law model still work in 2025 after S2F failed?

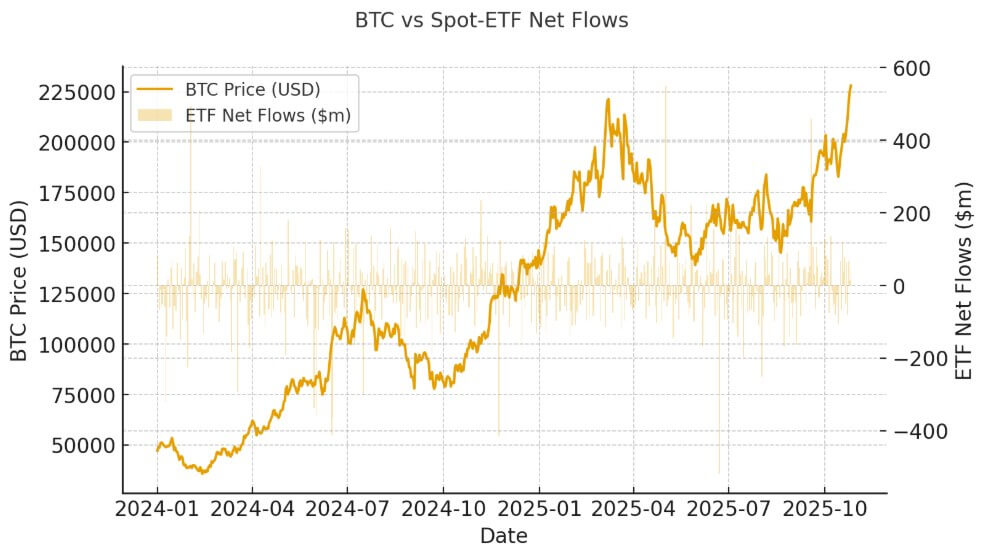

With S2F in the rearview, the live power-law channel indicates that BTC is roughly 20% below fair value, but ETF flows could push it to either extreme. Bitbo’s implementation of Giovanni Santostasi’s model places the price near $109,700, the fair value near $136,100,

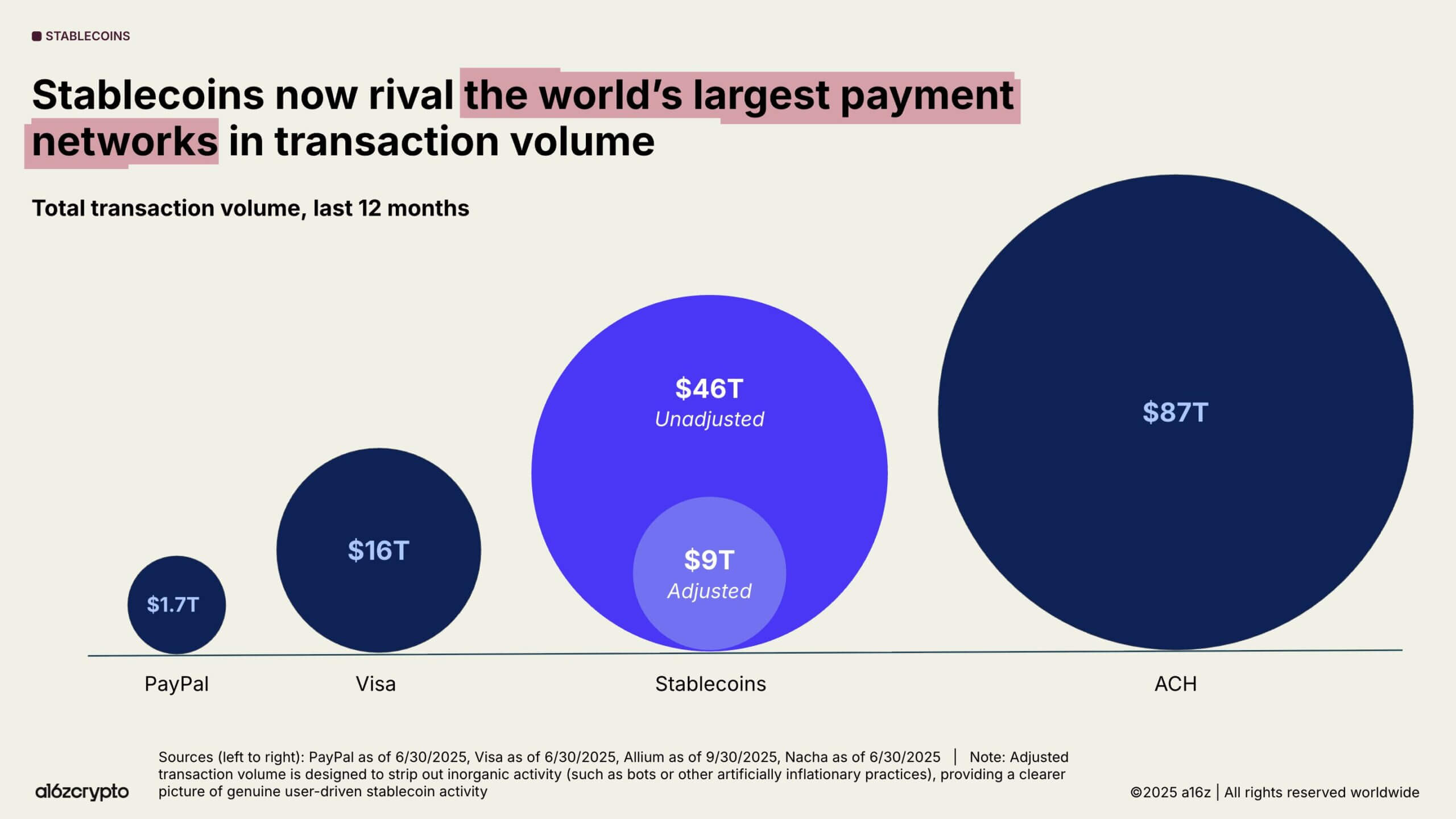

The $308 billion question: Can stablecoins thrive amid China ban?

China has again made its position on stablecoins unmistakably clear. At a recent financial policy forum, Pan Gongsheng, governor of the People’s Bank of China (PBoC), described stablecoins as a “new source of vulnerabilities” within the global financial system. He warned

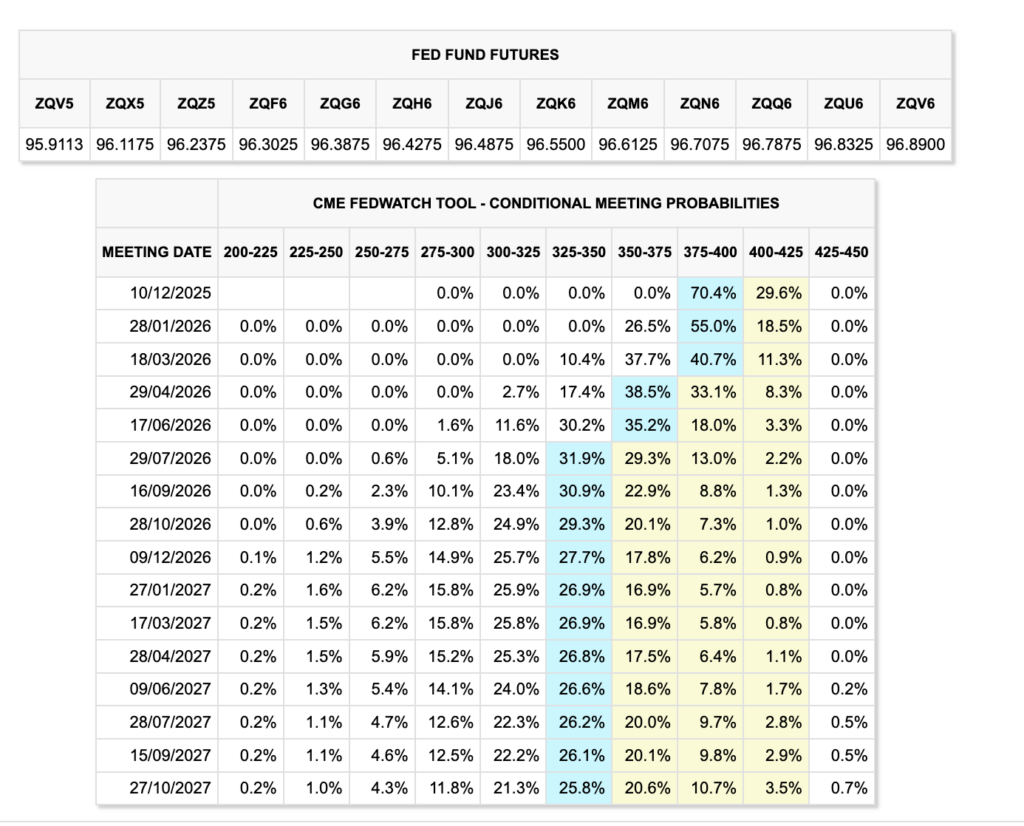

Fed cancels December rate cut, 18% chance of hike, slowing Bitcoin rally

The Federal Reserve just cut the policy rate by 25 basis points, moving the target range to 3.75% to 4.00%. However, futures markets have now removed the prospect of a further cut in December. Before yesterday’s FOMC meeting, many traders expected

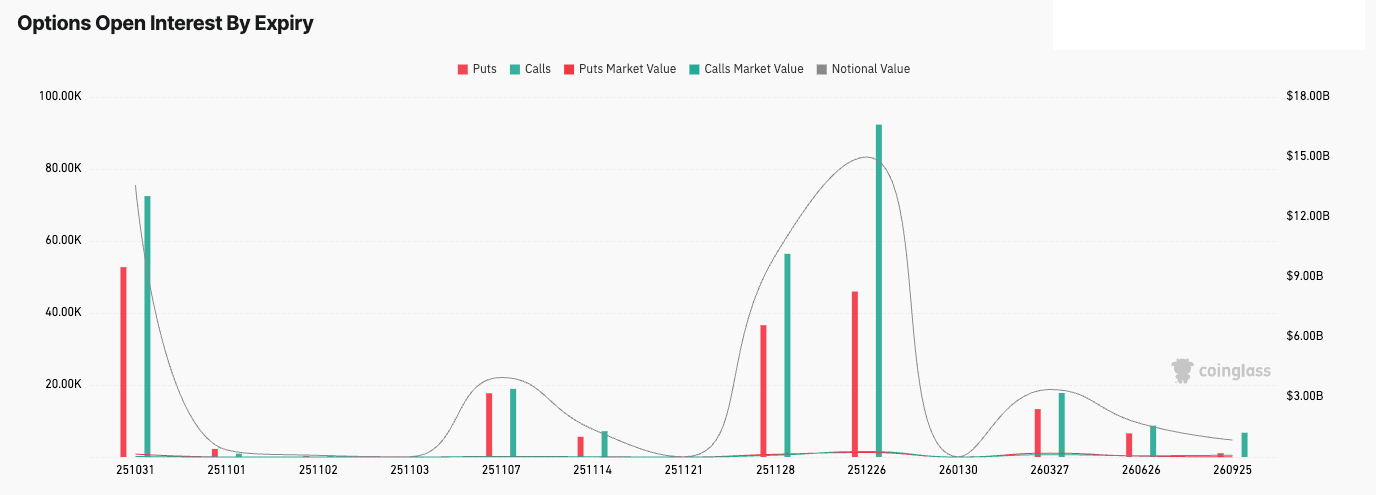

Why $13B in Bitcoin options expiring this week is a price nothing burger

Every few months, headlines warn of a looming multi-billion-dollar options expiry poised to shake Bitcoin price. This quarter’s figure, roughly $13 billion in notional contracts, sounds dramatic, yet it’s part of a well-worn pattern on Deribit, the exchange that clears nearly

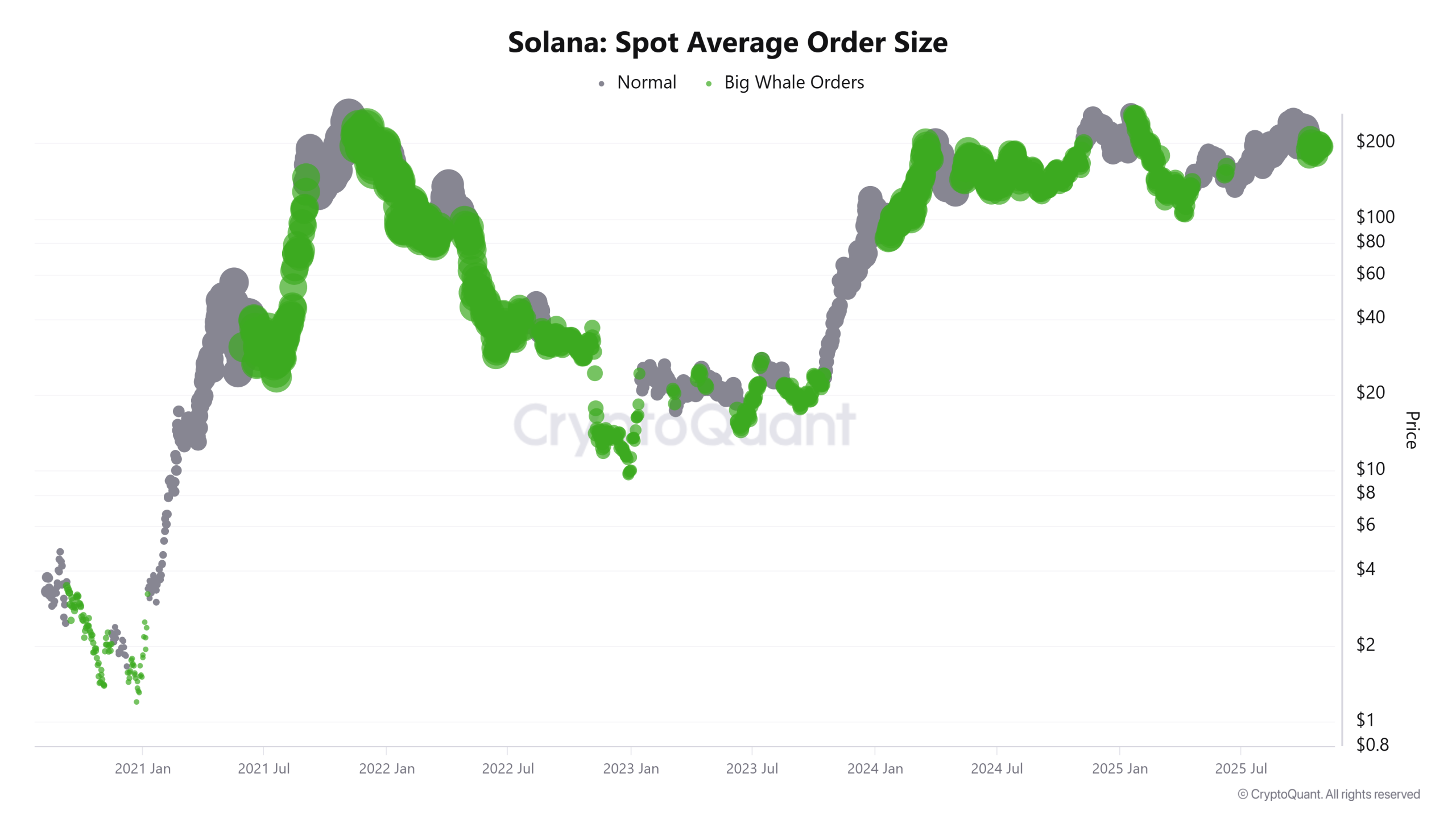

Whales awaken as old SOL hits exchanges but $117M ETF inflows soak up supply

Solana exhibits an on-chain pattern that appears bearish at first glance but becomes constructive when considered alongside capital flows into regulated investment products. Over the past month, early Solana holders, investors who accumulated during quieter market phases, have begun moving older

Here is why Bitcoin registered its first red October in 7 years

For more than a decade, October has been one of Bitcoin’s easiest months to be bullish. Historically, it has delivered average gains of about 22.5%, helped by post-summer liquidity, year-end portfolio positioning, and, more recently, steady demand from US investment products. As

Bitcoin fork Zcash up 380% to $5.8B: Does scarce privacy have legs?

Zcash (ZEC) was little more than a historical footnote for most of the past years. The digital asset was seen as a relic of crypto’s cypherpunk age, forgotten amid the rise of AI tokens, restaking narratives, and layer-2 rollups. Yet, it has

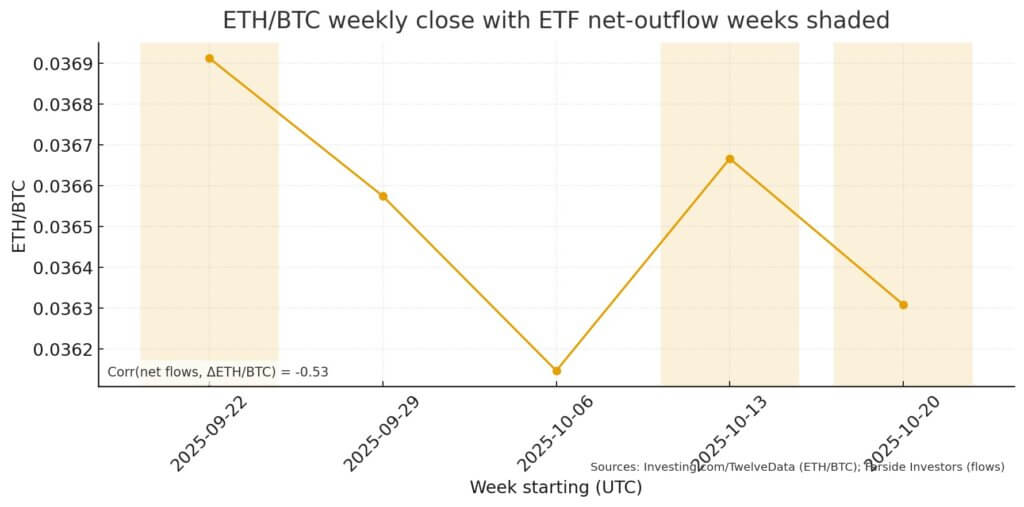

Are Ethereum ETFs a price headwind?

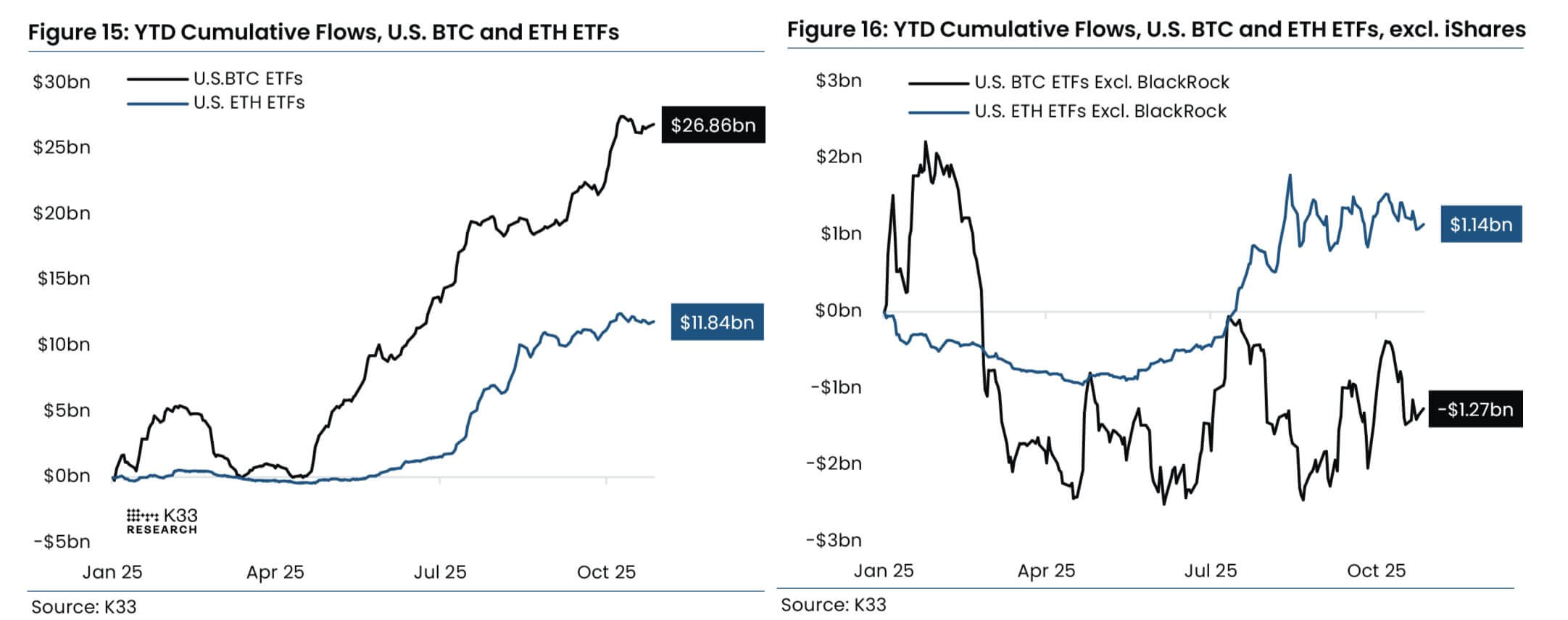

US-traded spot Ethereum exchange-traded funds (ETFs) recorded persistent outflows during late September and mid-October, periods that coincided with relative weakness in the ETH/BTC ratio. Yet, non-US inflows and continued staking growth blunted the price impact, suggesting the headwind is episodic rather

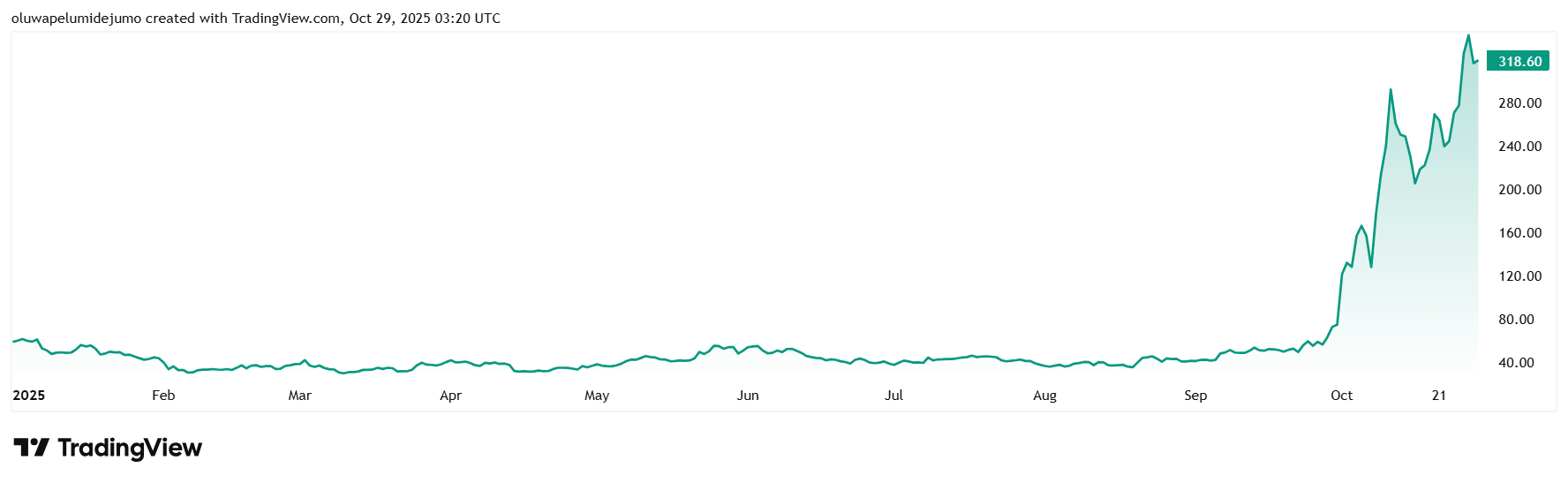

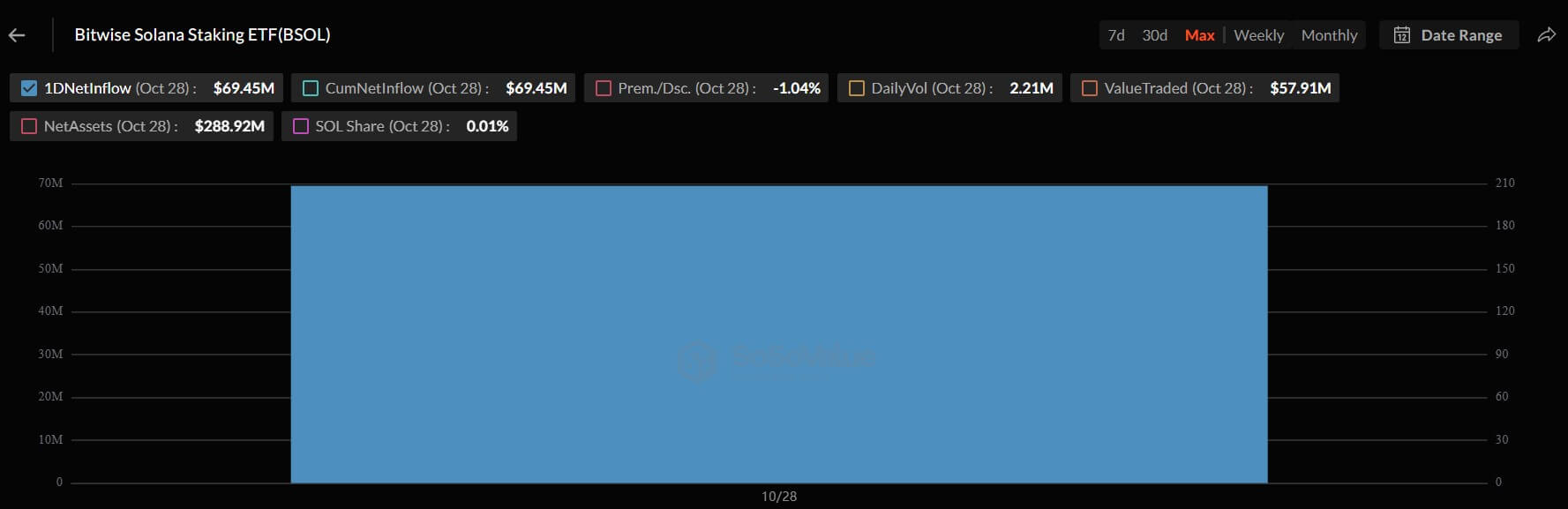

How Solana’s ETF success will propel SOL price to new heights above $500

For years, Solana was seen as crypto’s fast but fragile alternative to Ethereum, which was admired for its speed but dismissed as untested. However, that perception shifted dramatically this week. Record launch On Oct. 28, Bitwise’s Solana Staking ETF (BSOL) debuted with $69

Does a weaker dollar drive Bitcoin price now?

Bitcoin breached $116,000 for the first time in two weeks, and the usual narrative surfaced: inflation hedge. But the data tells a different story. This cycle, Bitcoin trades less like a consumer-price shield and more like a real-time barometer of dollar

US spot Bitcoin ETF balances are negative without BlackRock

Over the past year, Bitcoin’s exchange-traded fund (ETF) boom has been celebrated as proof that Wall Street has finally embraced crypto. Yet the numbers reveal something far more fragile. On Oct. 28, Vetle Lunde, head of research at K33 Research, noted

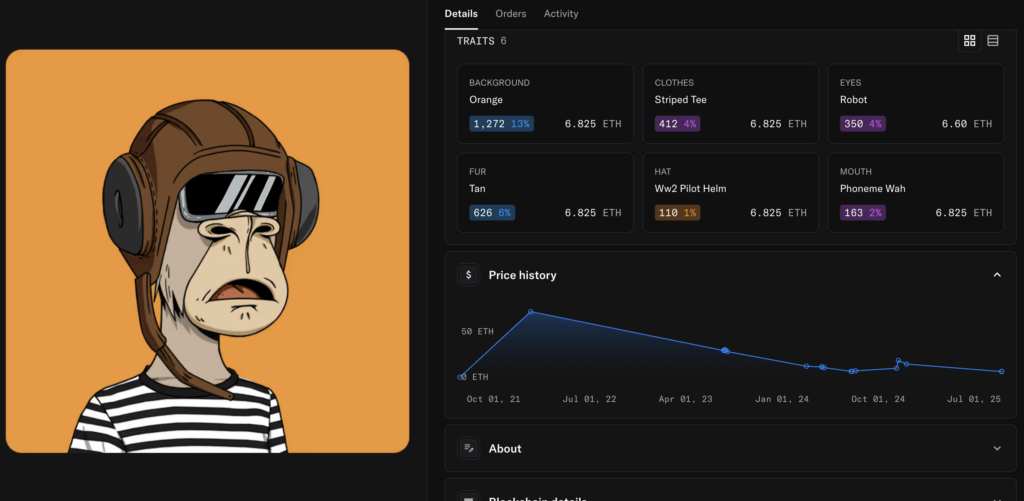

NFTs are coming back but Blue Chip projects are on life support

NFT trading activity showed signs of life in Q3 2025, breaking a long stretch of decline that defined the post-hype years. After two years of contraction and shifting narratives, on-chain markets found a new footing, not in blue-chip collectibles or speculative