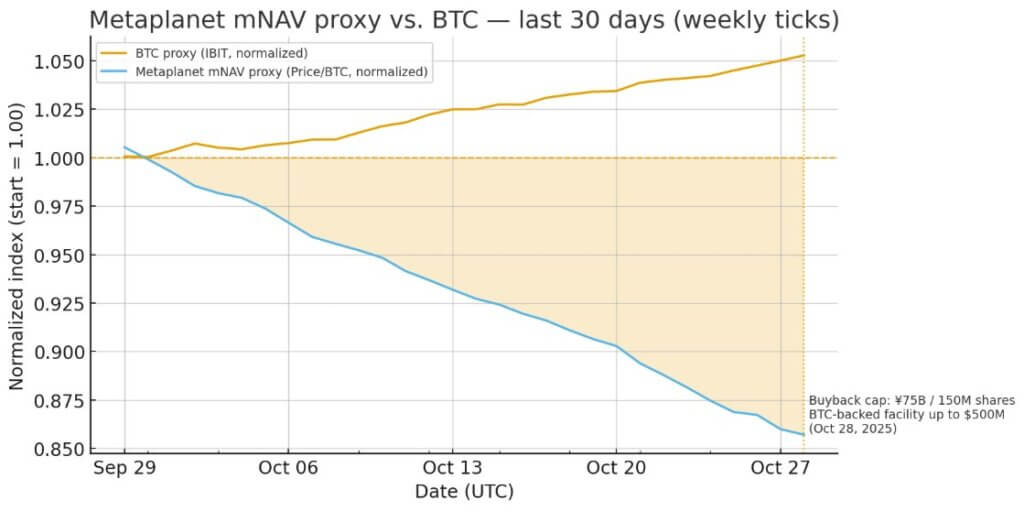

$500M BTC credit: Is Metaplanet proving crypto treasuries are momentum trades?

Yesterday, Oct. 28, Metaplanet authorized a share buyback program disclosing a Bitcoin (BTC)-secured credit facility of up to $500 million. This capital allocation tool works best when the stock trades below its market-to-net-asset-value ratio, amplifying gains in Bitcoin rallies and magnifying

New US company completes $1 billion XRP purchase as Ripple celebrates price surge

Less than a week after its debut, Evernorth, a newly formed XRP-focused treasury company, has emerged as one of crypto’s most profitable institutional entrants. The firm’s swift accumulation of nearly $1 billion worth of XRP has already generated an estimated $75

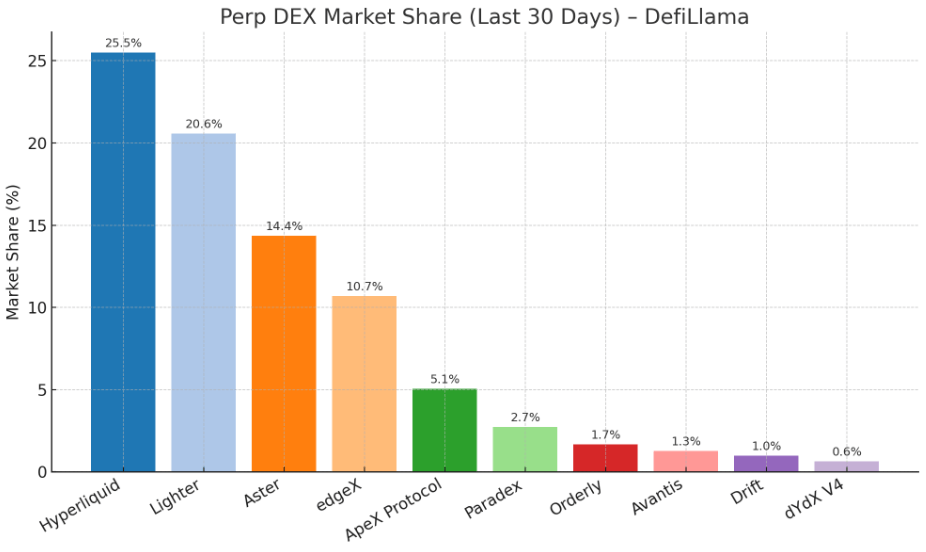

Decentralized exchanges surpass $1 trillion monthly volume as volatility spikes

Perpetual decentralized exchanges (perp DEXes) registered $1.049 trillion in monthly volume as of Oct. 24, marking the first time on-chain derivatives markets crossed the $1 trillion threshold and establishing a new benchmark for decentralized trading infrastructure. DefiLlama data shows roughly $1.241

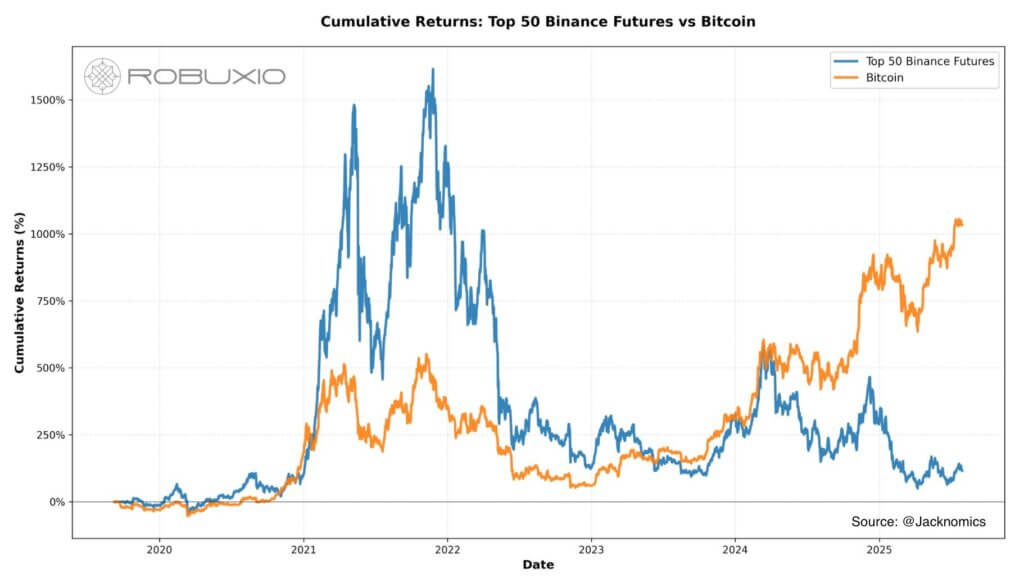

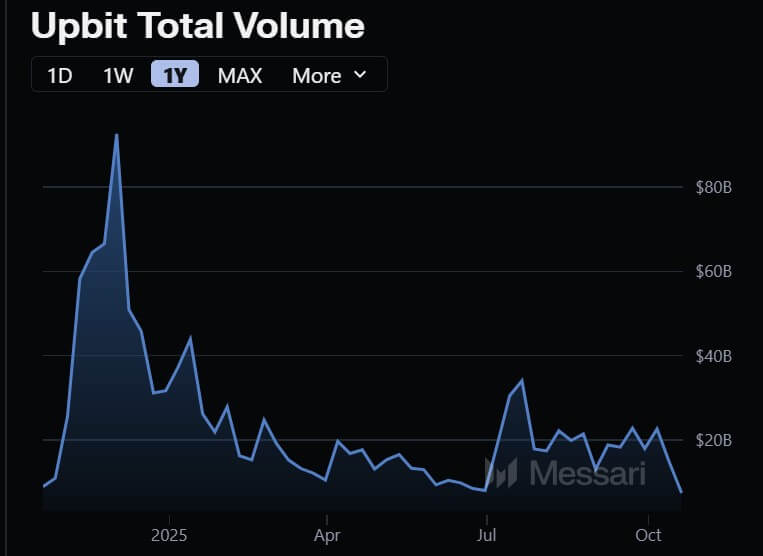

The worst bull run ever? How institutions, memes, and macro turned crypto’s glory cycle into a grind

For a market supposedly in a bull run, it doesn’t feel like one. Sure, Bitcoin may have set a couple of record highs this cycle, but the rallies have been uneventfully yawn-inducing, and the corrections have been savage. Altcoins are

Bitcoin rally smashes past $116k on softer Fed bets: What changes next?

Crypto markets started this new week with a surge powered by a rare alignment of favorable macroeconomic shifts. According to CryptoSlate data, Bitcoin climbed to a fresh intraday high above $116,000 before stabilizing near $115,587 as of press time. Notably, this

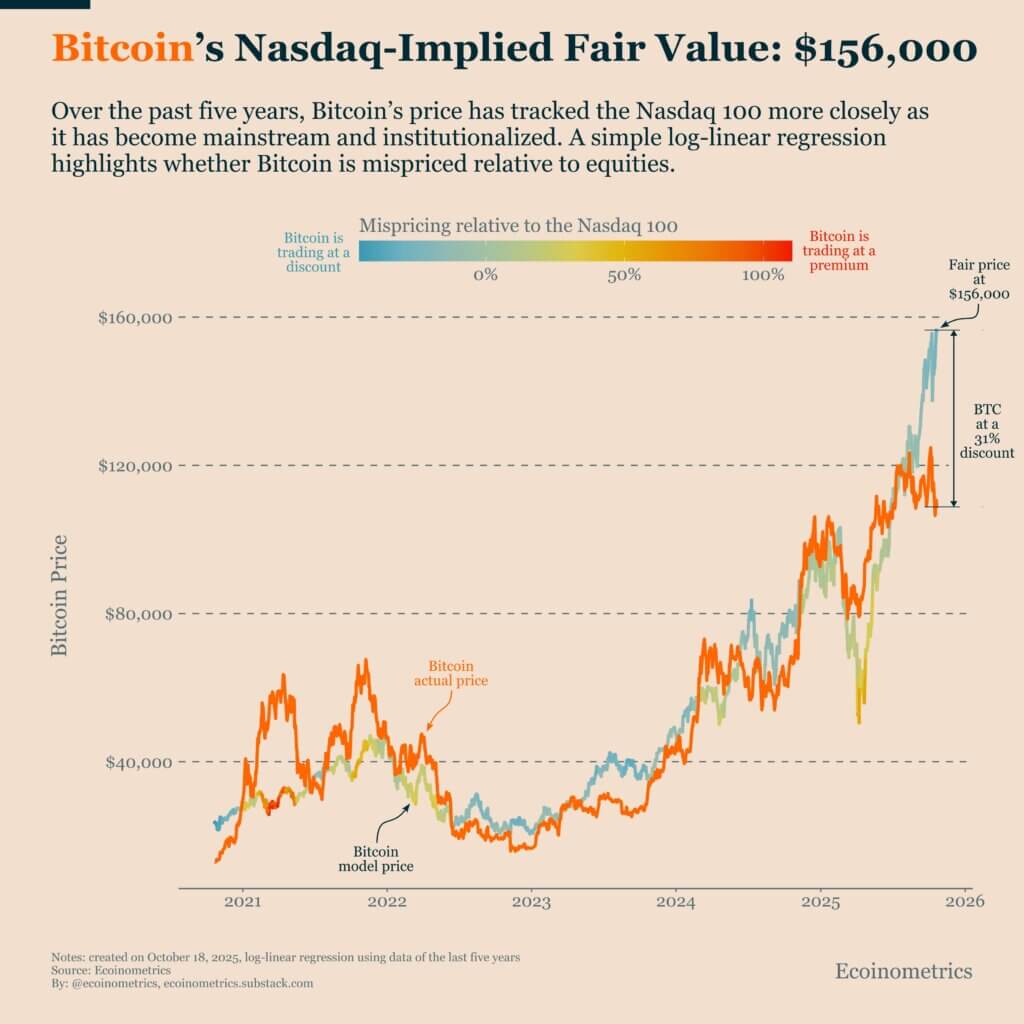

Bitcoin is trading at a 30% discount relative to Nasdaq fair value

Bitcoin is currently trading at a roughly 30% discount compared to its Nasdaq 100-implied fair value. While any high-conviction Bitcoiner already knows how cheap the asset is right now, this ratio highlights the knock-down BTC price in proportion. And it’s

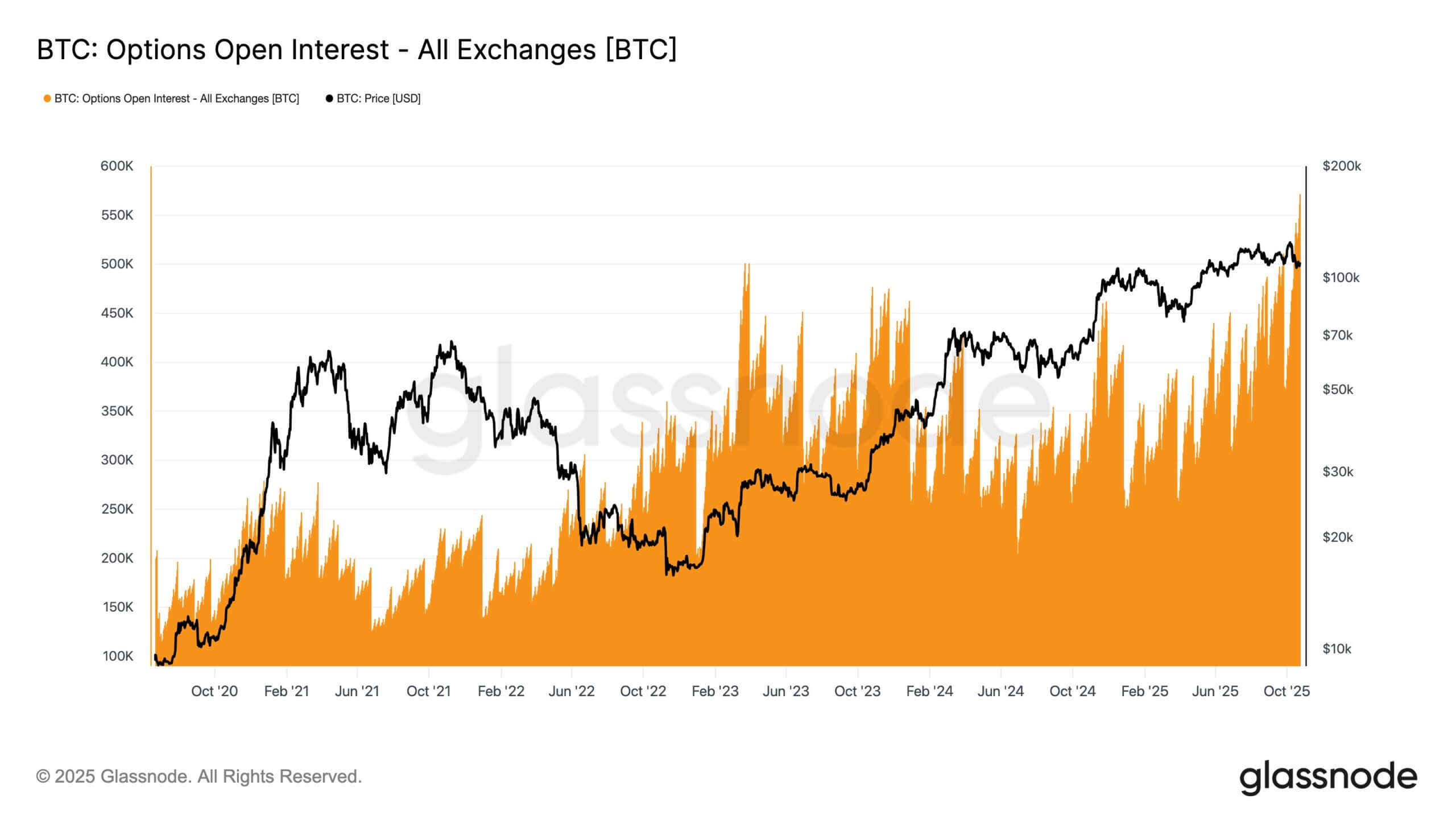

Bitcoin options market cautious as traders hedge against volatility

The Bitcoin options market has quietly become one of the most revealing arenas for gauging trader sentiment. And right now, it’s flashing mixed but telling signals. While Bitcoin has clawed its way back from the early-October washout that vaporized tens

How retail altcoin traders lost $800 billion betting against Bitcoin

After two years of waiting for an “altcoin season” that never came, retail crypto traders have missed out on roughly $800 billion in potential gains by betting against Bitcoin’s dominance. A new report from 10x Research shows that altcoins have lagged

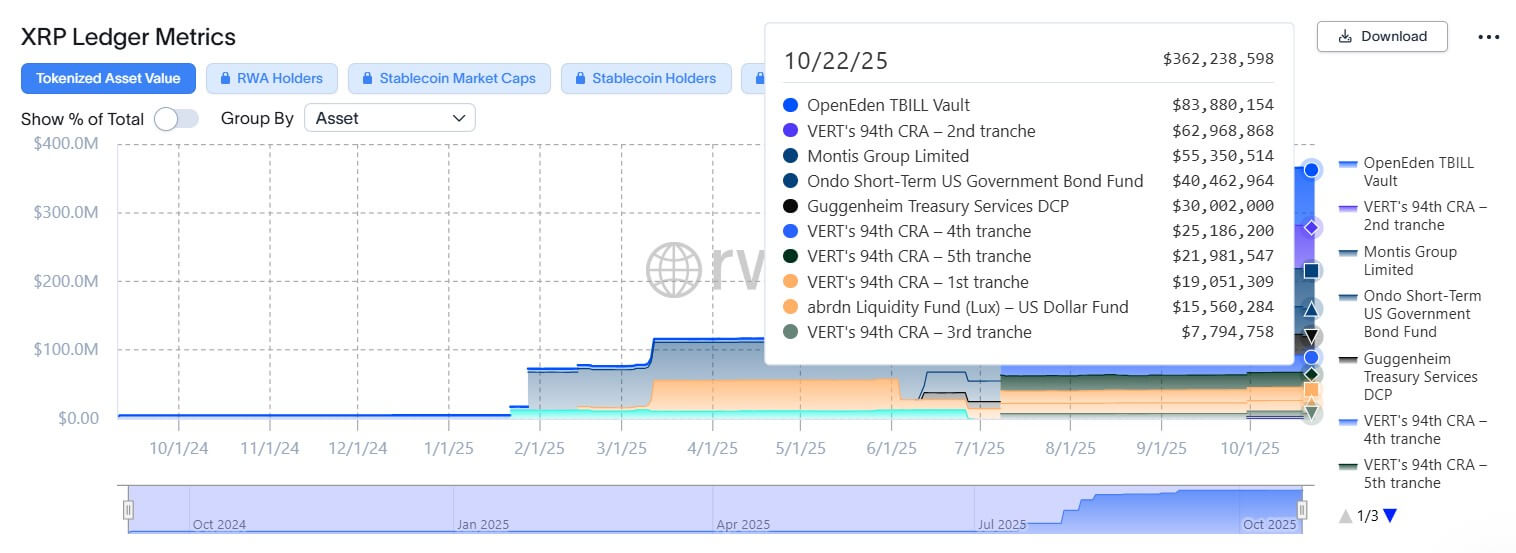

How XRP’s renewed role is driving crypto-fiat settlement and innovation worldwide

For nearly a decade, XRP has been the underdog of the digital-asset world, overshadowed by Bitcoin’s narrative dominance, Ethereum’s developer gravity, and Solana’s speed headlines. Yet while most of the market debated ETFs and exchange listings, XRP’s core network, the XRP

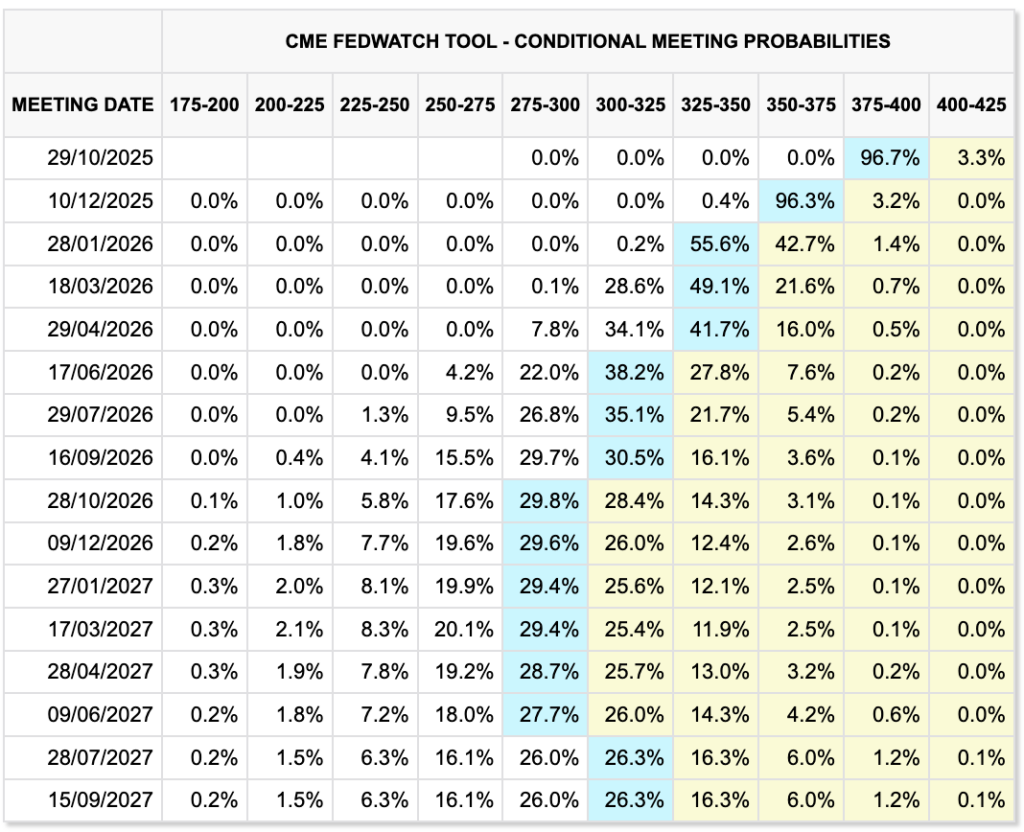

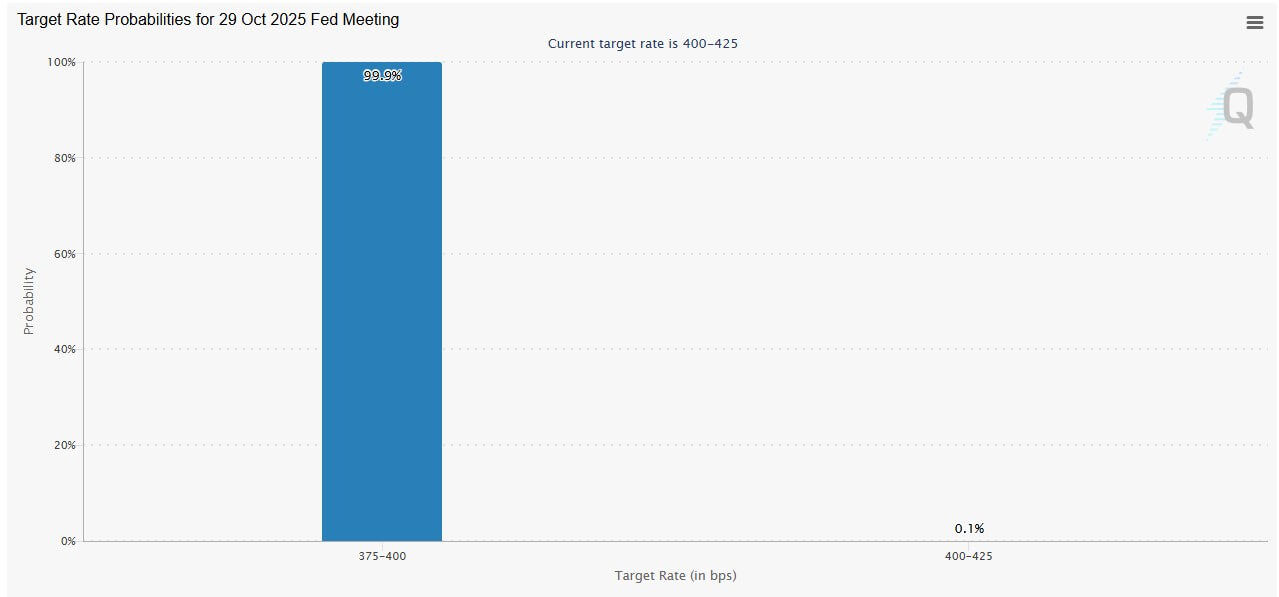

Inflation to set up Bitcoin melt-up as rates to fall to 2.75% by next October

US inflation ticked up to 3.0% year over year in September, and futures markets still price a Federal Reserve rate cut next week. Headline CPI printed 3.0% on the year and 0.3% on the month, while core CPI held at 3.0%

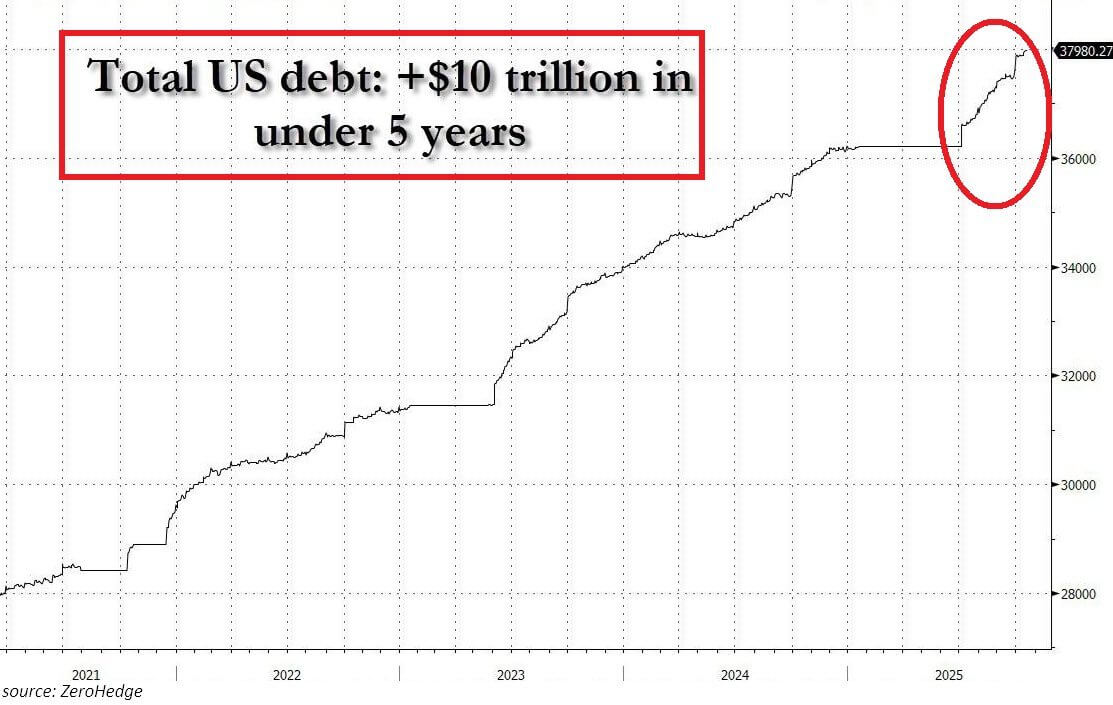

How high would Bitcoin price need to go to erase US $38 trillion debt?

The US has never owed more money that it does today, and some believe the solution isn’t political reform or higher taxes but Bitcoin itself. America’s national debt has crossed $38 trillion, surpassing the country’s annual GDP by nearly 31%. Notably, the

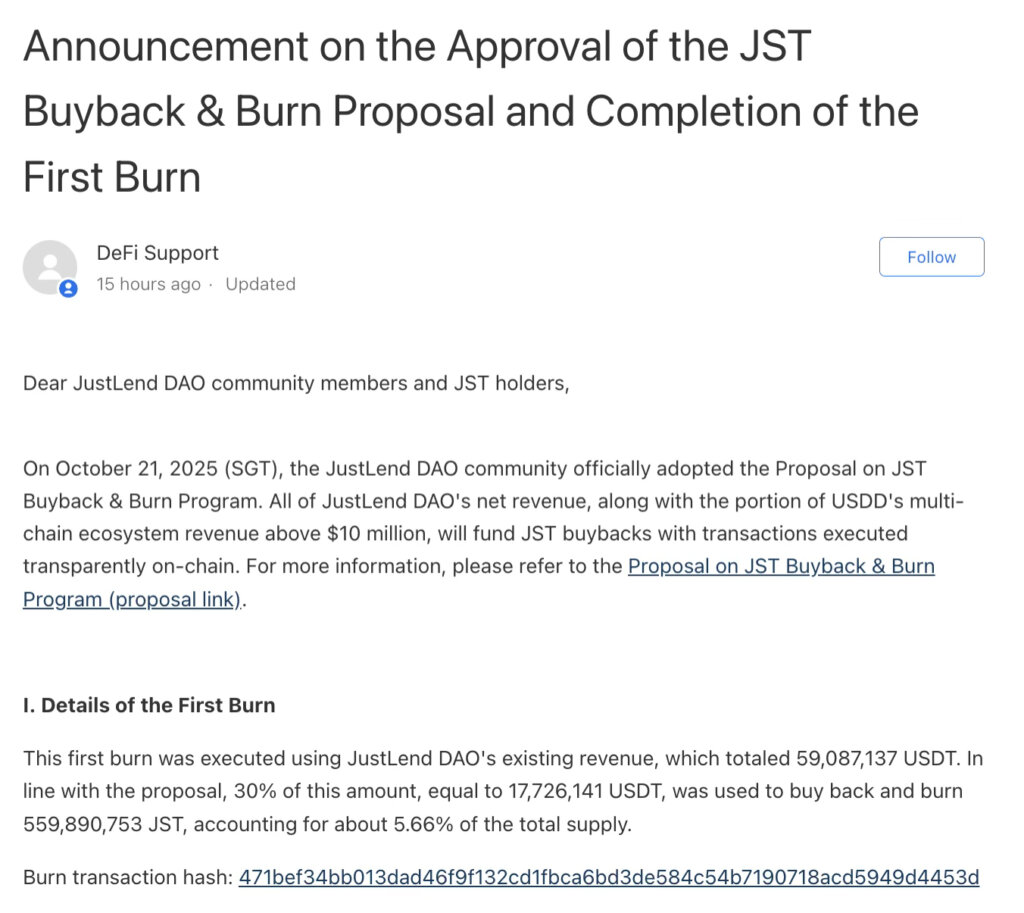

JustLend DAO Completes First JST Buyback and Burn, Ushering In a Revenue-Driven Deflation Cycle

On October 21 (SGT), JustLend DAO—the flagship DeFi protocol of the TRON ecosystem—reached a major milestone with the successful completion of its first large-scale JST burn. This marks JST’s evolution from a fully circulating token into a continuously deflationary asset. As

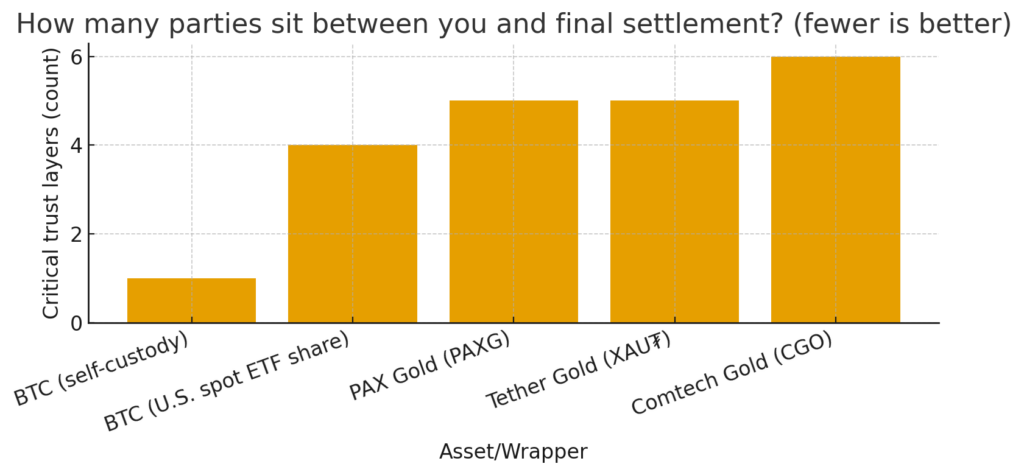

If tokenized gold is just a “trust-me-bro” IOU, what’s really on-chain?

We audit popular gold tokens against five trust tests, then compare them with BTC ETFs and native BTC settlement. Binance founder Changpeng Zhao recently claimed tokenized gold is not on-chain in response to Peter Schiff arguing tokenized gold can outcompete Bitcoin. Saying

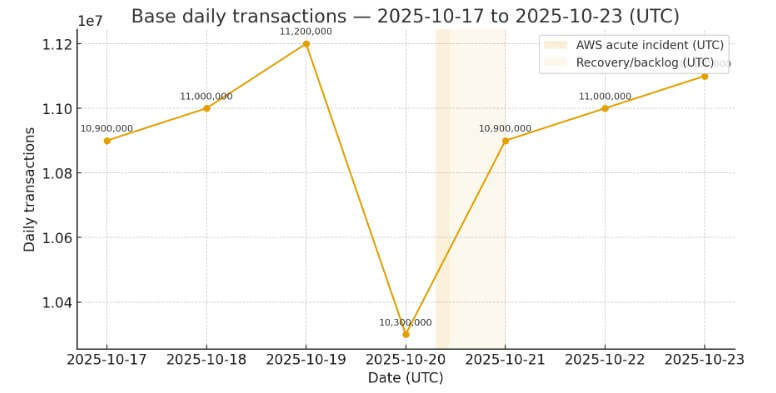

Why did MetaMask show $0 on Ethereum when AWS went offline?

An Amazon Web Services disruption on Oct. 20 knocked out MetaMask and other ETH wallets displays and slowed Base network operations, exposing how cloud infrastructure dependencies ripple through decentralized systems when a single provider fails. AWS reported a fault in its

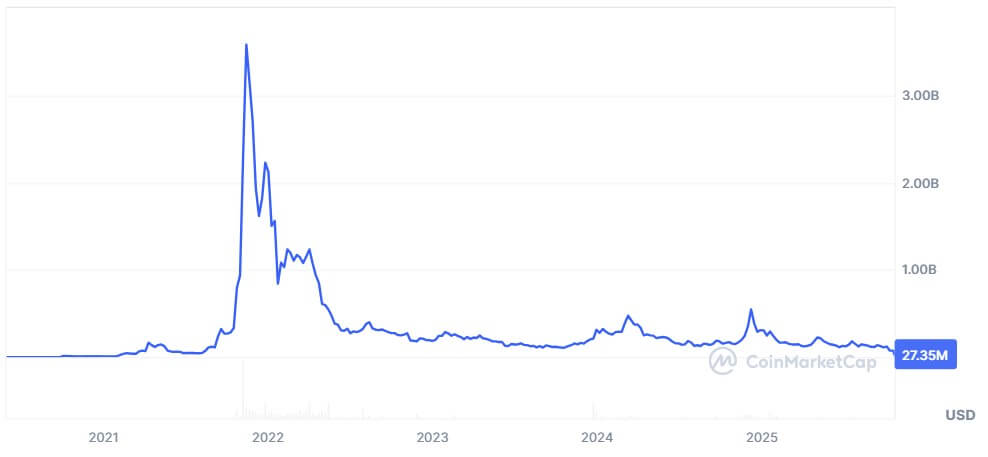

From $4B peak to shutdown: What Kadena’s fall teaches other L1 blockchains

When Kadena Organization, the company behind the Kadena blockchain, announced it was shutting down operations on Oct. 21, the message was formal, quiet, and devastatingly simple. The company thanked its community, cited “market conditions,” and confirmed that it would cease all

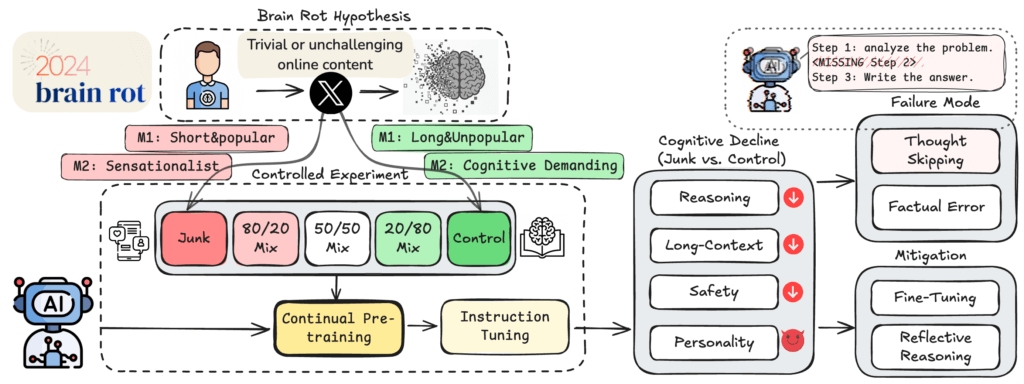

The Un-Dead Internet: AI catches irreversible ‘brain rot’ from social media

The internet is not dead, but it may be rotting. New research by scientists at the University of Texas at Austin, Texas A&M University, and Purdue University finds that large language models exposed to viral social media data begin to suffer

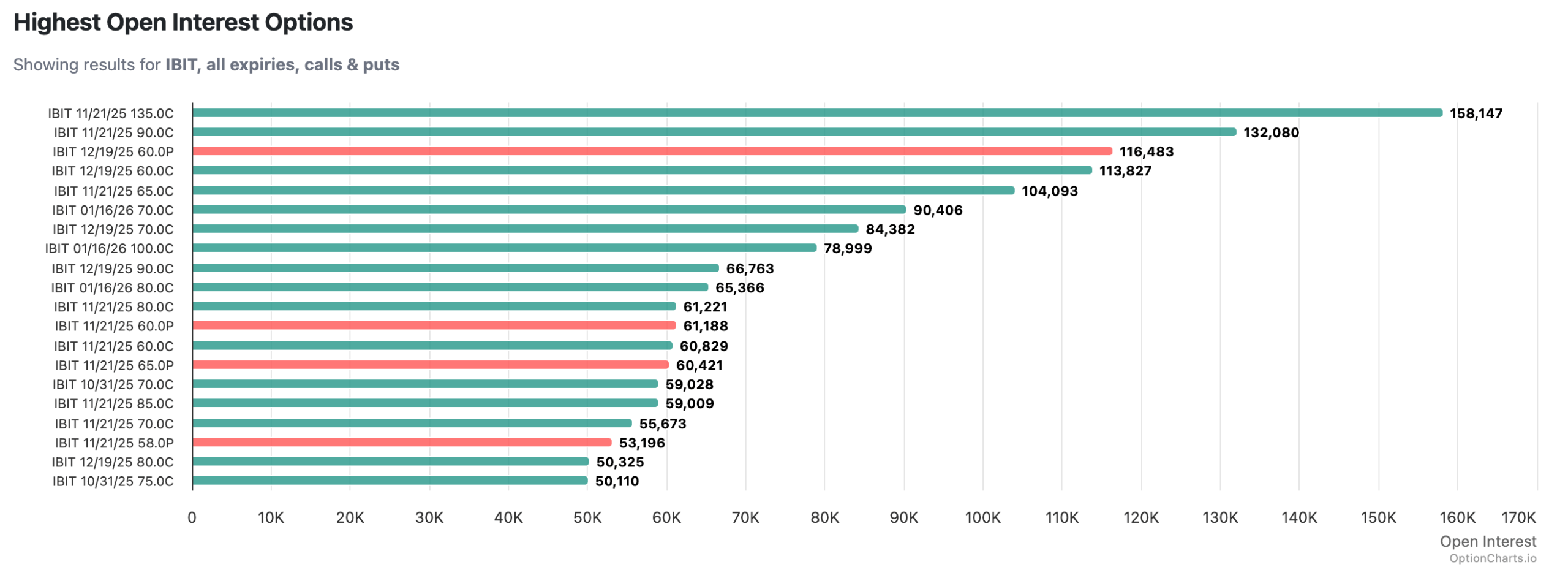

BlackRock’s $40B IBIT options: Is Bitcoin’s volatility now the market’s favorite income play?

The leverage era in Bitcoin trading has faded into something more deliberate. What once resembled a perpetual motion casino now behaves more like a bond desk. Options activity has overtaken perpetuals, realized volatility has narrowed, and the largest Bitcoin fund in

Bitcoin awaits critical US CPI data for jump over $120,000 or decline to $100,000

Bitcoin is bracing for the release of the September US Consumer Price Index (CPI) on Oct. 24, the first major data point since the federal shutdown began. Analysts at The Kobeissi Letter emphasized the importance of this update, noting that it